Bitgur.com Site Review

Bitgur

Bitgur is The Scout That Sniffs Market Sparks Before They Catch Fire

AceOfCrypto here. I put Bitgur through the grinder so you get the good part without sleeping through the alarms. Bitgur’s not trying to be your research lab. It wants to tell you when something changed fast, where it changed and how messy it looks. That means volatility whistles, listing pings, exchange performance tables and a proprietary Bitgur Volatility Index that tries to tell you when the sea’s about to get choppy. If your playstyle is find, verify, then strike, Bitgur can hand you the first lead. If your playstyle is buy the hot headline and hope, Bitgur will hand you a mirror and say nice try.

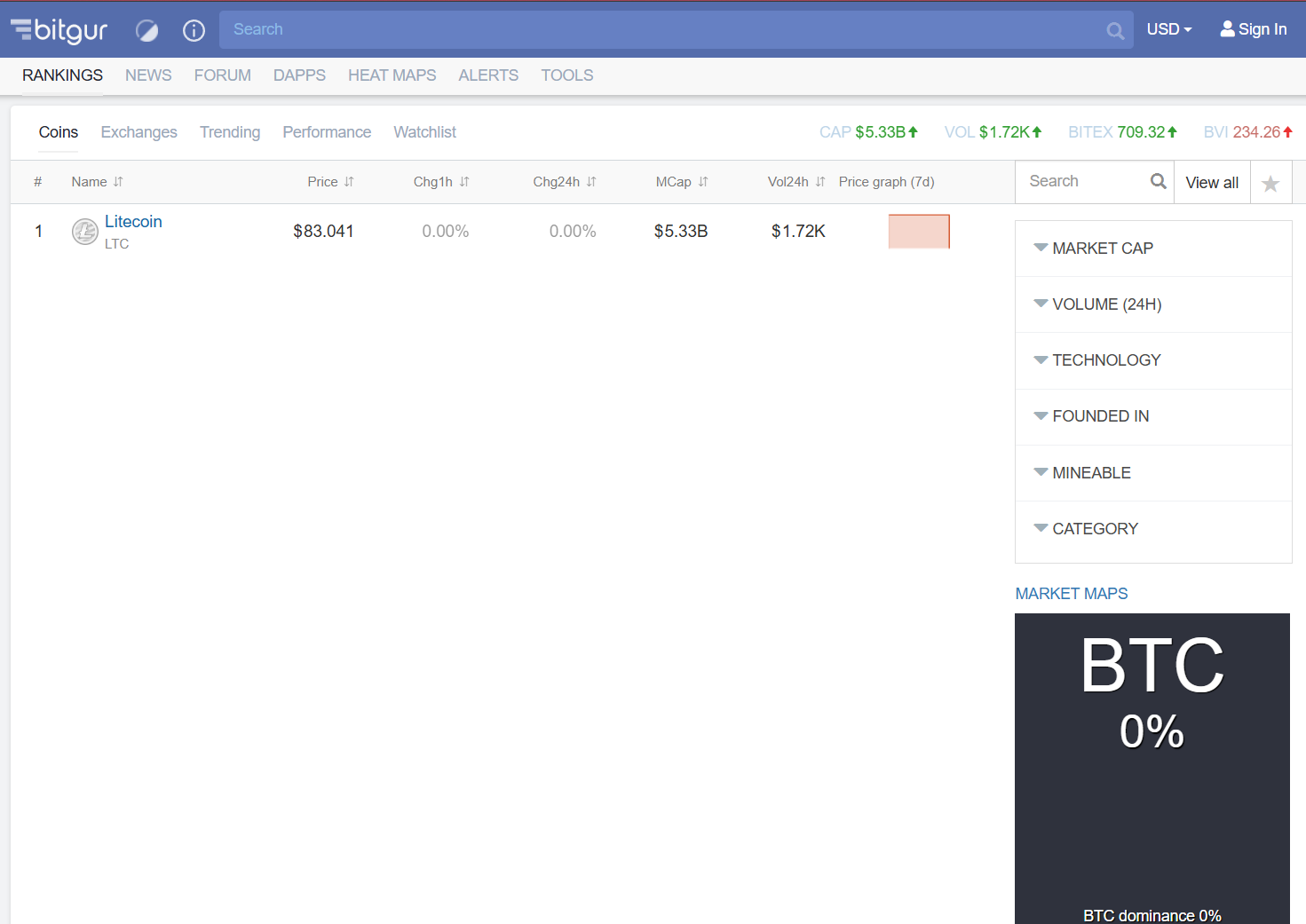

What is Bitgur?

