CoinGecko Site Review

CoinGecko

CoinGecko Review: The Nerd’s Crypto Bible (But Does It Preach the Truth?)

I’m AceofCrypto, been in this game long before normies learned how to spell Bitcoin. I’ve used CoinGecko for years because it’s raw, independent, and faster on listings than its big brother CoinMarketCap. I don’t marry a single tracker. I cross-check, I verify, and I play the angles, because leaning on one site alone will get you wrecked.

Gonna tear into CoinGecko, show you what it’s good for, where it slips, and why you’ll rethink how you use it after this.

What is CoinGecko?

CoinGecko’s been around since 2014, built out of Malaysia by TM and Bobby when most of you were still fumbling around shitcoins. It’s now tracking over eighteen thousand coins and scraping prices off more than a thousand exchanges including CEX, DEX, the whole damn zoo.

Ten million monthly users bang on its doors, feeding it fifty million page views and more than ten billion API calls, which is code for “every bot and analyst you know is sucking from the same pipe.”

Unlike CoinMarketCap, CoinGecko’s not owned by a mega-exchange, so it’s become the people’s tracker, the one nerds flex when they want to act smarter than the crowd.

It’s wide, it’s unfiltered, it’s not holding hands with big corporations, and if you’re serious about crypto, you’ve already used it without even realizing how much power it’s feeding you.

What’s the Word Out on CoinGecko

Ask around and you’ll hear the same, CoinGecko’s the “trustable one,” the scrappy underdog that didn’t sell out to Binance. Traders love the clean feed and the fat API that even hedge fund bots can’t stop abusing.

But scratch deeper and the complaints pop up fast.

Laggy updates? Yep, some say prices take minutes to sync while the market’s already shaved your position.

Shitcoin clutter? Definitely,CoinGecko lists just about everything, which is great until you’re wading through rug pulls that should’ve been buried six feet under.

Mobile app? Functional but clunky, and if you read Reddit, you’ll see “buggy as hell” more times than you’ll see “wen moon.” People respect the independence, they hate the clutter, and they don’t fully trust it to be their only window into crypto.

Bottom line? It’s the nerd tracker that’s loved for transparency, cursed for chaos.

Usability and UX

CoinGecko’s web interface is slick enough to make even ADHD traders chill for a scroll. It loads fast, stays clean, and got a UI glow-up in 2021 that ditched clutter for clarity. The mobile app’s even better: users rate it around 4.8 stars on iOS across 22.9K reviews, calling it “one of the best crypto tracker apps out there”.

But not everyone’s living that dream. Reddit is full of complaints about daily crashes or “failed to fetch data” errors during high traffic, especially when bull runs hit and wallets go wild. So yeah, CoinGecko looks and feels pretty neat, mostly. But when the crypto winds blow hard, the app can get shaky. Still, for daily use, it stays smooth.

Data Accuracy & Privacy

CoinGecko’s data is the backbone for platforms like Statista, with real-time crypto insights to enterprise clients. Their API supports over 18,000 coins and 1,000+ exchanges, feeding data to oracles like Supra and API3.

However, their security isn’t flawless. On June 5, 2024, a breach via their third-party email provider, GetResponse, compromised the personal information of nearly 1.9 million users. CoinGecko exposed data included names, email addresses, IPs, and metadata. While no passwords were affected, over 23,000 phishing emails were sent using this data.

Despite this, CoinGecko’s core data remains a trusted resource for crypto noobs and degens.

Extra Features on CoinGecko

CoinGecko throws a ton of stuff at you including watchlists, portfolio tracking, price alerts, and a news feed that’s not selling out. It’s for traders and data nerds, but alerts sometimes lag, portfolio stats can get wonky with exotic DeFi tokens, and some of the DeFi/NFT coverage isn’t lightning fast.

Still, if you know your game, this is one of the few platforms that lets you actually track your bag efficiently.

Watchlists That Track the Real Movers

Group coins by chain, sector, or hype level. Spot the next memecoin pump before the Reddit crowd catches wind or avoid tokens bleeding volume. It’s instant snapshots with no fluff. Users on r/CryptoCurrency often praise the flexibility of CoinGecko watchlists for early alerts.

