CryptoCompare.com Site Review

CryptoCompare

CryptoCompare Review With Institutional Chops, Retail Reach, Lots of Data

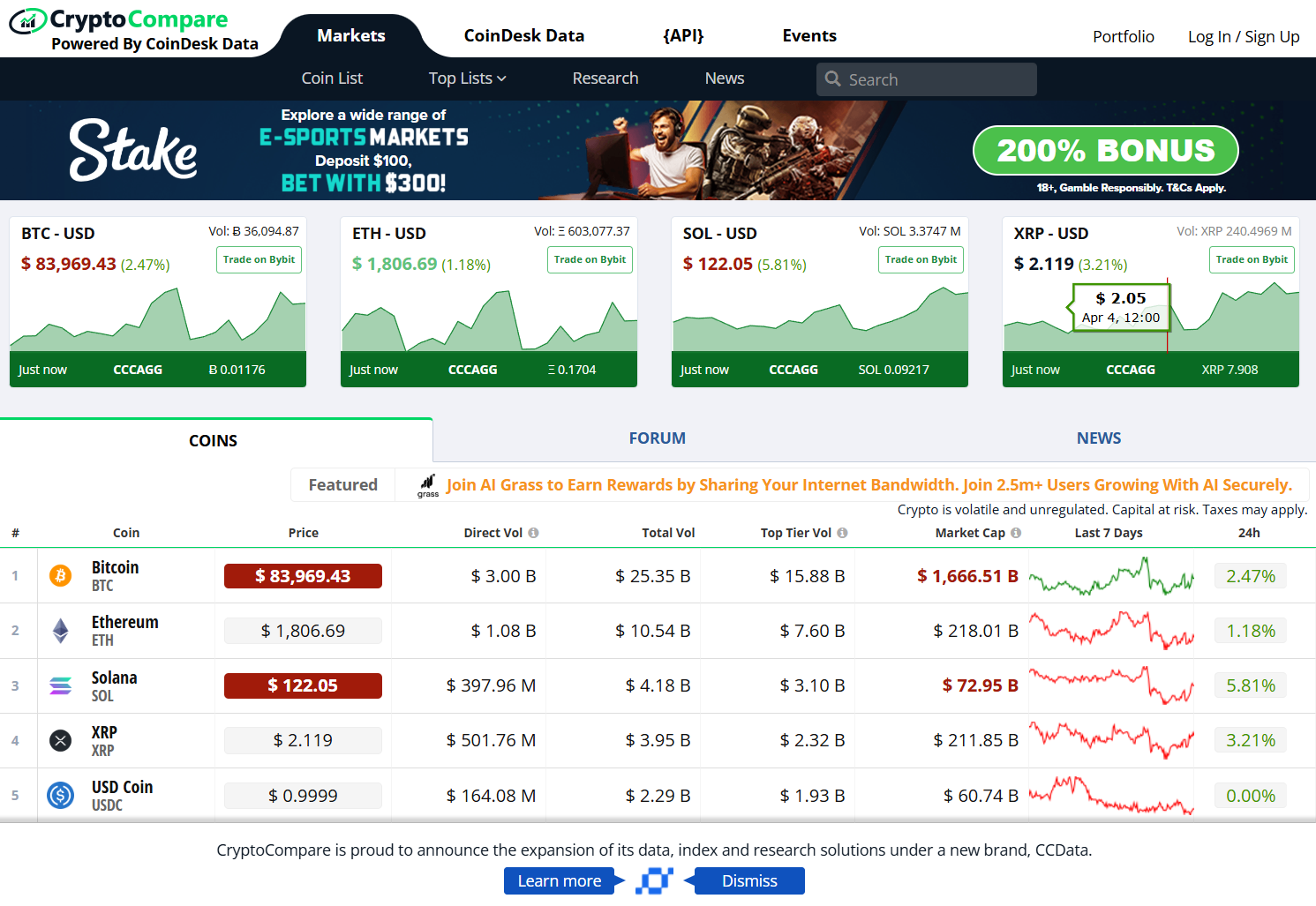

When you need good price trackers, AceofCryptos’s got your back with full reviews.You want clean, institutional-grade crypto numbers without the sales pitch. CryptoCompare gives you that with aggregated ticks, a heavy index suite, exchange benchmarking, and an API people actually build products on. It started as a data lab in 2014 and grew into one of the market’s core price engines.

What is CryptoCompare?

