CoinMarketCap Site Review

CoinMarketCap

What Is CoinMarketCap?

CoinMarketCap is the Google of crypto price trackers. You type in a coin, it spits out charts, prices, and numbers. Been around since 2013, and it’s still the site degens check first thing in the morning to see how badly their bags got nuked overnight.

It’s accurate, almost.

Covers every coin in the market (no cap).

Use it on its own to sink your boat.

There’s bias cooked into this,

AceofCrypto breaks it down.

Read the whole thing before apeing in on a new coin pretending to moon on CoinMarketCap.

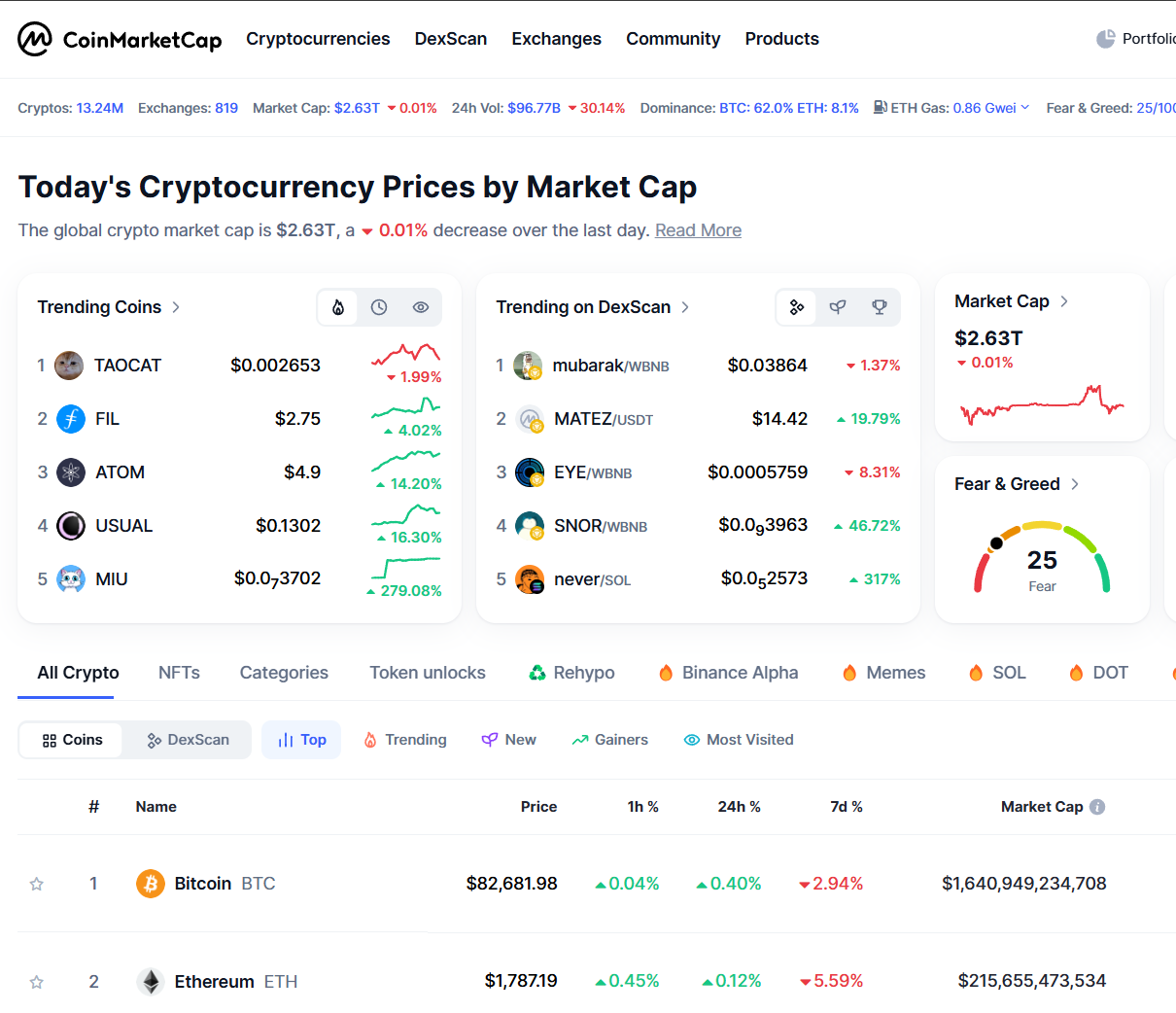

CoinMarketCap Usability

Clean, fast, and ADHD-friendly. CoinMarketCap shows core data up front including prices, trends, and filters.. Site claims track more than 2 million assets and covers ~97% of tokens out there.

They also offer a mobile app that’s fairly responsive with wallets, charts, watchlists, and other features. Plus, their API handles over 1 billion calls per month, so the backend can take your traffic without collapsing.

Data Accuracy & Speed

For Bitcoin, ETH, or top coins, data’s fast and reliable. For random meme coins, sometimes it feels like CMC’s just winging it. Still, it aggregates data from 790+ exchanges, so you’re getting a market-wide view, not some sketchy Telegram hyped scoop. Their API delivers both live and historical pricing, letting you trace coin behavior from launch to now.

While it’s riding high, there were circulating reports that drag its ass down. These news get shot down early, but CMC’s taken damage, along with users.

Extra Features

CMC has extra features, more if you pay for it. You need this stuff, start paying, and you get fried. Here’s what’s on the table.

Watchlists

You hit the star icon, and boom, you’ve created a custom list of coins to stalk. It syncs across your desktop and mobile, so you’re never out of the loop. Users can follow other people’s lists too, or keep their own public. Super useful for keeping tabs without getting distracted.