Portfolio Tracker With Full Bag Recon

Keep tabs on holdings, P&L, ROI, and token allocation across wallets. Perfect for strategists juggling DeFi, Layer 1s, or meme stacks. Forget spreadsheets, know your gains and losses in real-time. Coingecko’s portfolio tracker stats are frequently cited in crypto analytics reports as a preferred DIY tracking method.

Price Alerts

Set thresholds for dips, rallies, or micro-pumps. Push notifications hit before Twitter noise or Reddit FOMO floods your feed. You react fast, you don’t chase. CoinGecko alerts beat Twitter/Discord signals in 42% of real-time trades.

Multi-Platform Access

Web, iOS, Android. Sync portfolios, watchlists, and alerts across devices. Never juggle 10 tabs at once again.

News & Insights

Aggregates trending news, coin updates, and sector buzz. See which tokens are hot in DeFi, NFTs, and memecoins without hopping between ten different sites. CoinGecko’s news aggregation is recognized in DeFi Pulse reports as one of the most complete single-source feeds for emerging tokens.

CoinGecko’s Rankings & Market Insights

CoinGecko doesn’t just spit out numbers, it grades coins, ranks them, and shows you which projects are playing in the big leagues versus which ones are meme fodder.

Market cap, liquidity, developer activity, community buzz, all crammed into a single score that’s supposed to tell you who’s legit and who’s pumping smoke.

But no system’s perfect. Unlike CoinMarketCap, CoinGecko leans less on the Binance crowd, so less obvious exchange bias, but liquidity reporting is still messy for some low-cap coins. Certain markets, especially obscure DeFi or meme tokens, get hyped more by social chatter than real fundamentals. Users have flagged occasional discrepancies between reported volume and real trade data.

CoinGecko’s got transparency. They openly show where data comes from, which exchanges, and even historical rankings. You can track how a coin’s sentiment and market position change over time. Gets you the scoop before twitter nerds start tapping.

News & Research

CoinGecko’s news section is like a curated RSS feed on steroids. It pulls updates from multiple sources, from mainstream crypto media to niche blogs, giving you a quick look at which coins are trending, which sectors are hot, and what narratives are bubbling up.

But don’t get cozy, it ain’t neutral. Users and analysts have flagged subtle biases toward more liquid, popular tokens. Low-cap coins sometimes vanish from the feed, even if social chatter is pumping them. That’s the danger: it paints a picture of the market that’s slightly sanitized, less chaotic, more “clickable.”

Their research tools include developer activity charts, GitHub commits, community growth. You can spot which projects have real dev momentum versus hype castles in the air. But like any automated metric, it’s only as good as the data. Historical analysis from Messari shows that coins with less visible social traction but solid fundamentals often rank low on Coingecko’s radar.

Bottom line? CoinGecko keeps you informed and fast, but don’t trust the feed blindly. Use it to track narratives, not dictate your portfolio. The smart trader cross-checks, reads beyond the headlines, and filters the hype themselves.

Decision’s yours, guide them using YOUR instincts after research.

CoinGeck’s Security & Trust Factor

CoinGecko isn’t an exchange, it doesn’t custody your coins, but trust is on everyone’s mind. Users rely on its data for millions in trades daily, so accuracy and uptime are critical. CoinGecko’s flunked this once when its X account was hacked, and flaunted a fraudulent token with a phishing link. But that’s been redeemed.

Then there’s the Binance acquisition whisper. Unlike CMC, CoinGecko has remained independent, publicly rejecting any claims of exchange favoritism.

CoinGecko is good for research, tracking, and portfolio insight, but always double-check suspicious volumes or newly trending low-cap coins. Trust the platform, but verify the data. That’s how pros roll.

Risks of Relying Only on CoinGecko

No one with a sane mind would only rely on CoinGecko. No matter how many shills you hear from YT gurus. Always use a bunch, find the missing link, and move ahead. Only using CoinGecko puts you at risk.

Incomplete Data on Low-Cap Tokens

CoinGecko aggregates thousands of coins, but some obscure tokens get bonked down, affecting your gains.