CryptoCompare is a market-data shop that scrapes and normalizes exchange feeds, publishes indices, and sells APIs and research to firms that need reliable price rails. Public-facing parts track thousands of coins and hundreds of thousands of pairs; the back end powers CCCAGG aggregated prices and index products used by institutional clients. Recent corporate move: CoinDesk acquired CCData and CryptoCompare’s retail arm in Oct 2024, meaning more resources, and more eyes on their datasets.

CryptoCompare’s Rep In The Community

CryptoCompare’s got positive rep. Traders and quants love the depth that include token lists, historical ticks, and the index / exchange benchmarking research show up in desks and papers. Critics complain UI feels dated in places, forums and review pages show mixed trust scores, and folks grip about occasional stale microcap feeds. Ultimately it’s respected for data, occasional gripes for UX and edge-case accuracy.

Usability & UX (Tracker mode)

Desktop-first. Dense dashboards. Filters and presets for pro workflows. Mobile is workable but trims features. Setup takes two minutes; mastery takes longer. If you like menus and metrics, you’ll be fast. If you want cute charts and hand-holding, look elsewhere. (That’s intentional.)

Data Accuracy & Trust (actual nerd shit)

CryptoCompare runs CCCAGG, a 24-hour volume-weighted aggregate index with outlier filtering and time penalties to smooth wacky exchange ticks. They publish methodology and validation reports and review constituent exchanges monthly. That gives you an auditable price feed with miles better than a single exchange price but not immune to bad upstream APIs or wash-trading distortions. CryptoCompare launched its Exchange Benchmark to tackle false volume and highlight exchange data quality.

Extra Features on CryptoCompare

API & Data Feeds

Programmatic access to real-time + historical prices, OHLCV, order books, social metrics and metadata. Built for production; enterprise plans scale. Third-party writeups peg burst capacity very high (vendor claims reported up to ~40k calls/sec), but treat that as “enterprise grade” not magic free juice.

Indices & CCi30

Ready-made indices (CCi30 and others) for benchmarks and product desks. Useful if you want a standard performance yardstick or to build index-tracking products. Methodologies are public.

Exchange Benchmark & Reviews

Monthly exchange reviews, scoring on market quality, legal/regulatory posture, data provision and more. This is the closest thing crypto has to an exchange credibility report. Useful before you trust an exchange’s volume stats.

Research & Asset Reports

Regular liquidity reports, asset deep dives and market notes, handy for idea generation and regulatory briefs. Institutional clients use these in decks.

Portfolio, Widgets & Embeds

Basic portfolio tracker, embeddable widgets and price tables for websites. Good for dashboards and quick portfolio P&L. Not a tax tool.

Pros of Using CryptoCompare

- Tracks thousands of assets and hundreds of exchanges with documented methodology.

- CCCAGG gives a defensible, volume-weighted reference price for valuations.

- Exchange Benchmark adds transparency to messy exchange volume reporting.

- Strong institutional offering: indices, research, enterprise APIs.

- Public docs and validations make it audit-friendly for compliance teams.

Cons of Using CryptoCompare

- Microcap and tiny-pair data can be stale or missing; aggregation can’t invent liquidity.

- UI and forum moderation get complaints; retail pages feel legacy.

- Advanced enterprise features cost money; free tier is limited.

Risks of relying only on CryptoCompare

No one uses just one, even though it’s leading moons. This is what you get if you’ve got your eyes stuck on CryptoCompare.

Aggregate ≠ Immediate Liquidity

CCCAGG smooths and averages. Nice for valuation. Bad for execution timing. If you trade off aggregated price without checking live orderbooks, you’ll eat slippage.

Upstream data problems

CryptoCompare depends on exchange APIs. Broken feeds, delisted pairs, or spoofed volumes upstream still leak into aggregates until removed by filters. Their exchange reviews reduce this, but they can’t watch every node every second.

Overconfidence in indices

Indices simplify markets. They don’t prevent dumps, unlocks, or narrative collapses. Use indices for benchmarking, not as trade signals.

Corporate shift risk

CoinDesk’s acquisition of CCData/CryptoCompare (Oct 2024) brings resources and scrutiny. Could mean better products, or changing priorities. Keep an eye on product roadmaps.

Rookie mistakes on CryptoCompare (don’t be that guy)

- Trading off CCCAGG price alone without checking exchange orderbook.

- Blindly trusting exchange rankings as liquidity proof.

- Assuming every listed pair is tradable in any meaningful size.

- Using index returns as price-prediction signals.

- Dumping seed phrases into forums to “verify” portfolios (no, just no).