Bitgur aggregates exchange APIs, runs performance tables and issues alerts for price moves, volume spikes and new listings. They publish a Bitgur Volatility Index or BVI to measure market turbulence and provide BVI alerts that you can plug into Telegram, email or browser push. Bitgur also exposes exchange metrics like trades per minute and deal average volume so you can eyeball where liquidity actually lives. They claim first-tier exchange feeds and surface short time-window performance reports to highlight the fastest movers.

What the Crypto Community Says About Bitgur?

Traders praise the alert speed and listing detection. People who trade momentum love getting a ping before the noise hits Twitter. Critics raise two consistent flags: one, data for tiny, thinly traded tokens can be flaky if the upstream exchange feed is sketch; two, third-party trust checks show risk signals about site hosting and transparency. That means Bitgur is powerful but you must verify before sizing up.

Usability & UX

Bitgur’s interface is built around the alert. Open the site and you see top movers across short windows, exchange lists, and the BVI meter. Alerts are granular: price delta, unusual volume, new exchange listing, BVI threshold. Delivery options include Telegram bots, email and browser push. Mobile and desktop both work, but the product shines when you set tight filters and let it scream into your chosen channel. If you like a tool that interrupts you only when something worth checking happens, this is it. If you want pretty charts and long reads, go elsewhere.

Data Accuracy & Security

Bitgur pulls directly from exchange APIs. That is useful because you see the market slices where price moved. But it also means garbage in equals garbage alerts. When an exchange API hiccups you can get stale or distorted readings. Also some website trust scanners flag Bitgur for hosting/ownership opacity, which does not prove maliciousness but is a red flag worth respecting. You gotta treat Bitgur as a signal layer, not a single source of truth.

Extra Features on Bitgur

Heatmaps & Performance Reports

Minute to daily performance tables showing which coins moved fastest. Use 15 minute and 1 hour tables to catch early spikes.

BVI Volatility Index & BVI Alerts

A weighted volatility score for first-tier cryptos. You can set alerts when BVI crosses thresholds so you know the market has shifted from calm to chaotic. Great for macro timing.

New Listing & Volume Spike Alerts

Get notified when a token appears on an exchange or when volume goes abnormal across paired markets. That early listing ping is gold if you verify liquidity fast.

Exchange Performance Tables

Shows trades per minute, average deal size and volume to visitors ratio so you can estimate where real liquidity sits and where the pumps live. Useful for choosing where to try an entry.

Widgets & Embeds

Ticker tables and live lists you can drop on a site or dashboard. Good for publishers or internal war rooms.

Delivery Channels

Telegram bot, email, browser push. Pick your pain threshold.

Pros of Using Bitgur’s Price Tracker

- Alerts and new-listing pings arrive fast; great for momentum hunters.

- BVI gives a single meter for market stress and helps avoid chasing during storms.

- Exchange metrics help you vet where liquidity actually sits.

- Good embed and delivery options for automation or publishing.

Cons of Using Bitgur as a Price Tracker

- Thin market data can appear volatile because upstream feeds are sketchy.

- Trust/hosting checks raise transparency questions for conservative shops.

- Not a research tool: tokenomics, unlock calendars and deep on-chain analysis are not native.

- Alerts can be noisy if filters are loose; defaults are not a trading plan.

Risks of Relying Only on Bitgur

Bitgur is not covering you on all sides. Make it your standalone, and you’ll pile more risks than Bitconnect post launch.

Signal vs Execution

Bitgur will show a pump but not the orderbook depth. That pump can be 90% paper on a single exchange. Confirm execution probability before pulling the trigger.

Feed Failure Modes

Exchange API failures create phantom alerts. If you automate buys on alerts without fallbacks, your bot could choke. Build backups.

Narrative Blindspot

Bitgur surfaces movement not motive. It tells you what moved, not why. If you act on movement without context you risk buying narrative dust.

Trust & Hosting Warnings

Third-party site checks flag Bitgur’s hosting and ownership signals as low trust. That does not mean scam, but it raises the cost of due diligence. Verify before you push large flows through automated scripts.

Rookie Mistakes Most Degens Make on Bitgur

- Buying the second an alert fires without checking orderbook or exchange count.

- Leaving default filters and getting flooded with useless pings.

- Automating large trades off alerts without redundancy and sanity checks.