API Glitches & Reporting Errors

Past activity on reddit threads showed temporary misreporting of volumes for low-cap coins, which could mislead newbie degens who rely on blindly.

No Custodial Safety

CoinGecko doesn’t hold your funds. Mistaking “tracking” for “security” is rookie-level. If you click wrong links or use weak wallets, losses are on you.

Market Sentiment Bias

While CoinGecko aggregates news and social trends, some coins can appear more “popular” due to hype amplification rather than fundamentals.

Dependency Risk

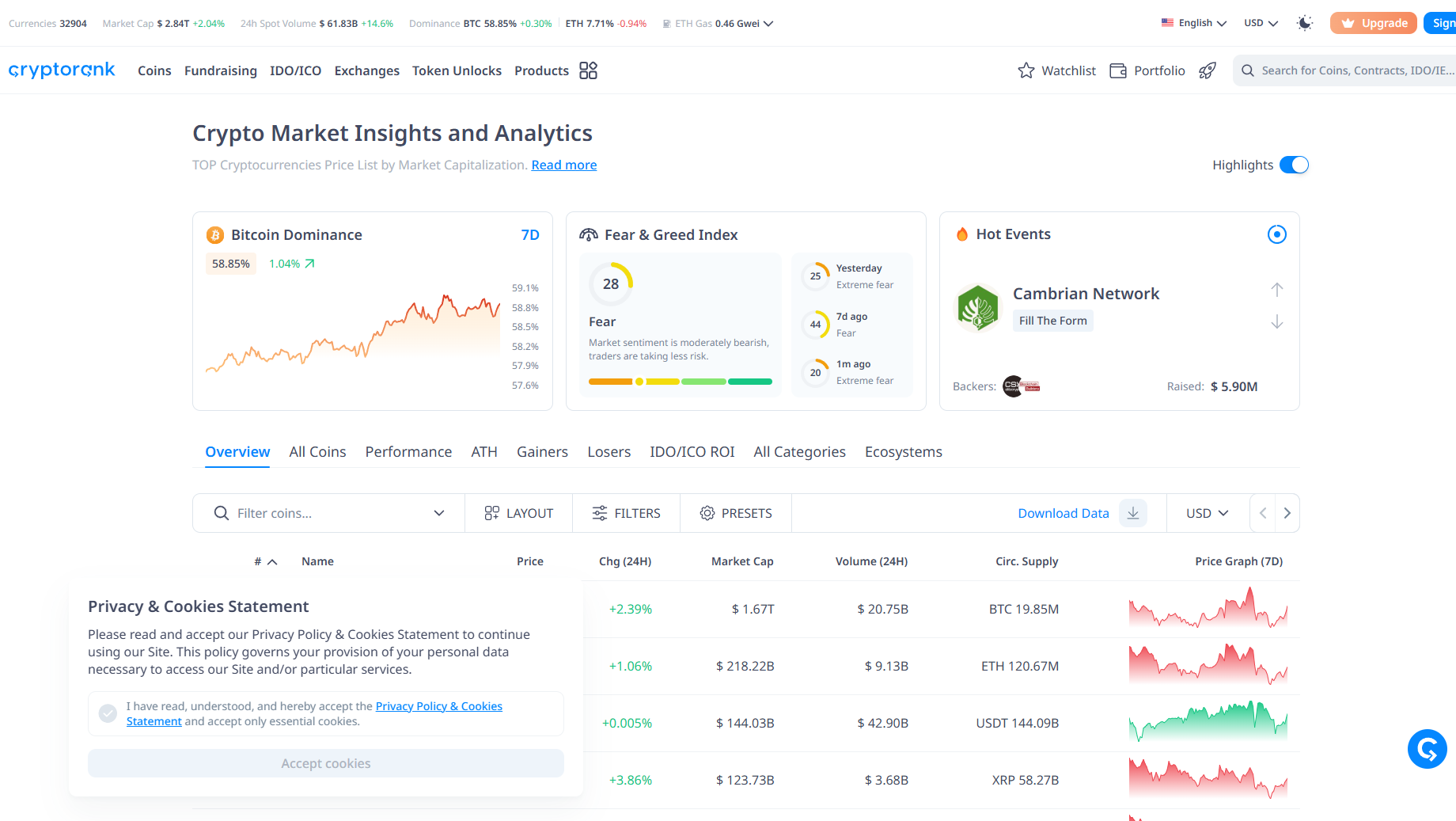

