DeFi Guide

DeFi Guide Earn Borrow and Swap | AceofCrypto

DeFi Guides That Slap (And Don’t Sound Like Bankers)

You’re not here to learn “what DeFi means.”

You’re here coz some dude 4x’d his net worth yield farming a frog token on Arbitrum and now lives in Bali.

So now you’re asking: What the hell is DeFi, and how do I not get rugged doing it?

Spoiler: DeFi is freedom with gas fees.

The banks hate it. Your MetaMask wallet loves it.

But if you jump in raw? You’re lunch.

AceofCrypt’s already run through the only DeFi guides worth reading. All tested and filtered through my B.S. detector.

They won’t guarantee you profits, but they might save you from staking $5K in a protocol written by ChatGPT v1.

Reviewed these myself.

I’ll give you all the info.

Crypto feeds off on intel.

Ace breaks it down in bits.

Take it all in, know your position & trade like a beast.

Why You Need a DeFi Guide (Even If You Ape Blind)

It’s just a simple question. Everyone’s answered it. But the answers have deeper links y’all need to see.

– Because staking, lending, farming, and swapping aren’t just buzzwords

– Because “trustless” doesn’t mean “riskless”

– Because DeFi is either a cheat code for wealth, or a graveyard of your stablecoins

– And because the moment you sign that contract, you’re on your own

Don’t be the guy who loses his bag to a “liquidity pool” without knowing what “impermanent loss” is.

I’ve combed through the fluff, here’s what actually teaches you DeFi.

The Only DeFi Guides That Show You The Way Better Than Ugandan Knuckles

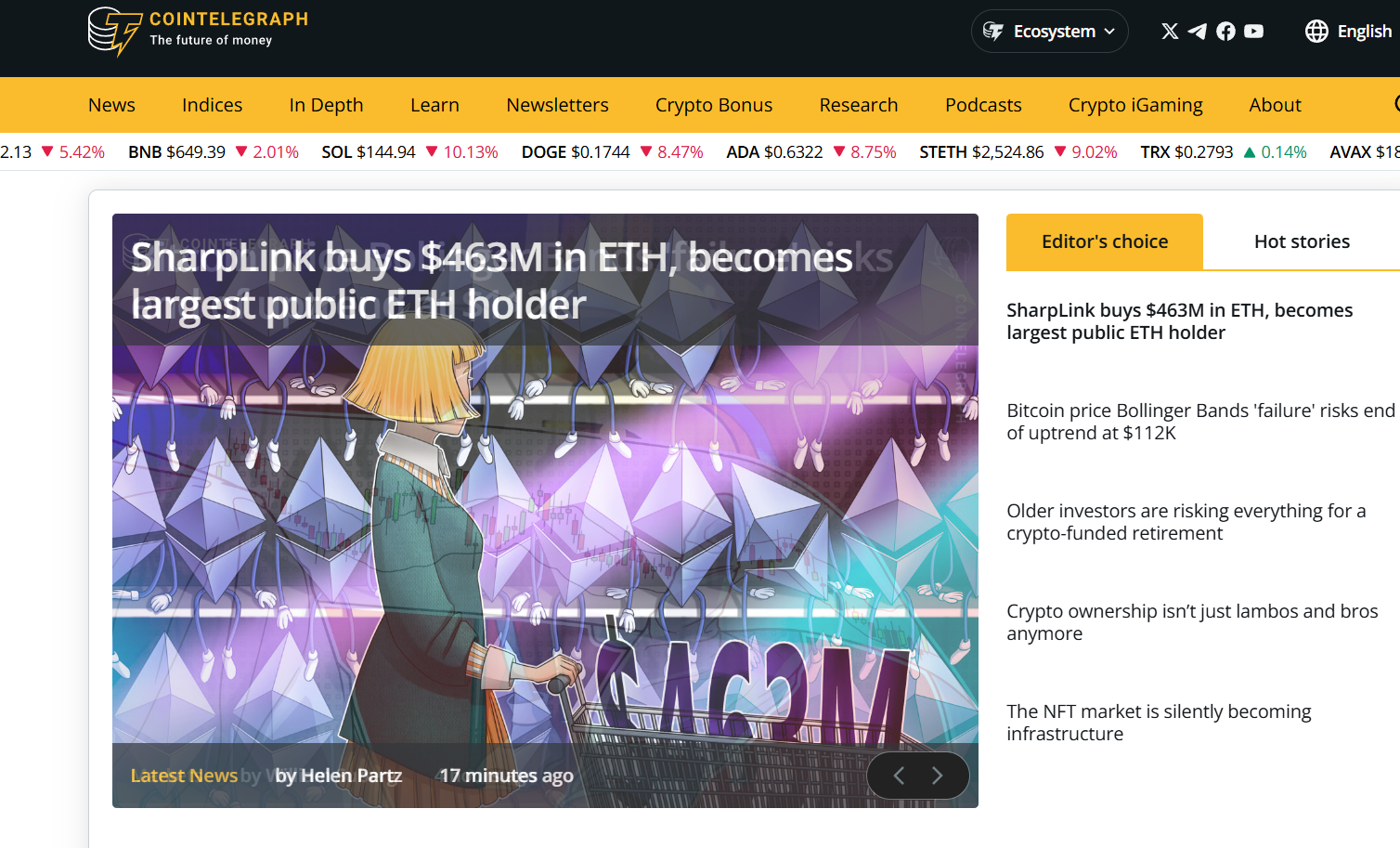

1. Cointelegraph – DeFi

It’s like Bloomberg, but with memes and less stock shilling.

