Decentralized Exchanges (DEXs)

Top Decentralized Exchanges DEX List 2025 | AceofCrypto

DEXs = Freedom, Only If You Know How to Wield It

Wanna stay sovereign while stacking tokens? DEXs is the only way to go. No middlemen, no bank boy scout asking for your ID or any other sensitive shit. You swap peer-to-peer. You stay in control. But just coz it’s decentralized doesn’t mean it’s dummy-proof. Most people fumble the bag because they don’t read the terrain before making the play.

AceofCrypto Advises To Not Screw Up on DEXs

Shit can get tricky when you walk into decentralized exchanges with the thought of just earning a few bucks through trade. Sit back down if you’re not going in with the raw deets! While I give you all the ins, I want you to think for yourself, that’s how you ace the tokenomics game. As for DEXs, they’re dope, but don’t walk in with just wanting to trade. Read between the lines, I’ll show you how.

Why DEXs Matter (And Why Normies Fear Them)

A centralized exchange holds your hand. A DEX hands you the weapon and says, “Figure it out.” That’s why most newbies treat DEXs like haunted houses. But those who tame the wild? They build empires. Remember, you’re not here to follow a crowd. If you’re gonna win big, hit up the real game like a pro and see DEXs for the shit ton of pros they arm you with.

Decentralized Exchanges are:

- Permissionless

- Non-custodial

- Open to anyone

But they’re also crawling with fake tokens, slippage traps, and copycat interfaces designed to steal your crypto faster than the FTX collapse. You gotta know which ones are pushing the real deal. I break down each individual platform into tiny bits. Analyze their game, and play them in their face. At the end of the day, you make your bags heavy.

Centralized vs Decentralized: Choose The Right Flow

While all you nerds can talk all about CEXs, saying how they rub you the right way, you’re walking a thin line. It’s not like DEX has risks, whatever you do, do it smart. Will you let authorities handle your stash? Or will you hold it responsibly? Get your priorities straight and pick your path carefully.

- CEXs: Fast. Familiar. But you get KYC’d, censored, and rug-pulled by the exchange itself, unknown dangers ahead.

- DEXs: No ID, no limits, but YOU are the safety net. You mess up? You lose it all, now rep there to save your ass..

The trade-off is power vs risk. Choose right, and you get:

- Direct wallet trades

- Full control of your funds

- Access to low-cap wins before CEXs list them

Choose wrong, and one mistyped contract nukes your wallet. Stick with AceofCrypto, and unlock your third eye for crypto.

Here’s What You Want From Top DEX Platforms

Like I said, these DEX platforms are gonna open up their gates to you, but do keep their ground rules and motives in check. Most share similar features, but they’re off by a bit sometimes.

Before you go full ape into a token swap, check for these:

- Real liquidity: Not the fake kind that disappears mid-trade

- Verified token contracts: Don’t get rugged by a clone

- Slippage settings: Control your entry, or get front-run

- Community trust: Rug pulls don’t happen on trusted platforms

I’ve dissected every DEX out there, clearly highlighting their game. Read full reviews on all of them to trade like a natural.

The Decentralized Exchanges That Top The Rest

AceofCrypo’s traded, lost, won and been dragged down across every DEX there is. I’ve done the treading, now I’ll give you the map. Here’s what you’re gonna wanna start with:

Uniswap – Ethereum’s alpha DEX. Deep liquidity, clean UI, and battle-tested. Gas fees sting, but it’s the gold standard for real traders.

PancakeSwap – BNB chain’s speedster. Cheap swaps, tons of new tokens, and degen farms everywhere. High reward, high chaos.

SushiSwap – Multi-chain, underrated, and still punching. Built-in farming and staking, minus the spotlight, real grinders eat here.