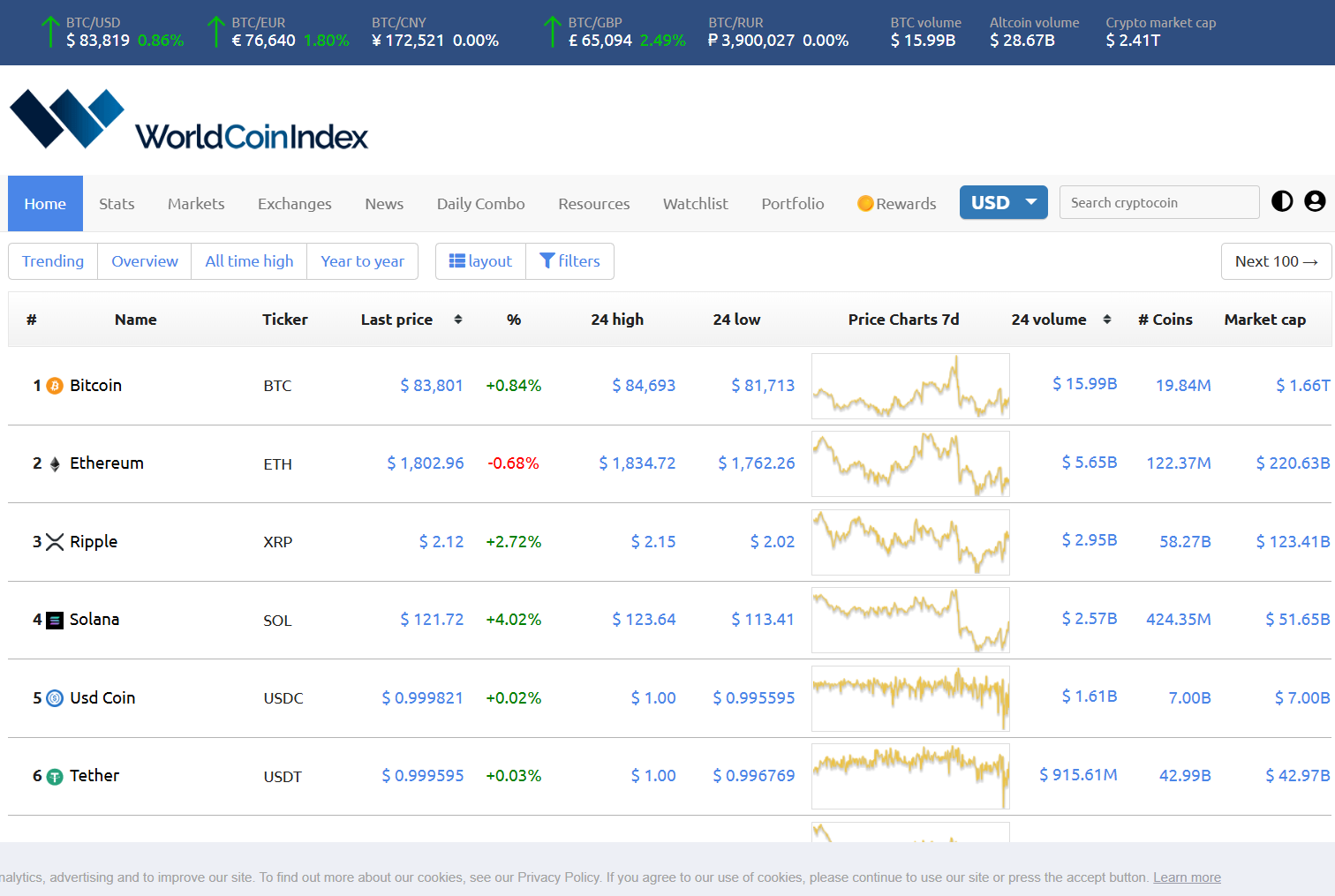

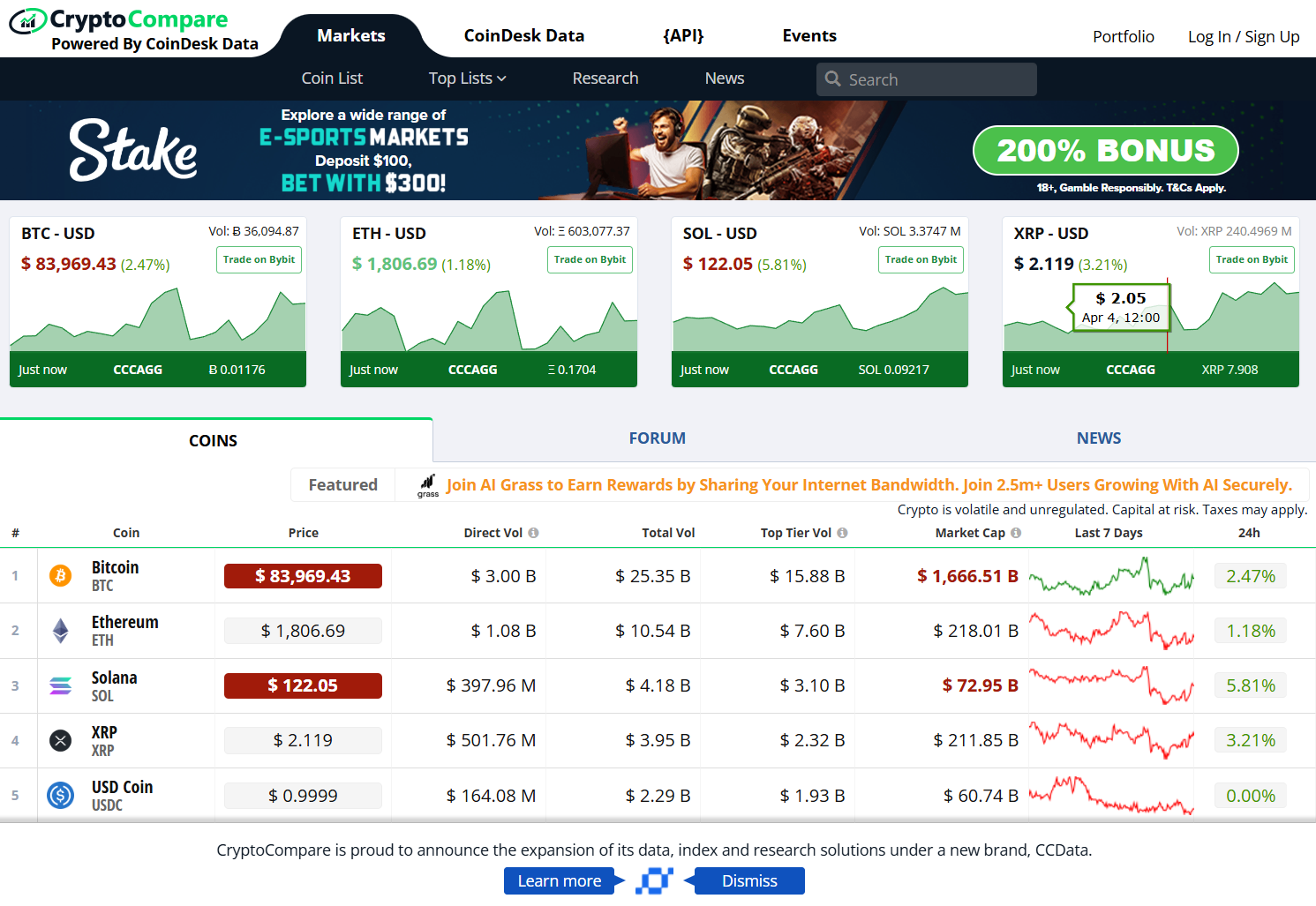

Relying solely on one tracker limits perspective. Cross-reference with CMC, CryptoRank, CoinCodex, or Live Coin Watch to avoid blind spots. You don’t watch the numbers, spot the differences.