- Ignoring exchange metrics and assuming every listed market has liquidity.

Ace’s Tips on Using Bitgur Like a Pro

Bitgur is real good, but only when you know how to use it like a pro. Here’s what Ace recommends.

- Default filter setup I use: minimum 24h volume $100k, exchange count 3+, and BVI trigger >60 for macro alerts. Tighten if you trade lower caps.

- When a new-listing alert arrives: open the exchange orderbook, check base currency and spread, confirm last trade timestamp. If depth is shallow, size down or skip.

- Use the BVI as a macro safety: if BVI >70, widen your slippage tolerance or sit on the sidelines for risky entries.

- Route alerts into a private Telegram channel and have a two-step action rule: alert → verify → size. Never one-button buy.

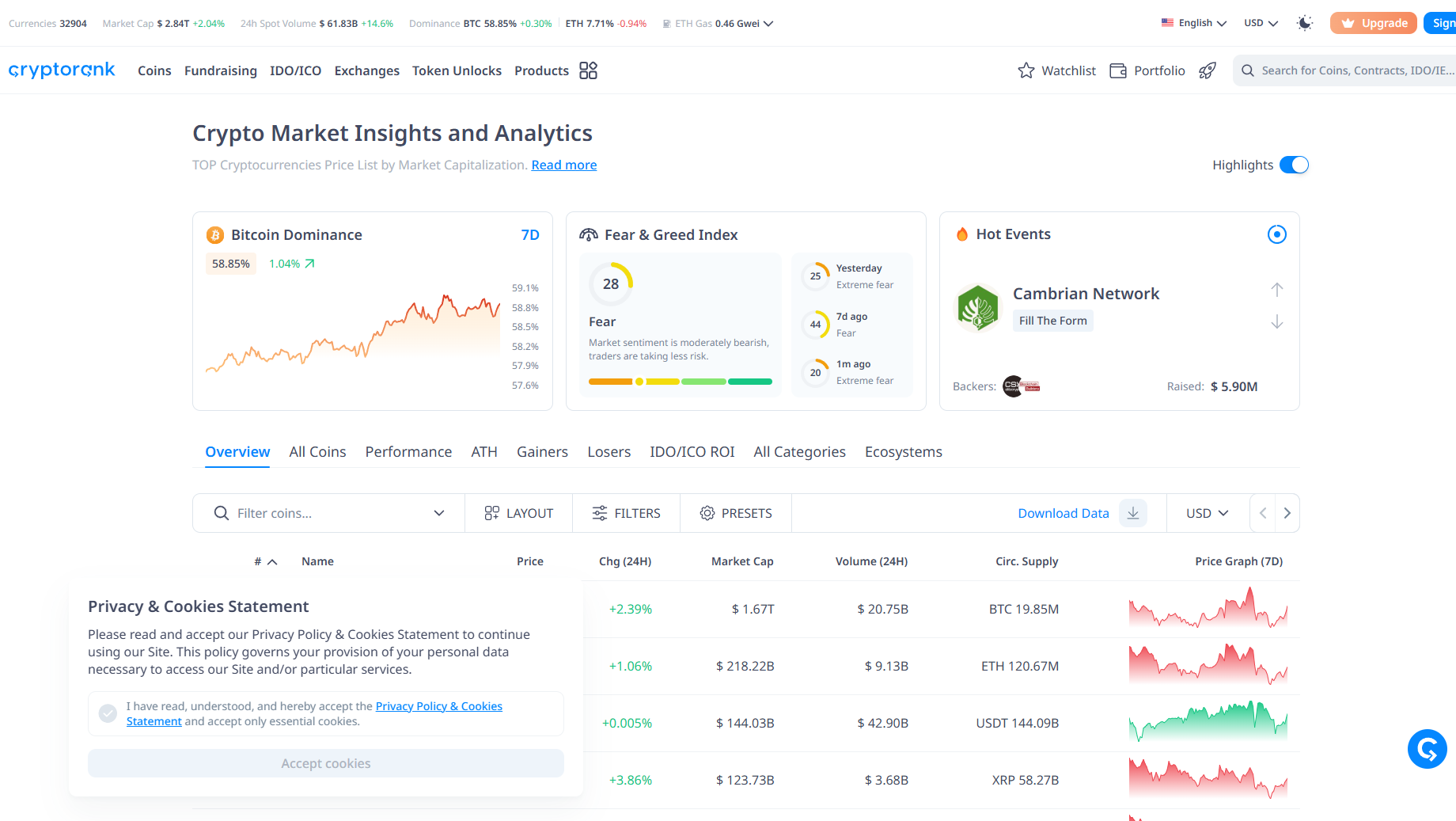

- Combine Bitgur with CoinGecko for token metadata and CryptoRank for unlocks and vesting. Bitgur finds the scream. the others tell you if the scream is valid.