Ace’s Tips (how to use CryptoCompare like a pro)

- Use CCCAGG for portfolio valuation and reconciliation; use exchange OBs for execution.

- Check the monthly Exchange Benchmark before trusting an exchange’s volumes.

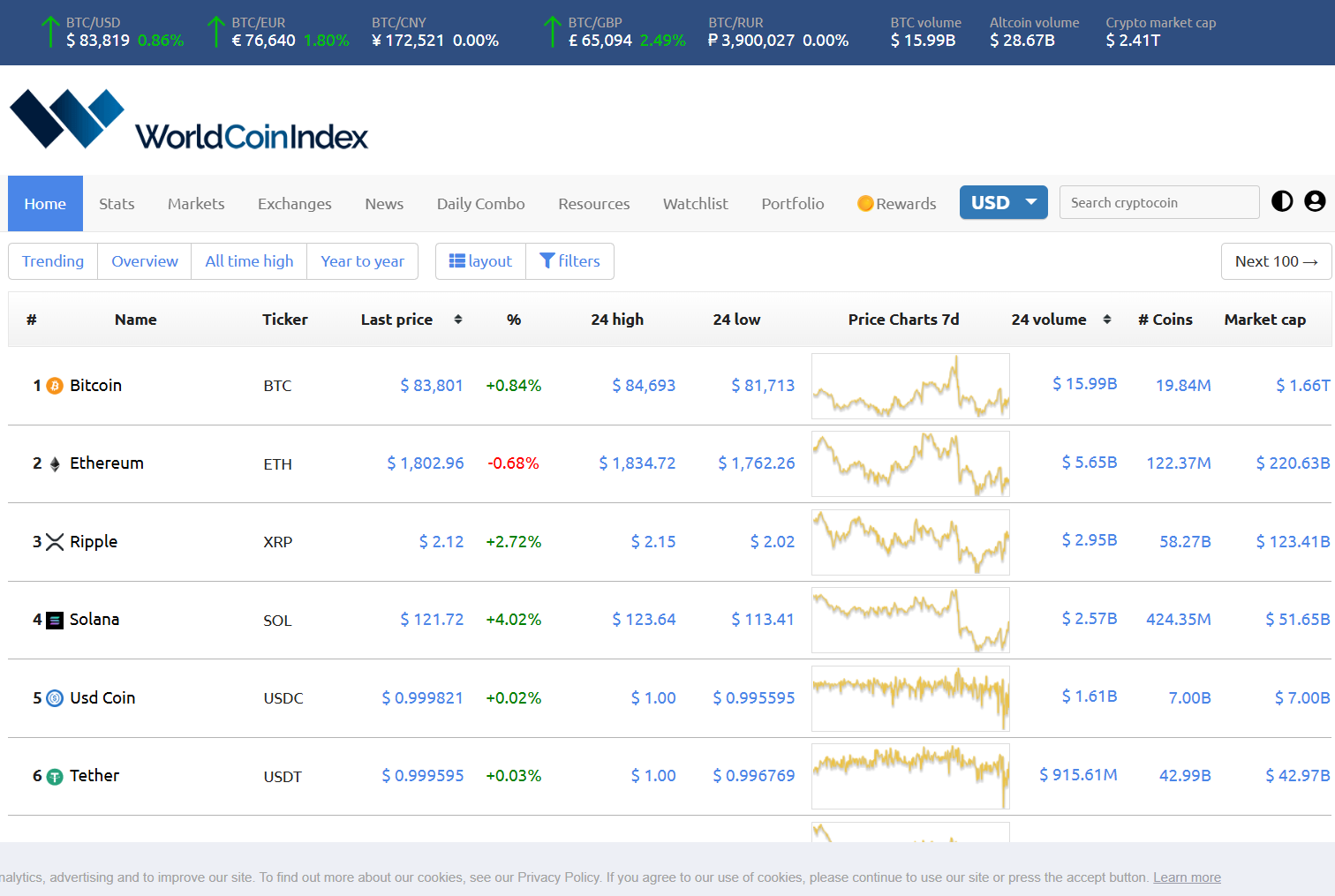

- Combine CryptoCompare data with on-chain explorers and a second tracker (CoinGecko/CMC/CryptoRank) to avoid blindspots.

- If you’re building automation, test API rate limits and error handling under stress.

- Read the methodology PDFs before you build products on any index, saves legal headaches later.

How CryptoCompare stacks vs the others

- vs CoinGecko – CryptoCompare wins on institutional indices, exchange benchmarking and enterprise APIs; CoinGecko wins on community tools and dev ecosystem.