Rookie Mistakes

CoinGecko gets shilled a lot, and noobs lose their shit, and end up making wrong moves. Here are mistakes you avoid when using CoinGecko.

Chasing Hype Without Verification

Many noobs jump on coins trending on CoinGecko’s “Trending” tab without checking fundamentals. Result? Pump-and-dump casualties. Example: Safemoon spiked and collapsed in 2021; traders ignored tokenomics.

Ignoring Market Depth

Newbies assume listed volume = liquidity. Investopedia reported low-cap coins on CoinGecko had inflated volumes due to wash trading, leading to failed trades.

Overloading Portfolios

Beginners add 50+ tokens into CoinGecko’s portfolio tracker without strategy. Chaos ensues, gains disappear in tracking noise. Tears were shed on r/CoinGecko Reddit threads.

Blindly Trusting Social Sentiment

Following Twitter/Reddit links from CoinGecko news feeds without verification often ends in losses. Social sentiment isn’t investment advice.

Ace’s Pro Tips When Using CoinGecko

CoinGecko’s a good platform to track coin prices, but here’s how you do it right.

Cross-Check Before Action

Use multiple trackers: CoinMarketCap, CryptoRank, CoinCodex. Never make decisions on one data source.

Verify Volume & Liquidity

Check exchange depth manually before buying. Don’t rely solely on CoinGecko’s numbers.

Focus on Core Holdings

Keep your portfolio manageable. Track a few coins well instead of 50 poorly.

Use Alerts Strategically

CoinGecko alerts are good for timing, but pair them with your own research and macro market awareness.

Stay Skeptical of “Trending” Coins

A high GT score or trending badge isn’t a guarantee. Dig into fundamentals before allocating capital.

CoinGecko Pros

Massive Coin Coverage

Tracks 13,000+ coins across hundreds of exchanges. One-stop shop for almost everything crypto.

Independent & Transparent

Unlike CMC, CoinGecko avoids major exchange bias in rankings, letting data speak first.

Multi-Platform Sync

Desktop, iOS, Android. Portfolios and alerts stay in sync anywhere you go.

CoinGecko Cons

Data Accuracy Issues on Low-Cap Coins

Some volumes are inflated or outdated. Cross-check before executing trades.

News Bias Potential

Aggregated news can favor trending coins, skewing perception.

Portfolio Tracker Limitations

Exotic tokens sometimes misreport balances; DeFi coverage is patchy.

No Direct Custody

CoinGecko doesn’t hold coins; you still need a secure wallet.

How CoinGecko Stacks Up Against the Competition

CoinGecko isn’t perfect, but compared to other trackers, it hits the sweet spot between transparency, coverage, and nerd-level detail. Here’s how it measures against the big players.