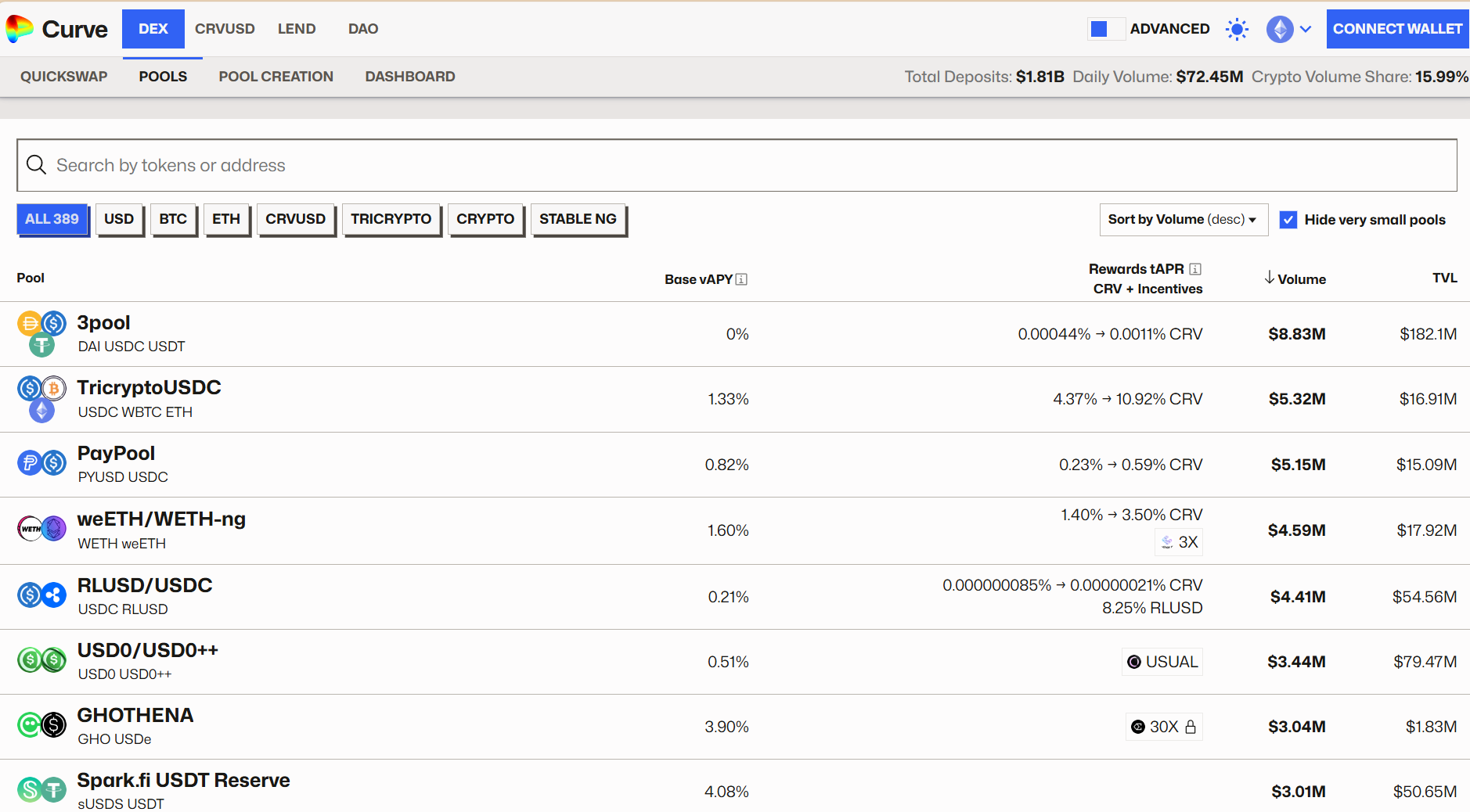

Curve Finance – Stablecoin kingpin. Low slippage, deep pools, but UI looks like Windows 95. Pro territory if you’re farming serious bags.

1inch – The aggregator sniper. Finds best swap rates across DEXs, auto-optimizes gas. If you’re not using this, you’re leaking profits.