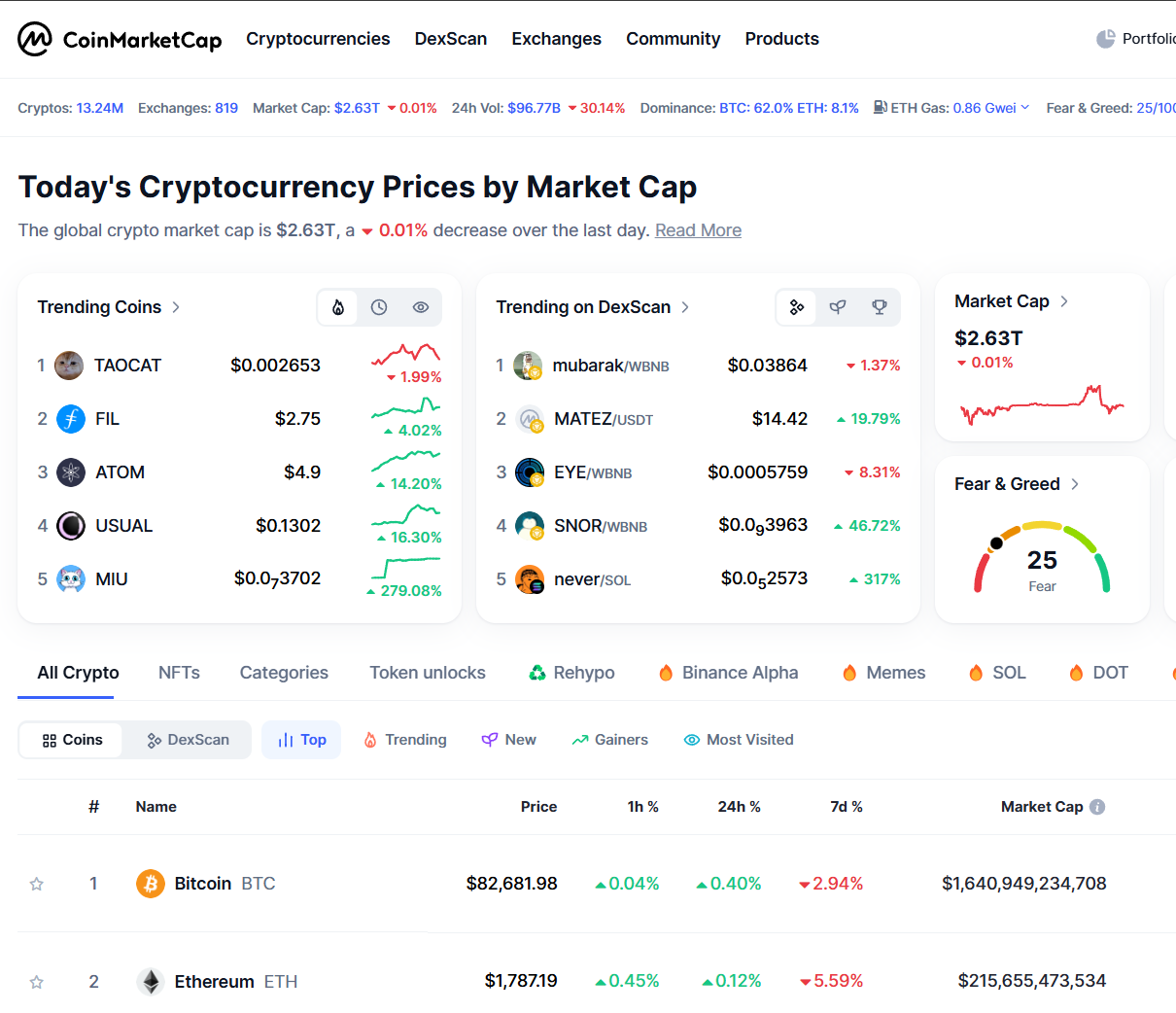

- vs CoinMarketCap – CMC has brand reach and mass web traffic; CryptoCompare offers firmer methodology, index products and research useful for desks.