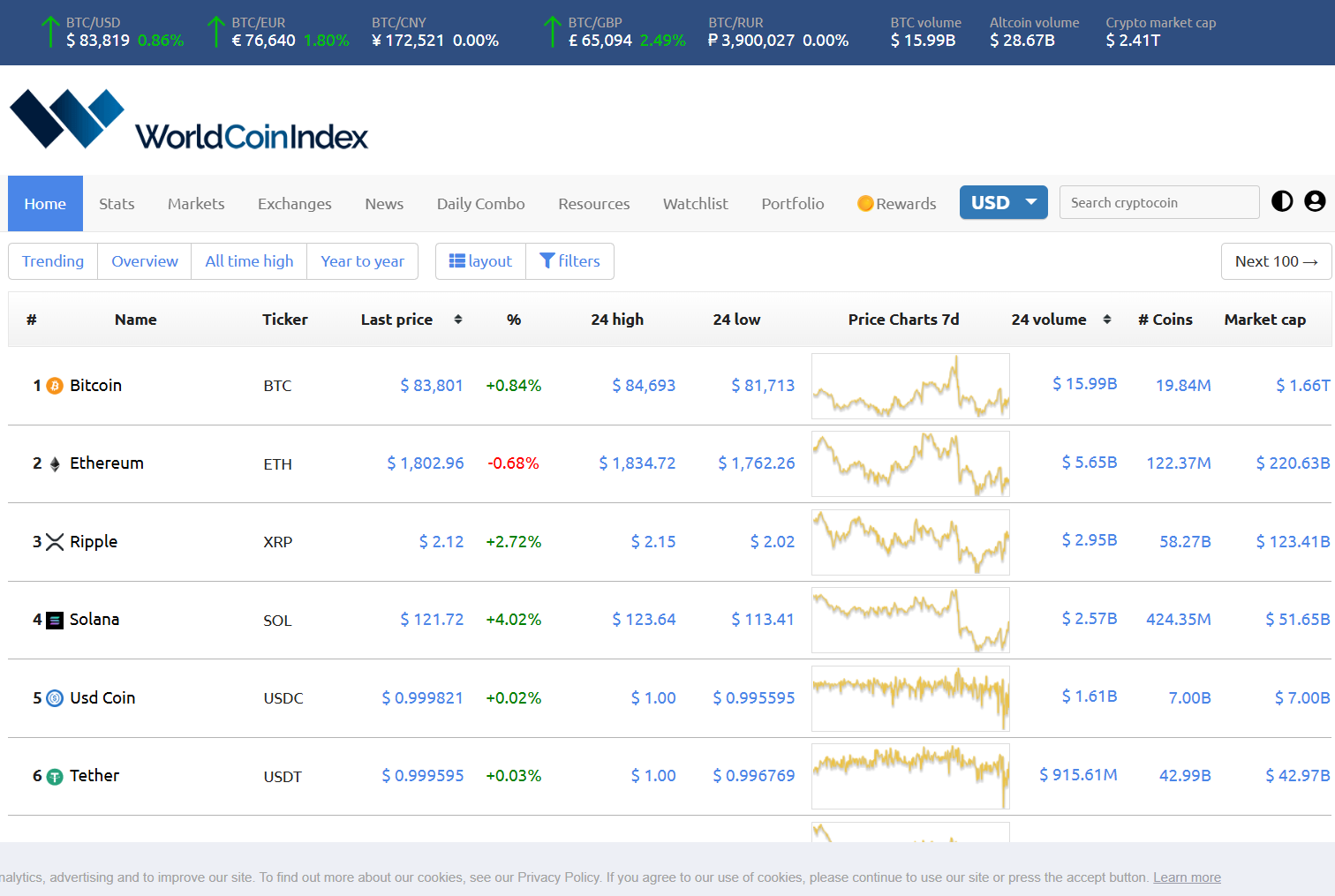

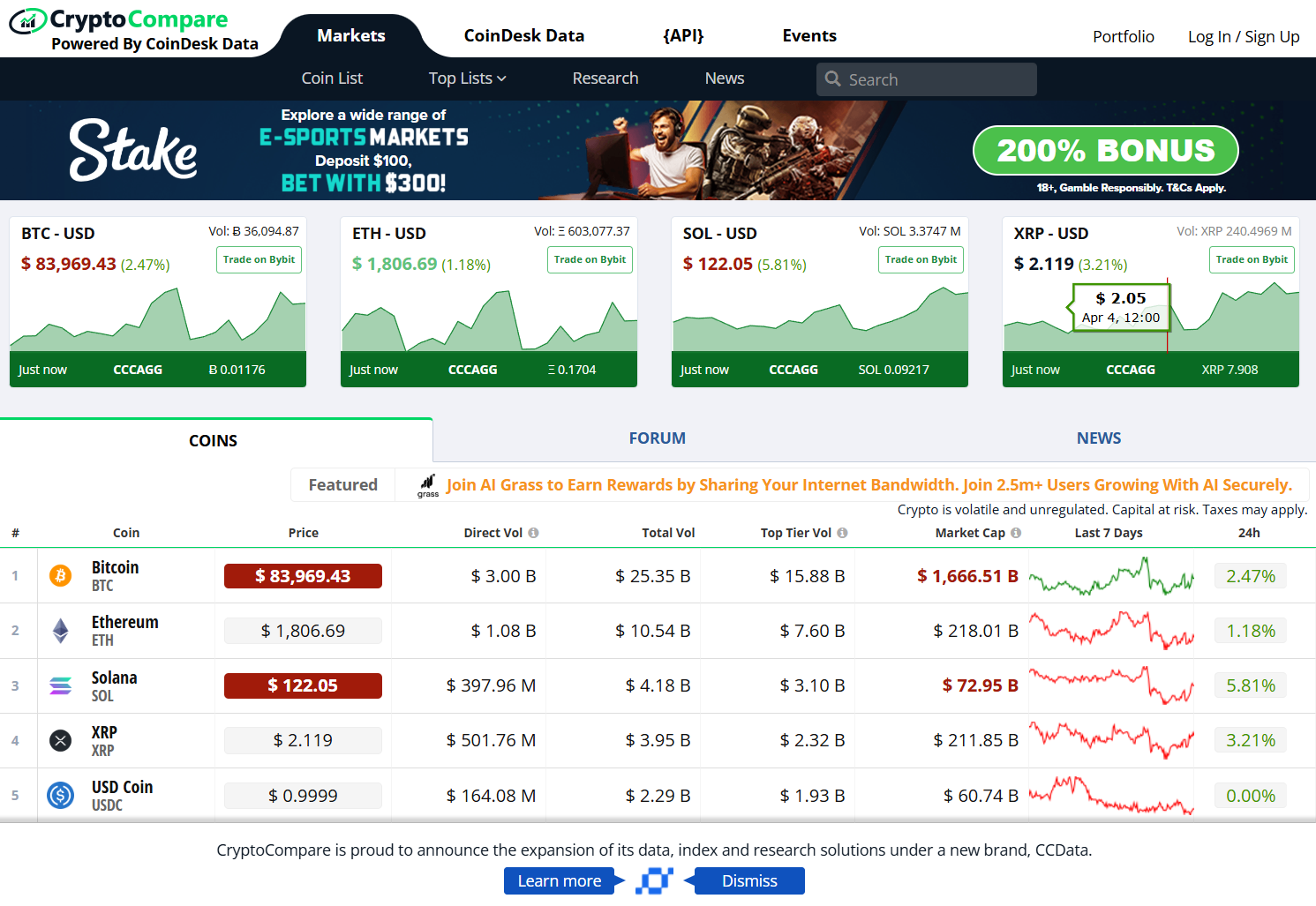

How Bitgur Stacks Up vs the Big Ones

vs CoinGecko

CoinGecko gives deep token metadata, dev metrics and social signals. Bitgur gives faster alerting and a volatility meter. Use Gecko for context, Bitgur for the first whisper.