Portfolio Tracker

Track over 10,000+ coins, watch your gains or red numbers in real time. No wallet links,it all lives in your free CMC account. Used by over 1.2 million people worldwide.

Price Alerts

Set target prices for any coin. When it hits, you get toasted with a notification. Handy for catching moves while you sleep or ignoring FOMO tweets.

Market Comparison Tools

You can compare coins side by side including price, market cap, volume, over any timeframe: 1 h, 24 h, 30 d, whatever floats your boat.

Coin Rankings & Market Insights

Market Cap Rankings

This is CMC’s crown jewel. Coins get ranked by market cap (price × supply). Looks clean, but it ain’t gospel. Exchanges feed CMC the data, and some of them pump fake numbers harder than Bitconnect in 2017.

Volume Games

Here’s the dirty part. In 2019, Bitwise called out 95% of reported crypto volume as fake (Forbes). CMC got roasted alive for being the scoreboard of scam volume. They patched it with Adjusted Volume and a Confidence Score, but ghost trades still sneak through.

Deeper Insight

You get sector rankings: DeFi, meme coins, NFTs, AI, whatever’s pumping this week. Add in dominance charts, if Bitcoin dominance is mooning, your alts are getting nuked. Watchlist counts show retail FOMO, but half of those are just hopium collectors.

News & Community Tab

CMC tries to play Bloomberg-lite with their News tab, pulling headlines from CoinTelegraph, Decrypt, and others. The problem is, it’s a mixed bag. Sometimes you’ll see legit updates like ETH Merge coverage in 2022 that got decent traction. Other times, it’s just recycled PR fluff dressed as “news.”

Then there’s the Community tab, basically a crypto Twitter knockoff. Looks like Reddit had a baby with Telegram and forgot to raise it. You’ll find good stuff here and there, but most posts are low-effort shills screaming “next 100x gem.” In 2023, CoinDesk even dragged CMC for letting obvious spam slide through.

