Crypto Regulatory Updates

Crypto Regulatory Updates Worldwide | AceofCrypto

Crypto Regulatory Updates That Might Save Your Ass (Or Ruin Your Bag)

One tweet from a senator and your favorite altcoin just nuked 40%.

Yeah, regulations aren’t hype, they’re the real market movers.

Forget influencers, forget TA lines drawn by toddlers.

The people making the rules are the ones shaking the bags. If you’re not tapped into the latest regulatory noise, you’re playing the game blindfolded, underwater, and chained to a Celsius loan.

Gotta get ahead of it.

These are the crypto regulation trackers degens need to surf the waves. Ones that break news, decode laws, and give you time to dump before the SEC shows up.

AceofCrypto’s relying on these sites.

Covered why in the reviews.

Read ‘em for the full ins.

Stay in the loop with these trackers.

Why Regulatory News Matters (Even If You Think It’s Boring)

Look, laws don’t care if your coin has a dog logo.

You miss a policy change? That’s your portfolio’s funeral.

Here’s why the smart money watches policy:

- KYC updates = your DEX suddenly needs your passport.

- Stablecoin laws = your “digital dollar” might get frozen.

- SEC lawsuits = entire chains vanish overnight.

You don’t need to be a lawyer.

You just need the right source.

Here are five that don’t miss.

Got a whole bunch for every angle.

Crypto Regulation Sources Reporting Real Sh*t real Time

Ace’s eyes are everywhere.

Anything moves, these sources are the first to cover ‘em.

Don’t rely on just one.

Juggle multiple like a true degen.

1. Cointelegraph Regulation – The DeFi Law Feed You Didn’t Know You Needed

They cover every fine, ban, and “we’re looking into it” faster than your altcoin can dump.

Graphics go hard, and they don’t sugarcoat it.

Why It Slaps:

- Super up-to-date with global crypto laws

- Covers both DeFi drama and institutional nonsense

- Easy to skim for alpha before a crash

Why It’s Risky:

- Too much info = panic bait if you’re soft

- Sometimes overhypes minor legal noise

Ace’s Tip: Read it before a big unlock or airdrop. If regulators are circling, this is where it leaks first.

2. Investopedia – Crypto Regulations for Non-Degens

Feels like your high school teacher finally wrote a piece on crypto, but it’s actually helpful.

Great for breaking down complex bills into “don’t go to jail” terms.

Why It Slaps:

- Clear definitions, actual legal references

- Explains why some tokens are suddenly “securities”

- Good primer if you wanna argue with your accountant

Why It’s Risky:

- A little slow, news hits here after it’s on-chain

- No spicy takes, all vanilla compliance

Ace’s Tip: Start here if you still think “custody” is a divorce term. It’ll save you from IRS regret.

3. Forbes – Digital Assets Regulation With Big Suit Energy

Reads like it was ghostwritten by a banker who moonlights as a lobbyist.

But when they drop a story, it’s already influencing the suits behind the scenes.

Why It Slaps:

- Big-picture policy + regulation across continents

- Institutional lens = what the VCs are watching

- Gets quoted by people who actually make laws

Why It’s Risky:

- Not DeFi-focused, more TradFi than DegenFi

- Takes longer to get into crypto-specifics

Ace’s Tip: Great for tracking stablecoin bills, ETF drama, and CBDC creep. Less alpha, more context.