Real Talk – DEXs Ain’t Disneyland

You’re not on Coinbase here. There’s no undo button. Hit the wrong token address? Bye-bye bag. That’s why you do your damn homework. Cross-check contract addresses. Use DeFi dashboards. Stay sharp.

DEXs give you the wheel, but you better know how to drive at 200 mph.

AceofCrypto’s Edge

I don’t just shill DEXs. I break ’em down. My reviews will give you all the hidden fine print these platforms won’t push. If you’re reading my reviews, you’ll get:

- Detailed Breakdowns

- Risk maps

- Speed and gas fee breakdowns

- Hidden traps and dev exploits

You trade smarter. You flip faster. You build stacks with eyes open. Gonna have to pick your platform first.

Don’t Get Burned By Decentralization

It’s a double-edged sword trading on DEXs. The freedom is real. The risks are too. That’s why AceofCrypto exists, so you trade with intel, not luck. Tap into my breakdowns. Sniff out scams. Stack gains like a warlord.

And always remember.

DEXs don’t care if you live or die. The edge is knowing that, and trading like a savage anyway.

Want the full reviews? You know where to find me.

This ain’t your average blog. This is a toolkit for killers.

Stay ruthless. Stay private. Stay winning. AceofCryto’s gonna mentor you all the way.

Swap crypto on Ethereum, Base, Arbitrum, Polygon, Unichain and more. The DeFi platform trusted by millions.

Multichain on BNB Chain, Ethereum, Aptos, Polygon zkEVM, zkSync Era, Arbitrum, Linea, Base, and opBNB

Trade crypto effortlessly with SushiSwap, supporting over 30 chains and featuring a powerful aggregator for the best rates across DeFi.

Curve-frontend is a user interface application designed to connect to Curve’s deployment of smart contracts.

1inch is dedicated to advancing a secure and compliant DeFi ecosystem. By uniting with forefront security and compliance specialists, we set the standard for safety and compliance, ensuring our users navigate the DeFi space with confidence.

dYdX offers a decentralized trading platform designed for perpetual contracts, combining deep liquidity, advanced trading tools, and low fees. The mobile and web experience provides flexible trading options, including up to 50x buying power, with a focus on transparency and self-custody.

An on-chain order book AMM powering the evolution of DeFi

The ultimate platform for custom liquidity solutions. Balancer v3 perfectly balances simplicity and flexibility to reshape the future of AMMs.

KyberSwap is a multi-chain aggregator and DeFi hub that empowers users with the insights and tools to achieve financial autonomy. All the above while being fast, secure, and easy-to-use.

Bancor has always been at the forefront of DeFi innovation, beginning in 2017 with the invention of bonding curves, pool tokens, and the first fully decentralized exchange powered by AMMs – which still remain extensively used across the industry. The newest inventions powering Carbon DeFi and Arb Fast Lane prove Bancor remains deeply committed to delivering excellence, advancing the industry, and pushing the boundaries of what is possible in the world of DeFi.

Leading DEX on all Polygon Chains. QuickSwap is the home of the DragonFi ecosystem and a leader in Polygon CDK adoption.

Trade, LP, farm, stake, and more at lightning fast speeds and near-zero gas fees.

Trade onchain with a winning edge. One-stop DEX, Aggregator, & Screener across Monad, Solana, Avalanche & more. Discover & buy every token at the best prices.

MDEX is a DeFi platform that integrates DEX, IMO, and DAO. Earn MDX By Staking LP & Tokens.

All in one decentralized exchange for leveraging diversified funds across ecosystems, with the speed of Sonic

Swap, earn, and build on the leading decentralized Cosmos exchange.

Project Serum is a decentralized exchange (DEX) and ecosystem that aims to bring speed and low transaction costs to decentralized exchanges. It has raised $100 million in funding over two rounds.

Loopring is a zkRollup Layer 2 for Trading and Payment.

Orca is your homepage for buying crypto on Solana.

Uniswap

Uniswap

1inch

1inch