Security & Trust Factor

CMC doesn’t hold your money, just shows prices. That’s good. Less chance of getting hacked. Downside is, they’re owned by Binance now, so take their “neutral rankings” with a grain of salt. It’s like letting McDonald’s rank burgers.

June 2025 was a faceplant. The site got hijacked with a wallet-draining pop-up scam, basically tricking users into “verifying” wallets and yeeting their funds. This wasn’t small-time either, it rode on CMC’s traffic firehose, and users actually lost money.

Reddit’s been screaming “spammy community tab” and “Binance bias” for years, and honestly, they’re not wrong. The trust hit from too much blind traffic. CMC is like the Google of crypto trackers: everyone uses it, nobody checks if it’s rigged.

So yeah, just eye the charts, and don’t wander off clueless.

Pros

- Massive database: Thousands of coins, tokens, DeFi, NFT projects. You want info, it’s basically crypto Wikipedia.

- Real-time price tracking: Updates faster than your uncle refreshing Binance on a bull run.

- Portfolio & Watchlists: Keep tabs on bags without losing your mind.

- Exchange coverage: Includes almost every legit exchange, plus trading volume and liquidity stats.

Cons

- Binance bias: Owned by Binance, rankings can subtly favor their ecosystem.

- Volume manipulation: Some exchanges still pump fake numbers, even with CMC’s filters.

- Spammy community tab: 90% of posts are low-effort shills.

- Security hiccups: June 2025 wallet scam pop-up proved even top trackers can get pwned.

Risks of Relying on CMC Alone

Wash Trading Madness

Bots faking trades, flexing like they run the show, making you think liquidity is baller. Trusting this alone? You’re basically gambling on pixel smoke.

Survivorship Bias

CMC only lists live tokens. Dead coins? Gone, vanished, never heard of ‘em. Your backtests look sexy on paper, but in real life, half your trades could be ghosts.

Centralization Risk

Pulls data from hundreds of exchanges, but shady volume and missing listings slip through the cracks. Rely on CMC alone and you’re trusting filters like a blindfolded ape.

Binance Bias

Post-Acquisition Domination

Binance bought CMC in 2020 for up to $400M. Promised hands-off? Sure, tell that to their exchange dominating liquidity rankings now. Objectivity? Questionable at best.

Still Debated

Industry pros and redditors alike are still arguing whether CMC nudges favor toward Binance assets. Skepticism isn’t going anywhere.