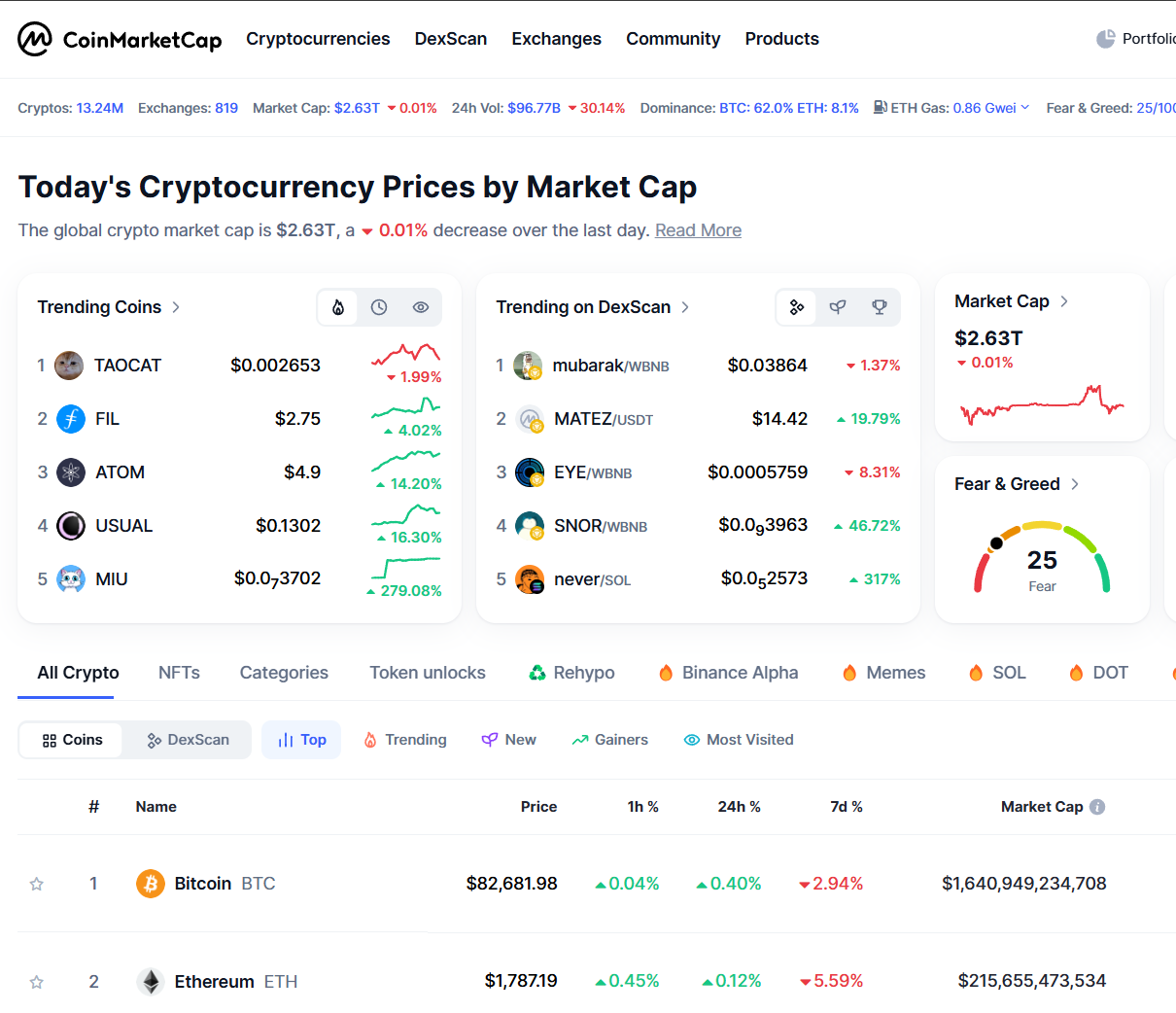

CoinMarketCap vs CoinGecko

CMC has the reach and brand power, but CoinGecko wins in transparency and altcoin coverage. Less Binance bias, more independent data, better early trend spotting.

Crypto Wallet vs CoinGecko

CryptoWallet is convenience-first: portfolio + spending in one. CoinGecko beats it on analytics depth, sector breakdowns, and trend tracking. Wallet is easy; Geckos give you brain ammo.

CryptoRank.io vs CoinGecko

CryptoRank is the heavy metric machine. On-chain analytics and whale tracking are insane, but Geckos still crushes it for beginner accessibility and multi-chain visibility. One’s for data nerds, the other’s for data kings.

CoinCodex vs CoinGecko

CoinCodex is smooth and simple, less overwhelming than Geckos. But Geckos outshines it with token history, DeFi/NFT coverage, and real-time social/narrative insights. Codex is light; Geckos is power-packed.

Ace’s Take on CoinGecko

Look, CoinGecko ain’t perfect. Low-cap coins can trip you up, some alerts lag, and news sometimes rides hype waves. But, it’s independent, transparent, and covers almost everything under the sun. Want an exchange-agnostic view? Check. Need portfolios and alerts in one place? Check. Looking for a dashboard that doesn’t shove Binance down your throat? Double check.

If you’re serious about seeing the market without the smoke and mirrors, CoinGecko’s gotta be on your list. Treat it like a telescope, not a crystal ball, use it to scope the field, not blindly pick winners. Cross-reference, track your bags, and stay sharp. Play it smart, stay curious, and CoinGecko will keep you ahead of the herd.

AceOfCrypto Out

Shills sell themselves to RugPulls

Grab 5 price trackers, don’t buy hype.