CoinCodex Site Review

CoinCodex

CoinCodex is The Clean, Hungry Tracker Straight-up Price Checking

AceofCrypto here, with CoinCodex, gonna explain this real good. You want numbers fast and a simple dashboard that doesn’t beg for attention. CoinCodex gives that. It’s a Ljubljana outfit from 2017 that swallowed a ton of market feeds and turned them into a lean tracker. It pushes live prices, watchlists, portfolio tools, alerts and a prediction/news feed, nice for quick scans and mobile glances, shaky if you need under-the-surface accuracy or alpha on microcaps.

What is CoinCodex?

CoinCodex is a crypto market aggregator and tracker founded in 2017. The site’s got coverage in the tens of thousands of tokens and hundreds of exchanges, the public docs list ~43,000+ tracked assets and 400+ exchange feeds, plus a beta API you can hit for programmatic data. That’s volume. That’s breadth. That’s a lot of noise to sift through if you don’t filter.

AceofCrypto’s here to expose the lesser known scoop on CoinCodex. It ain’t perfect, just got a few perks for you to use. Here’s the whole breakdown.

What’s the Word Out on CoinCodex?

People like how clean CoinCodex is. Users say the UI is uncluttered and the mobile widgets actually work for daily price checks. Critics call out prediction features and “price forecasts” as overconfident. There are also angry Trustpilot reviews from users who swore by predictive outputs and got burned. Bottom line, solid scanner, questionable prophet.

Usability & UX

The interface is spare and fast. Desktop gives full lists and filters; mobile focuses on watchlists, widgets and quick alerts. Filtering by market cap, chain, gainers/losers, and tags is straightforward. The tradeoff: depth hides behind clicks. Want token unlocks, vesting schedules, or granular on-chain traces? You’ll need other tools. For daily checks, CoinCodex is snug. For deep dives, it’s a doorway, not the lab.

Data Accuracy & Security

CoinCodex pulls from hundreds of exchange APIs and claims real-time updates. That gives wide coverage, but wide coverage means noisy coverage. Low-liquidity pairs and new tokens often show stale or sparse data. API is beta, so use with caution for trading automation. On the systemic risk side: the market still suffers wash-trading and fake volume issues, no tracker is immune, CoinCodex included. Cross-verify heavy plays always.

Extra Features on CoinCodex

This is a tracker, it’s got the extra kicks. Here’s what, and how.

Watchlists

Save coins. Group them by chain or thesis. Home-screen, mobile widget, desktop sync. Great for the top 10 you actually trade. Not great for hand-holding with tiny gems, those may vanish from lists if feeds dry up. Keep the widget up, but go back to your laptop when you see the opportunity.

Portfolio Tracker

Manual entry or import public addresses. Shows allocation across chains and P&L snapshots. Functional. Not an accounting suite, don’t use it to file taxes without cross checks.

Price Alerts

Email and in-app alerts are the real players. Simple triggers on price levels and percentage moves. Works for the basics. Expect delays when markets pukes, the free tier isn’t built for millisecond trading.

API (Beta)

Free, attribution license, beta v0.2. Good for dev toys, dashboards, and bot prototypes, but don’t throw production capital at it without tests. Rate limits and breakages happen.

News, Research & Predictions

CoinCodex publishes price forecasts, news roundups, and token unlock calendars. Useful for narrative scanning and spotting unlock pressure. Don’t take predictions as trade calls, users report faith in forecasts leading to bad bets. Verify with others if you’re itching.

Pros of Using CoinCodex

- Tracks a massive universe of tokens and exchanges

- Clean UI and fast glanceability on mobile and desktop

- Integrated watchlists, widgets, portfolio and alerts

- Free-ish API for building dashboards (beta).

- Built-in token unlocks and fundraising tracking.

Cons of Using CoinCodex

- Data depth for microcaps is spotty; missing trades happen.

- Prediction features attract bad faith trust from rookies.

- Some features behind paid tiers; pro tools cost money.

- Mobile experience trims advanced filters.

Risks of Relying Only on CoinCodex

Using one price tracker is gonna sink your bags faster than bitconnect. CoinCodex has some dangers coded into the system. Here are the risks most users face.

Blind Trust in Predictions

CoinCodex posts forecasts. People treat them as gospel. Forecasts are not guarantees. Trust issues have real dollar scars.

Microcap Data Gaps

New or tiny tokens can have stale prices or missing pairs. Acting on that data is a fast route to liquidity traps.

Volume & Wash Trading

Reported exchange volume can be inflated industry-wide. That distorts rankings and perceived liquidity. Always validate volume on multiple trackers and on-chain flows.