AceofCrypto’s Pro Tips

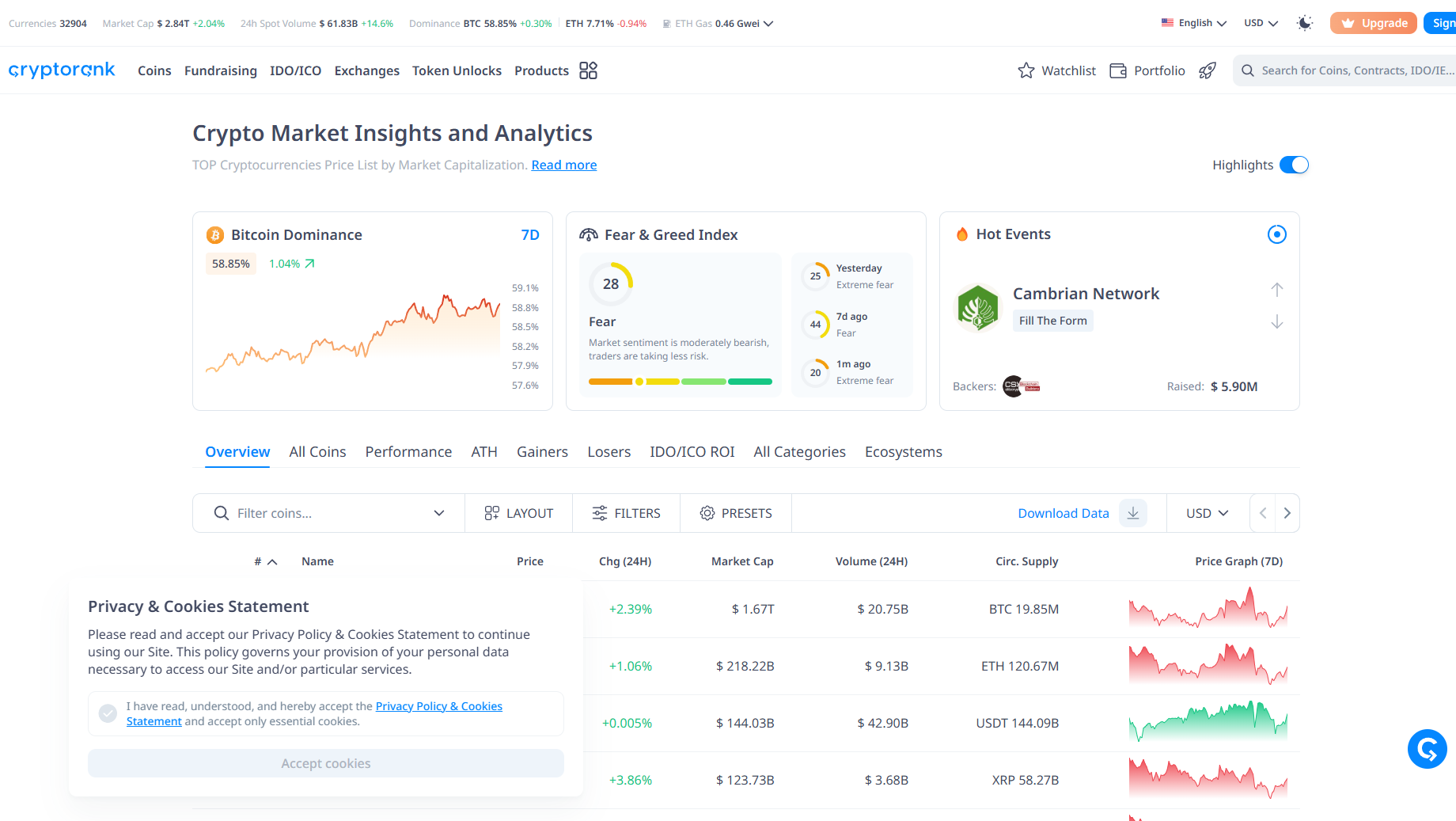

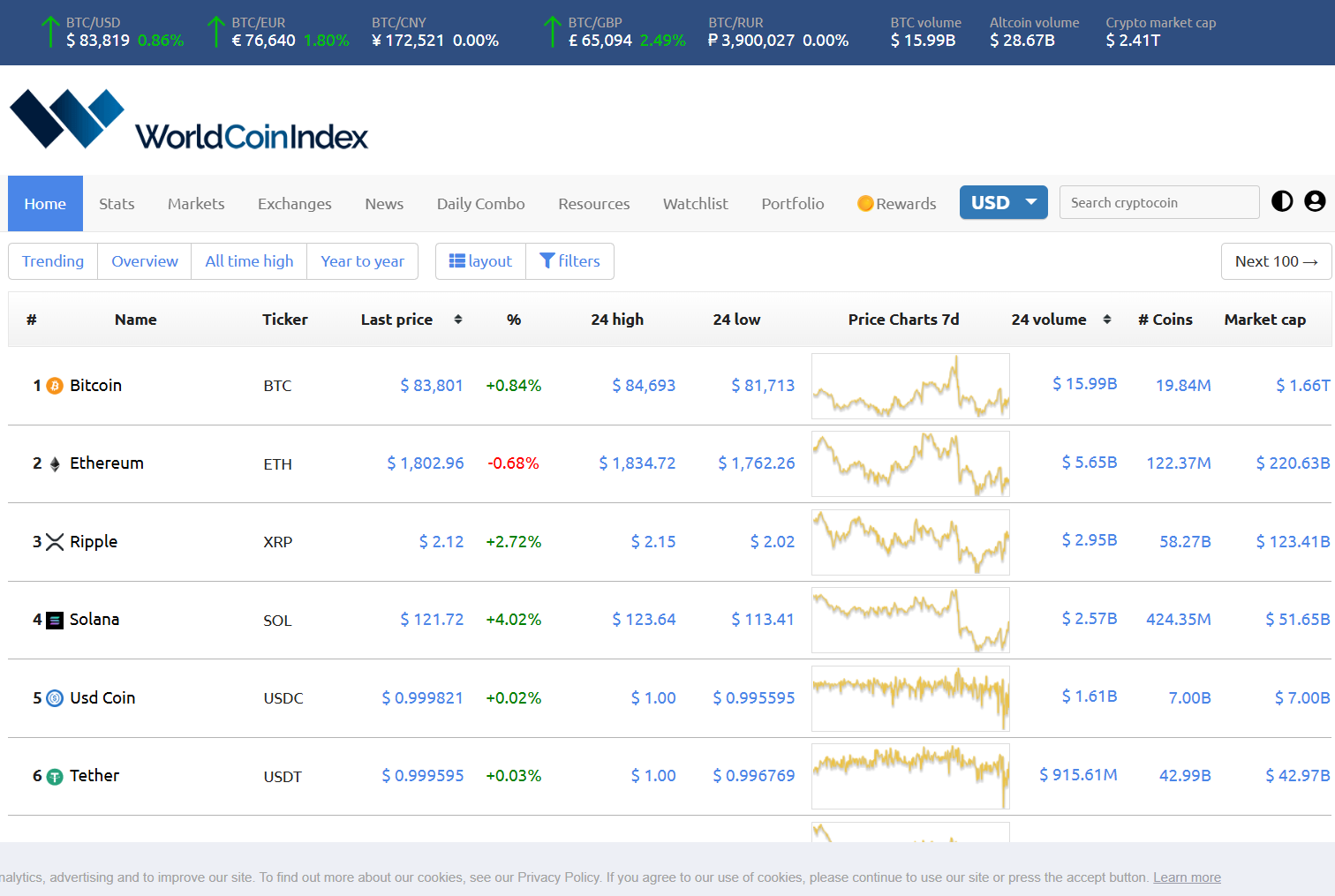

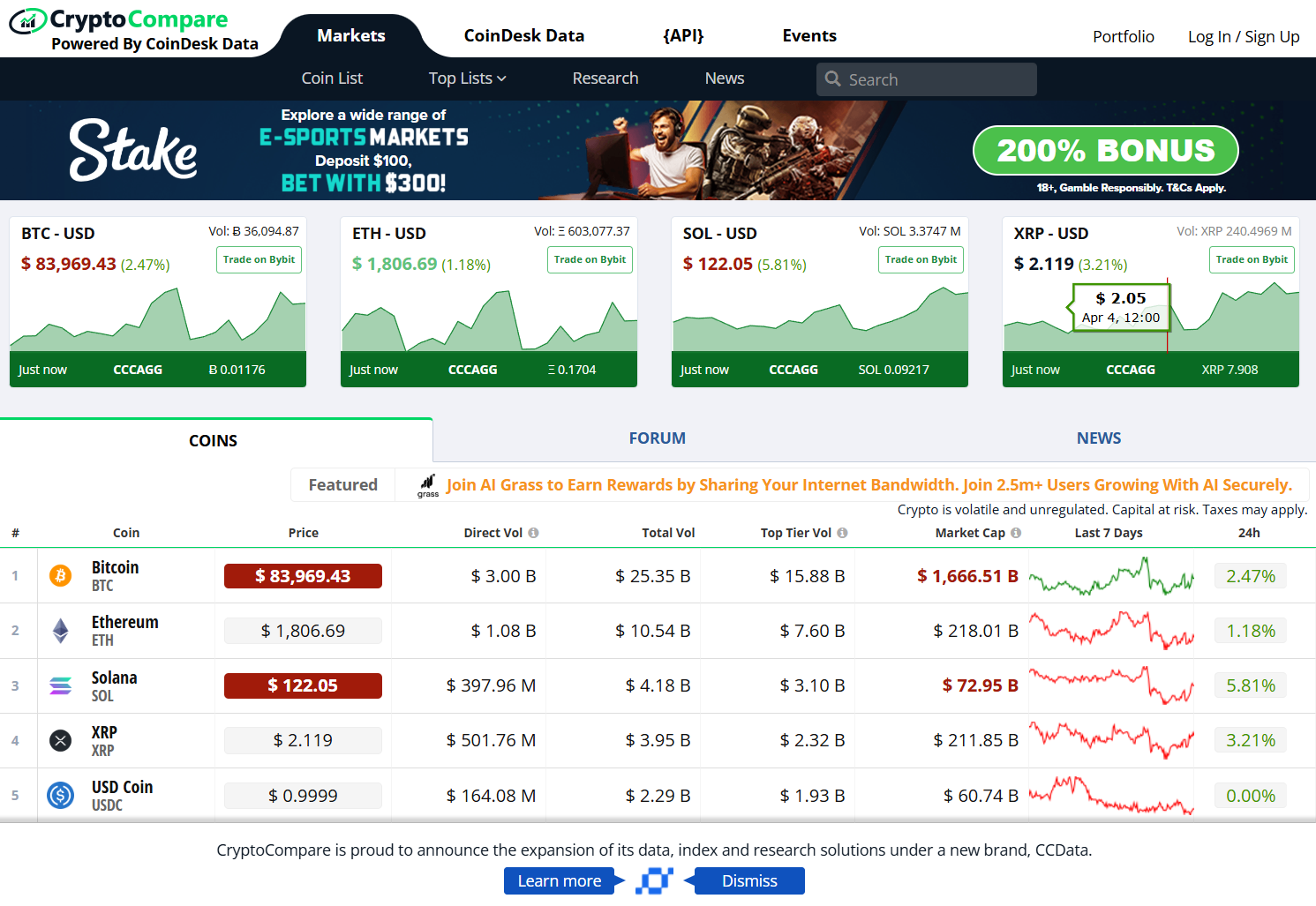

- Never rely on CMC alone, cross-check with CoinGecko, CryptoRank, or directly on-chain data.

- Use CMC for quick snapshots, but double-check volume and liquidity manually before you deploy serious capital.

- When you see a coin with weird volume surges, open the exchange page. Look for telltale signs: low order depth, big sell walls, or .0001 listings.

- Enable CMC’s liquidity filter and check where liquidity is coming from, not just the totals.

Rookie Mistakes to Avoid

- Mistake #1: Seeing a fat volume entry and jumping in. Often that’s bot noise.

- Mistake #2: Ignoring delisted or dead coins, your backtest wins may vanish in real account management.

- Mistake #3: Treating CMC’s data as truth. Binance ownership means you’ve got to read between lines, not just numbers.

AceofCrypto’s Last Word on CMC

CMC is the big daddy of crypto trackers, no doubt. If you’re starting out or just wanna glance at coin prices, market caps, or toss together a portfolio, it’s solid, reliable, and easy to digest. But don’t get it twisted. Leaning on CMC alone is asking for trouble. Wash trading, survivorship bias, Binance bias, they’re the plot twists waiting to drain your gains. Use it, but cross-check, stay sharp, and don’t let shiny charts trick you into overconfidence. CMC is a tool, not a crystal ball, and AceofCrypto always says, play smart, laugh at the chaos, and keep your edge.

AceofCrypto Out

Lean on one, you’re gonna burn.

Lean on four or more, you’ll win for sure buddy.