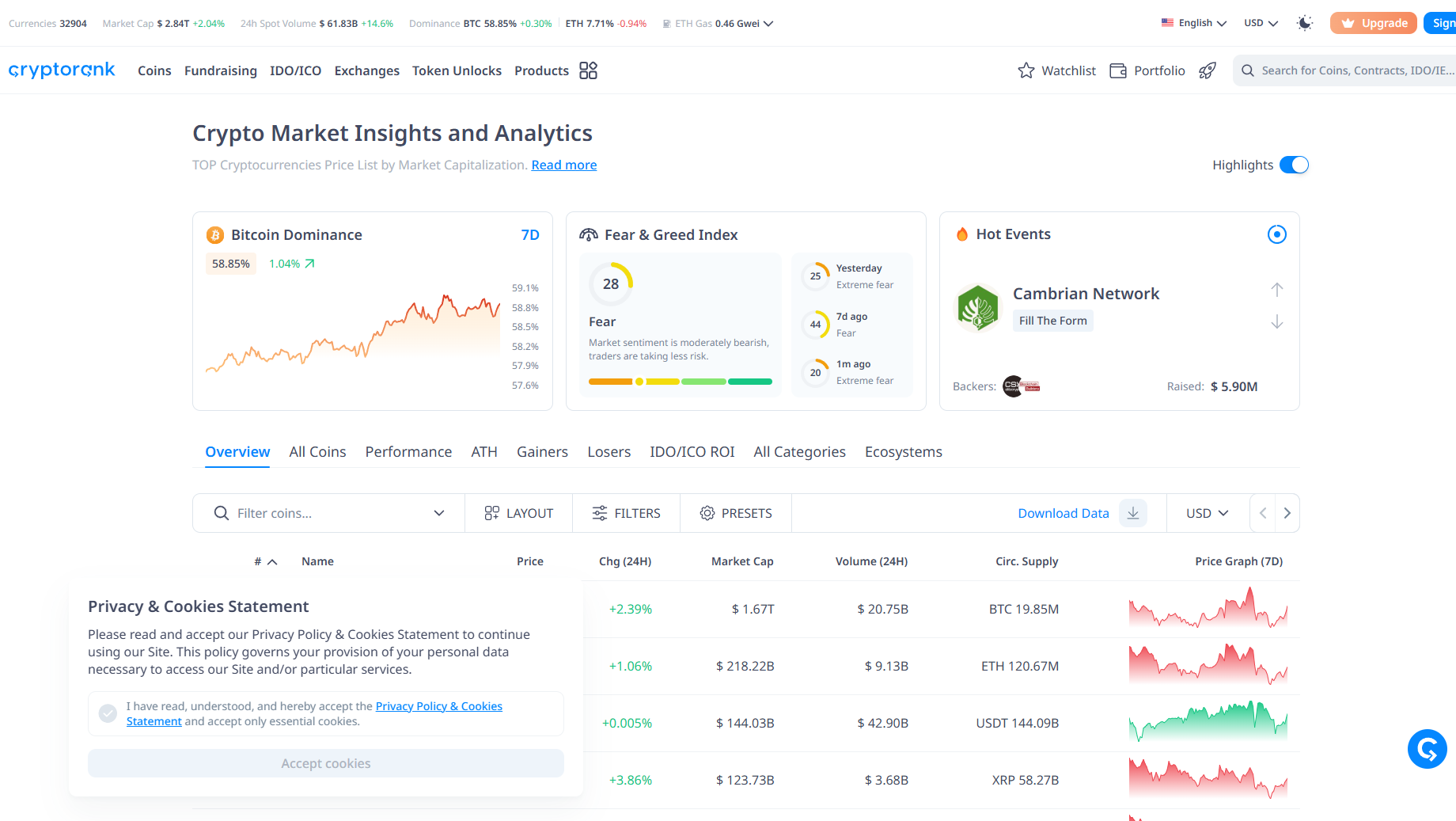

- vs CryptoRank – CryptoRank focuses on tokenomics, unlocks and on-chain filters; CryptoCompare focuses on exchange aggregates, indices and enterprise data. Pick analytics vs benchmarks.

- vs CoinCodex / LiveCoinWatch – Codex/LCW give fast retail scanning and UX polish; CryptoCompare gives institutional rails, published methodologies, and auditability. Choose speed or compliance.

AceOfCrypto’s Final take on CryptoCompare

If you need auditable, enterprise-grade price rails and benchmark products, CryptoCompare is one of the first tabs you open. It gives defensible reference prices, exchange scoring, and research that desks use. Don’t treat aggregated indices as execution prices. Cross-check low-cap markets. And watch how CoinDesk’s takeover changes the roadmap. Use CryptoCompare for the backbone, add a couple of scanners and an on-chain explorer for the muscles.

AceOfCrypto out.

Keep digging the tables

Moons hide behind data