API Reliability for Automation

Beta APIs break. Bots that trust a single feed will eat dust. Stress-test before you trade live.

Missing Narrative Signals

CoinCodex is a data slab. It won’t catch every social pump or influencer raid. Combine it with social sentiment tools if you trade coins for a living.

Rookie Mistakes

- Betting on a CoinCodex “prediction” without checking tokenomics.

- Using portfolio snapshots as legal records or tax prints.

- Automating trades off the beta API without rate-limit tests.

- Tracking 200 tiny coins and calling that “diversification.”

- Ignoring on-chain flows and only trusting UI volume.

Ace’s Tips for CoinCodex

Here’s what you gotta do once you get the hang of CoinCodex

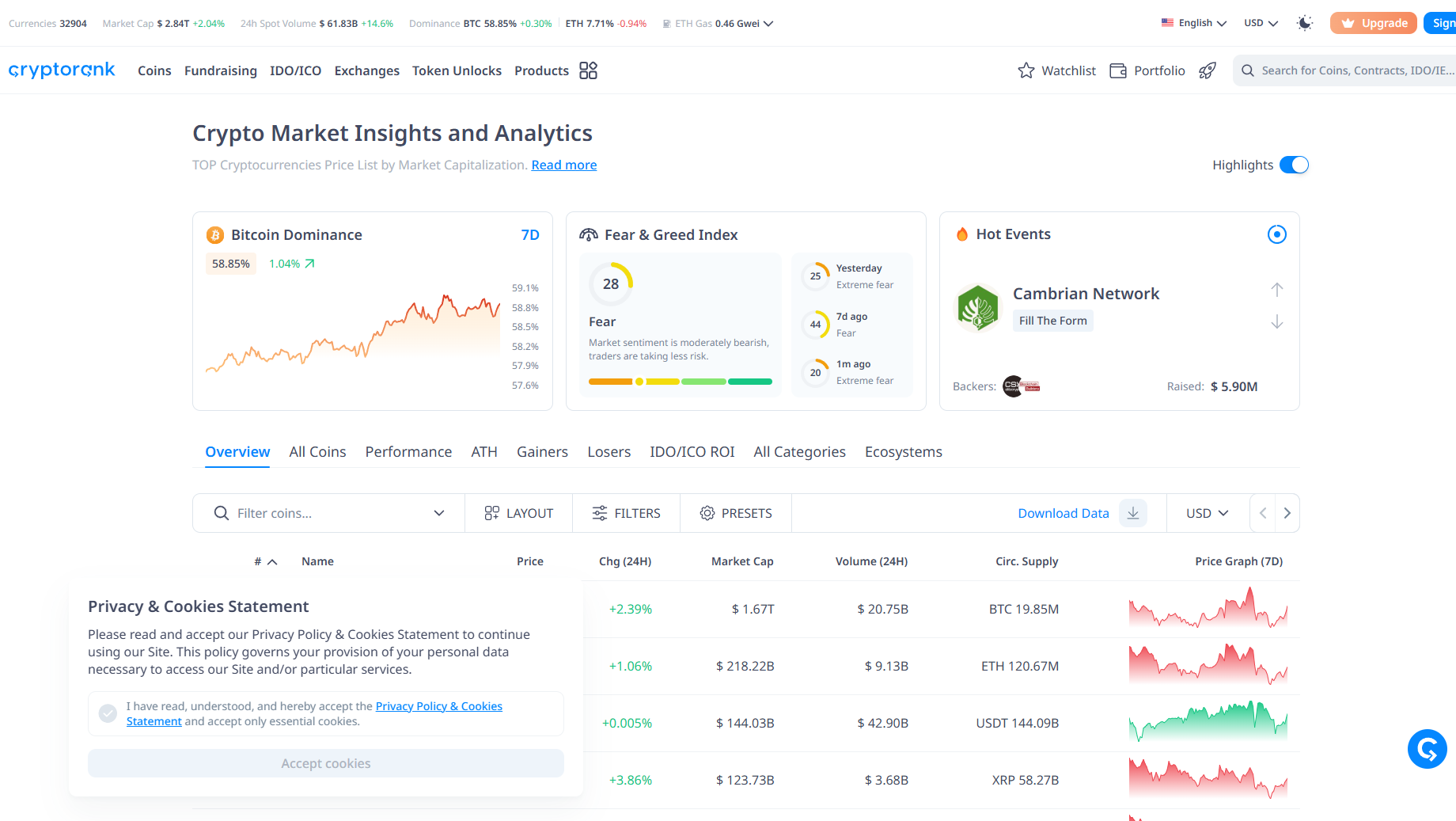

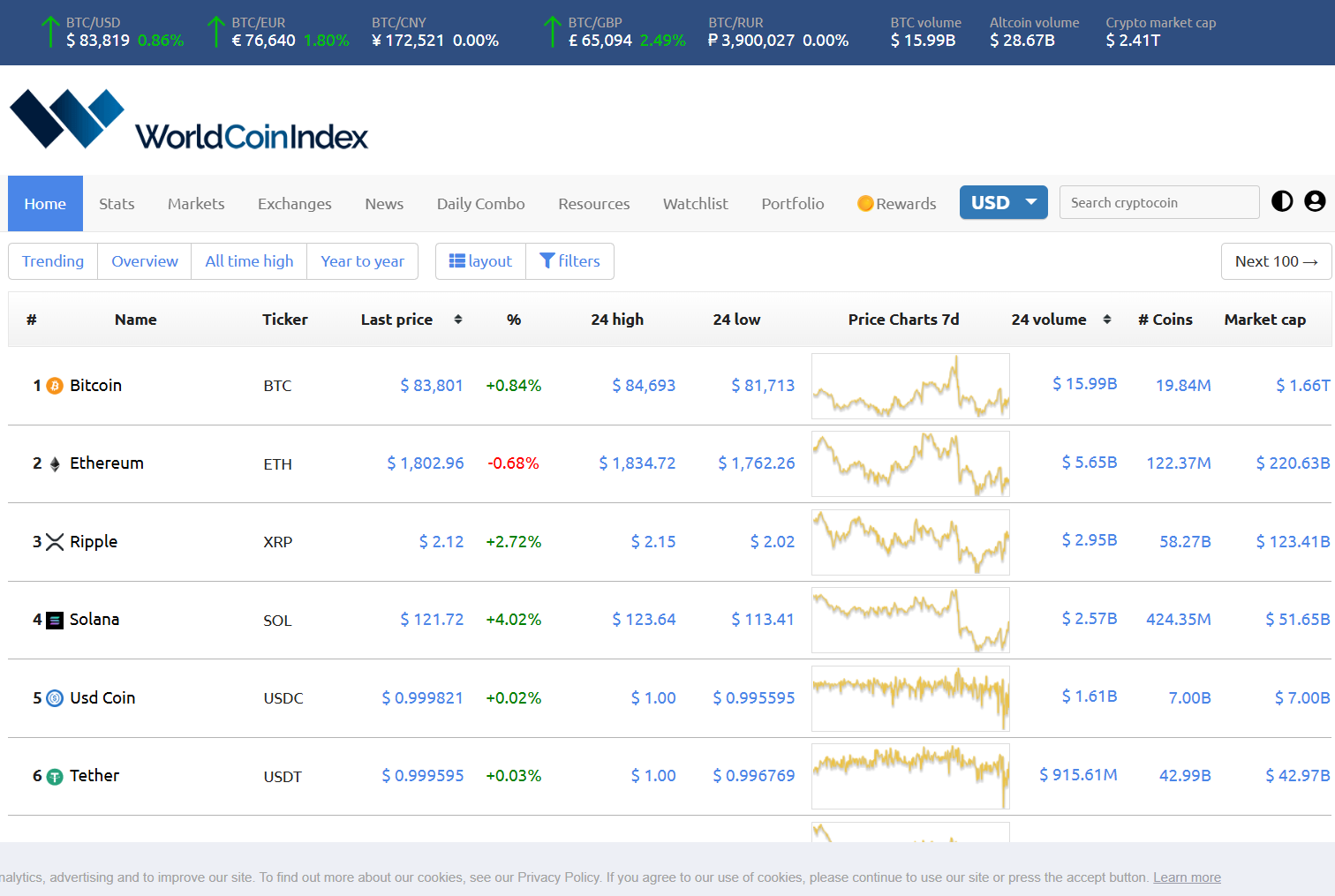

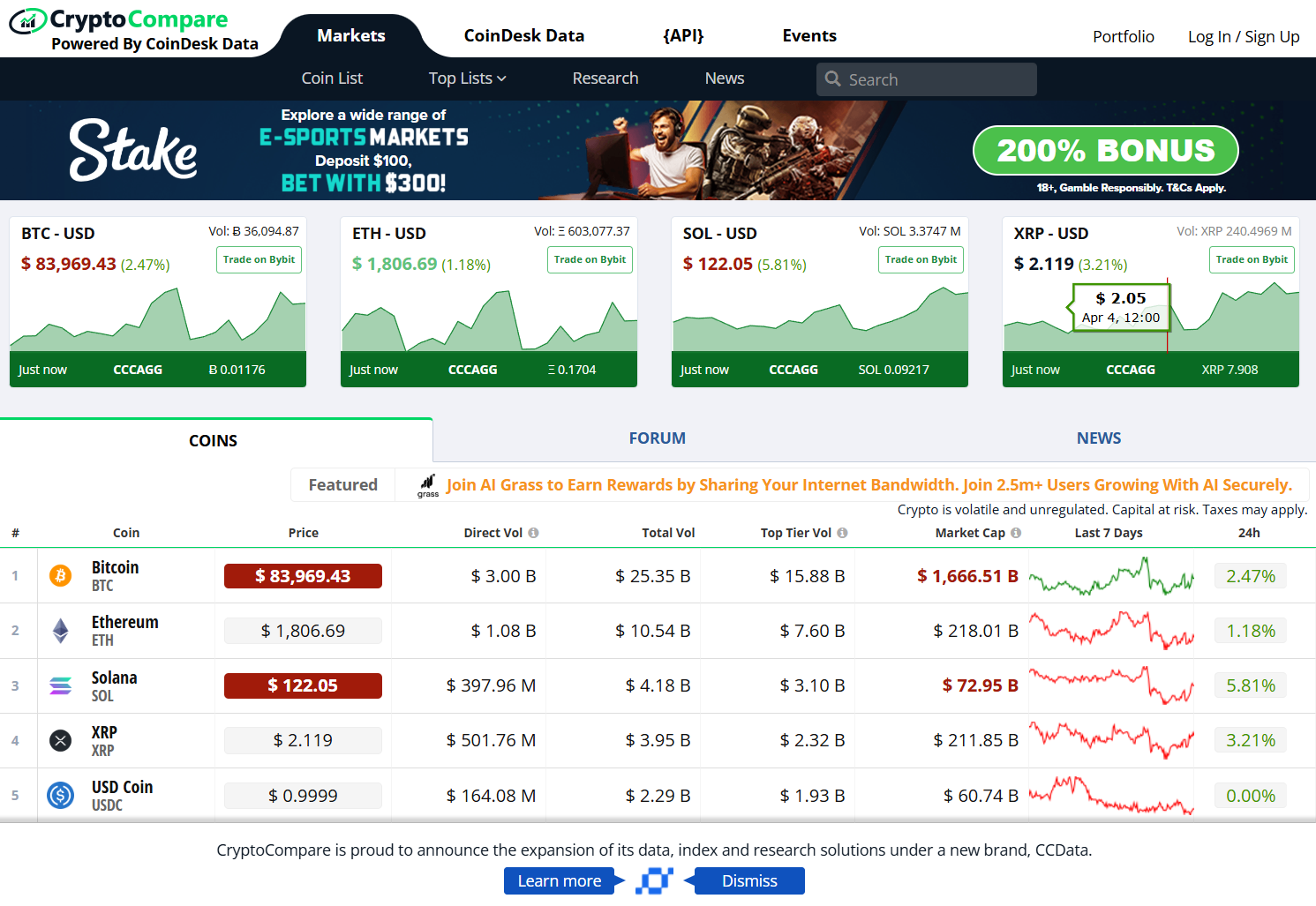

- Use CoinCodex to scan and shortlist. Then deep-dive with CoinGecko/CryptoRank/Etherscan.

- Filter by market cap + exchange liquidity before you size a position.

- Treat predictions as hypotheses, not signals. Validate with tradebook data.

- Test the API on paper trades. Don’t ship bots blind.

- Use unlock calendars when sizing early-stage tokens, unlocks = selling pressure.

How CoinCodex Stacks Up Agains the Others

vs CoinGecko

CoinGecko is the DeFi darling with NFT stats, yield farming data, big dev community always adding integrations. CoinCodex throws volume by sheer token count with more listings, faster coin addition, lean scanner with less clutter.