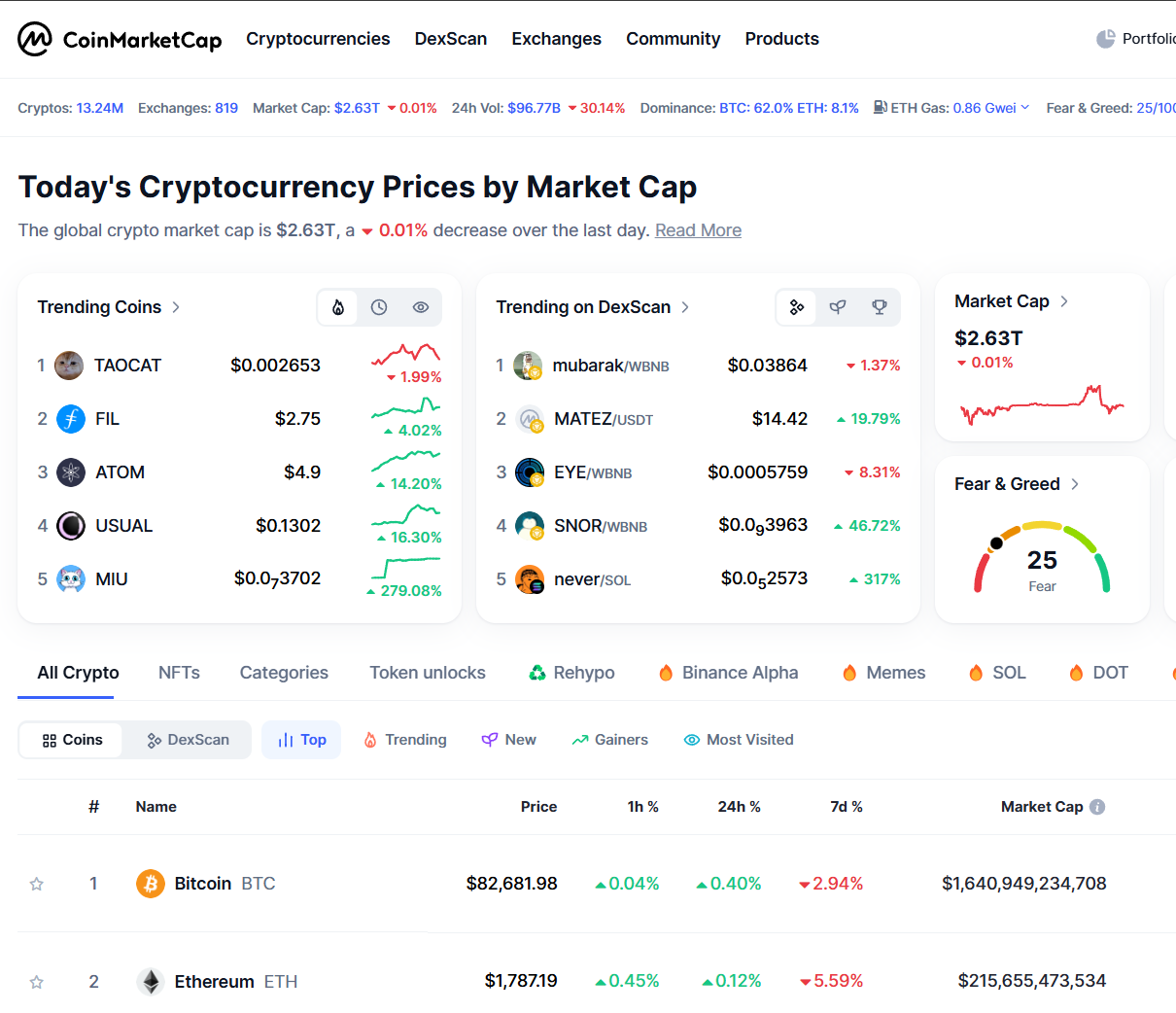

vs CoinMarketCap

CMC has exhaustive listings and corporate polish. Bitgur is lean, alert-driven and better for live signal hunting.

vs CryptoRank

CryptoRank beats Bitgur on unlocks, vesting and investor flows. Bitgur beats CryptoRank on real-time listing detection and short window performance.

vs LiveCoinWatch / CoinCodex

LCW and Codex have strong dashboards. Bitgur is sharper for alerts and noisy situations.

Ace’s Vibe About Adding Bitgur To The Stack

Bitgur sits in my alerts lane. It pings me about new listings, volume spikes and sudden market stress. When it screams I verify orderbooks, check tokenomics, and then size a trade with a conservative slippage plan. Never automate a big buy from a single alert feed. Treat Bitgur like a scout that runs ahead of your research squad. It finds the flare. you do the recon.

AceOfCrypto out.

Use it to smell smoke.

don’t build your house over the campfire.