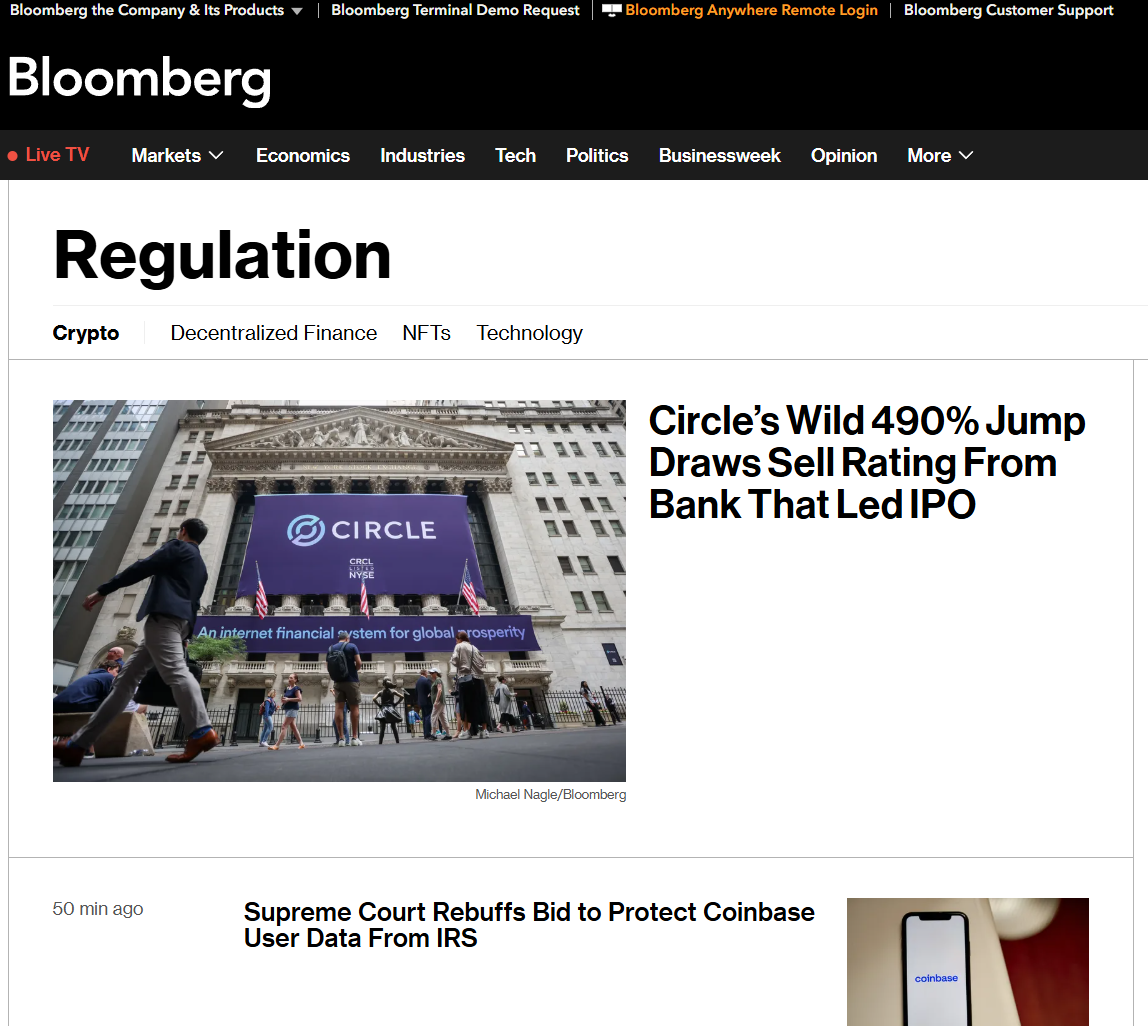

4. Bloomberg Crypto Regulation – Where Billionaires Read About Bans

The newsfeed for whales who don’t use MetaMask.

Still, if a new bill hits the Senate, Bloomberg’s already dissecting it.

Why It Slaps:

- Reports on legal news before it becomes Reddit panic

- Heavy on facts, light on meme BS

- Credible enough to get cited in lawsuits

Why It’s Risky:

- Dry as toast

- Paywall ninja moves, they’ll tease then lock it up

Ace’s Tip: Use it to front-run institutional fear. If Bloomberg’s talking bans, sell before Twitter reacts.

5. Atlantic Council – Where Global Crypto Policy Gets Real Grim

Not sexy, not flashy, but this is the source central banks read before nuking your bags.

Best for CBDC updates, international crackdowns, and surveillance coin creep.

Why It Slaps:

- Deep coverage of global regulation and stablecoin geopolitics

- They don’t care about market sentiment, just facts

- Pure institutional-grade policy coverage

Why It’s Risky:

- Zero trading tips

- Might depress you into selling everything and moving off-grid

Ace’s Tip: Check this if you’re holding stablecoins across borders or betting on a country’s pro-crypto stance.

Rookie Regulation Moves That’ll Get You Wrecked

And I ain’t talking about “regular wrecked” where you dust it off and get back up.

These common mistakes are straight up embarrassing and devastating.

P.S Don’t do these.

– Holding coins banned in your country and tweeting about it like a genius

– Ignoring centralized exchange policies until your funds get frozen

– Not paying attention to staking regulations (hello, Kraken settlement)

– Assuming your airdrops are “free” and tax-free, they’re not

– Thinking “decentralized” means immune. Regulators don’t play by chain rules

Ace’s Regulation Survival Stack

Here’s how I avoid surprise subpoenas:

- Cointelegraph Reg – For real-time panic alerts

- Atlantic Council – For seeing the big global squeeze

- Investopedia – To make sure I know what the hell the rules actually mean

- Bloomberg – For early TradFi panic signals

- Forbes – For the institutional take before they dump your bags on CNBC

You Can’t Trade If You’re Banned

Don’t wait until your wallet’s blacklisted or your chain gets delisted.

Regulations move markets, and silence projects faster than a rug.

Know the rules. Watch the news.

Trade with one eye on the charts, the other on the courtroom.

AceofCrypto out.

Tap in. Stay legal. Win big.

Crypto regulation is an umbrella term for the network of laws, statutes and legal practices surrounding the crypto and blockchain industries.

Cryptocurrencies continue to gain traction with investors around the world. Explore how leading countries are regulating the emerging asset class.

Keep up with the latest crypto regulation. Dive into the latest news and updates to stay informed, maximize opportunities, and drive success in the crypto world.

Bloomberg Crypto Regulation

This research categorizes and explains how the 75 economies around the world are regulating cryptocurrencies within their jurisdictions.

A bit of history about cryptocurrency. Bitcoin was the first cryptocurrency created and was launched in January 2009 by a computer programmer using the pseudonym Satoshi Nakamoto.

Explore the latest developments in global crypto regulation and crypto compliance. Download the report now.

Crypto Regulations in 2025: What’s Next? Learn about the current state of global regulations, emerging trends and future directions.

Learn about recent Trump administration executive orders shaping crypto and establishing a working group on digital asset markets as well as SEC updates

This resource center contains links to congressional proposals related to the regulation of crypto assets and other helpful materials.

The US chapter of GLI – Blockchain covers government attitude and definition, cryptocurrency regulation, sales regulation, promotion, mining, and more.

Cryptocurrency regulation in the US keeps changing simultaneously, which creates challenges for businesses and investors. Check here for more.

Cryptocurrency is an asset class for the digital age that’s not well regulated—yet. Many cryptocurrency advocates welcome a more clear regulatory framework.

Let’s find out some remarkable regulatory updates for the crypto industry (and your funds) worldwide in 2024 —so far.