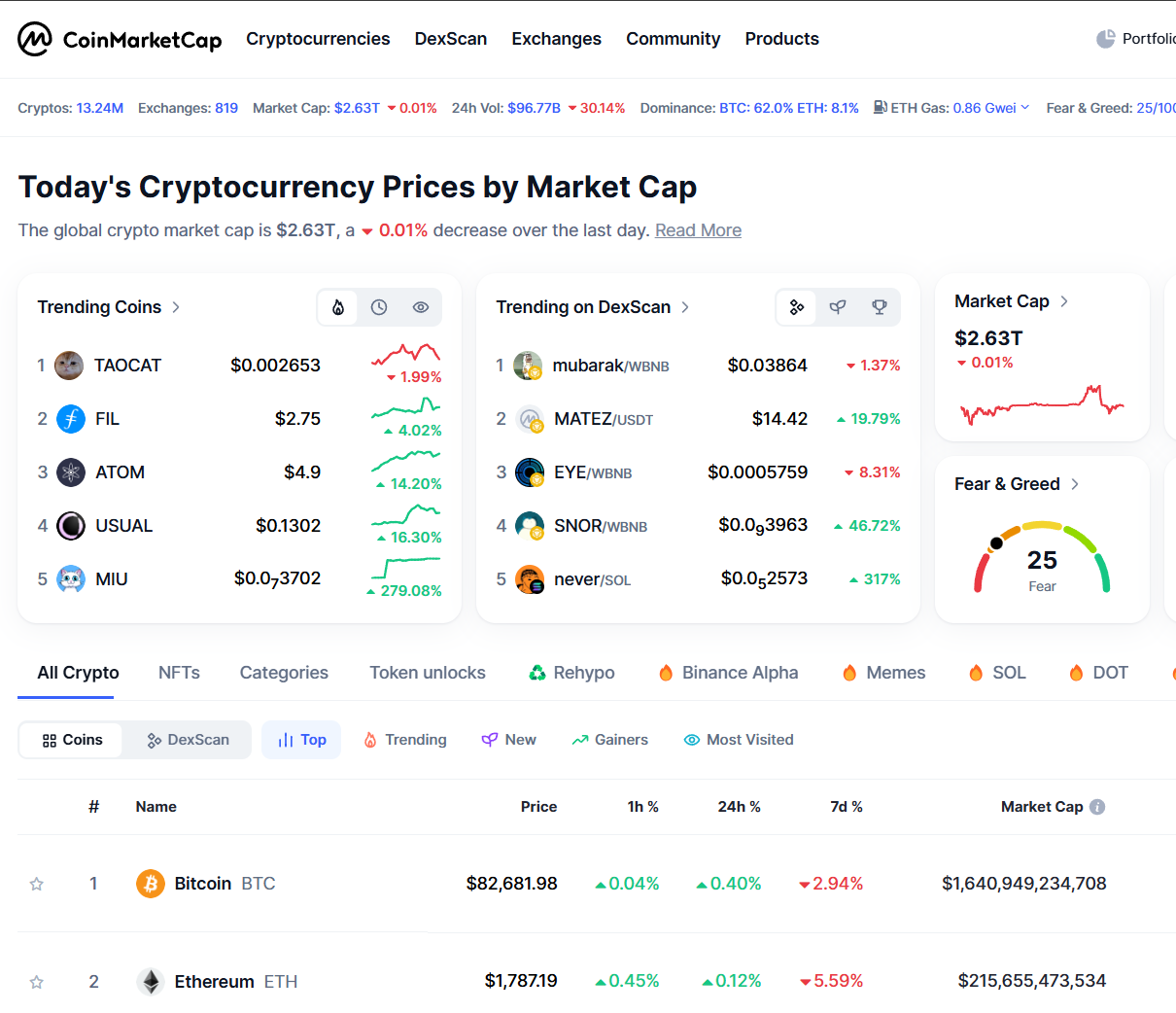

vs CoinMarketCap

CMC has reach, Binance ties, and exchange influence, the household name normies still Google first. CoinCodex moves quieter, covering exotic alts and microcaps faster, without the Binance bias baked into CMC.

vs CryptoRank

CryptoRank is analytics-heavy with token unlock calendars, vesting charts, investor breakdowns, filters for deep research. CoinCodex is surface-level but instant with price, charts, alerts, snapshots for quick market reads when you don’t need data science.

vs Wallet Apps (Bitcoin.com, TrustWallet, etc.)

Wallet apps win UX can spend, send, and have swap flows built right in. CoinCodex wins reach with more coins tracked, better history, cleaner alerts. It’s not where you transact, it’s where you scan the field.

AceofCrypto’s Bottom Line for CoinCodex

CoinCodex is the scanner you open when you want breadth fast. Use it to surface names, check unlocks, and manage a light portfolio. Don’t use it as the only truth. Cross-check, stress-test the API, and treat every prediction like a dare. If you run it the way pros do, remember to shortlist, verify, execute, CoinCodex will save you clicks and time. If you rely on it blind, it’ll make you look dumb and cost you money.

AceofCrypto Out

Scan the battlefield first

Plan the attack through more lenses