News, deep dives, and DeFi breakdowns that don’t insult your intelligence.

Why It Slaps:

- Keeps it fresh with current DeFi protocols and updates

- Big on trends, airdrops, and protocol changes

- Decent for getting context and staying updated

Why It Sucks:

- Doesn’t teach you how to actually farm, stake, or bridge

- Ads and fluff articles sneak in too often

Ace’s Tip: Use this as your DeFi radar. Not for step-by-step, but to keep your head in the market.

2. Coinbase – What is DeFi?

Clean, basic, and made for normies.

It’s DeFi explained like you just discovered what crypto is yesterday.

Why It Slaps:

- Super easy to digest

- Explains core concepts like lending, DEXs, and stablecoins

- Decent for explaining to your cousin who still banks with Wells Fargo

Why It Sucks:

- Too surface-level for actual usage

- Leaves out major risks like smart contract bugs or rug mechanics

Ace’s Tip: Read this once, then graduate. If you’re past “What is DeFi?”, this won’t help you anymore.

3. Investopedia – Decentralized Finance (DeFi)

DeFi, but with definitions that sound like they belong in a finance textbook.

Still, when you want clarity, the nerds deliver.

Why It Slaps:

- Breaks down terms in banker-speak, which sometimes helps

- Has a surprisingly neutral take on the good vs. scammy side of DeFi

- Updated enough to not be completely outdated

Why It Sucks:

- Dry as a whitepaper written in 2018

- Doesn’t tell you what’s happening now in DeFi

Ace’s Tip: Best used when you hear a buzzword you don’t understand, then go find a real DeFi degenerate to explain it in English.

4. Decrypt – DeFi

Edgy crypto media site meets semi-serious education.

Think of it as your degenerate friend’s smarter cousin.

Why It Slaps:

- Articles cover the real protocols people are using

- Includes risks, collapses, and lessons learned

- Actually fun to read

Why It Sucks:

- No true masterclass, you’ll still need to piece things together

- News sometimes overshadows the educational bits

Ace’s Tip: Read this if you already farm, stake, and LP, but want to keep up with where the real plays are moving.

5. Finematics – Guide to DeFi (Video Series)

Finally, a YouTube channel that doesn’t make you fall asleep or buy a course.

Visually slick, explains things better than most blogs.

Why It Slaps:

- Breaks down DeFi mechanics with clean animations

- Covers everything from yield farming to veTokenomics

- Perfect for visual learners

Why It Sucks:

- Doesn’t update weekly, so some stuff gets outdated fast

- Still needs real-world testing after watching

Ace’s Tip: Watch this before you touch any DeFi dApp. You’ll understand what your ETH’s actually doing while you sleep.

Rookie DeFi Moves That’ll Make You Poor

Doesn’t take a lot to throw you off course. Here’s how noobs hit a wall after starting off.

– Providing LP on a coin you don’t understand

– Forgetting gas fees can eat your entire yield

– Thinking “high APY” means “safe investment”

– Not checking tokenomics or unlock schedules

– Signing contracts on random sites without reading a single line of code

Ace’s DeFi Stack

When I’m not charting, I’m farming. Here’s my DeFi setup:

- Finematics – For brushing up before I touch new protocols

- Cointelegraph – To sniff early alpha and stay ahead of rugs

- Decrypt – When I want honest breakdowns with context

- Degen Twitter – Yeah I said it. Sometimes the best DeFi guides are threads from maniacs

- Etherscan – Because I trust contract calls, not influencers

DeFi is a Literal Battleground.

You either learn it, or you lose your wallet.

And these platforms will teach you how to ride it without getting wrecked.

Stay curious. Stay skeptical.

And for the love of your seed phrase, never stake on something you can’t explain.

AceofCrypto out.

Tap in. Stake smart. Farm with eyes open.

Are you new to DeFi tokens, ecosystems and protocols? We got your back with our beginner-friendly comprehensive guide to decentralized finance.

Short for decentralized finance, DeFi is an umbrella term for peer-to-peer financial services on public blockchains, primarily Ethereum.

Decentralized finance (DeFi) refers to blockchain-connected platforms and applications that, in theory, can replace the existing centralized financial services networks.

Decentralized finance has ballooned over the past year—but what is DeFi, and how can you get started with its set of tools? We explain.

Guide To Decentralized Finance – Finematics

DeFi is short for “decentralized finance,” an umbrella term for Ethereum and blockchain applications geared toward disrupting financial intermediaries.

DeFi promises to allow investors to “become the bank” by giving them opportunities to lend money peer-to-peer and earn higher yields than those available in traditional bank accounts.

DeFi lets users access crypto financial services with just a wallet and some crypto. Decentralized applications (DApps) enable lending, liquidity provision, swaps, staking, and more across many blockchains.

Everything you need to know about Decentralized Finance, and the Consensys products that will facilitate your DeFi journey.

Explore the answer to the question, “What is DeFi?,” including DeFi’s benefits and drawbacks, how it differs from CeFi, examples of DeFi, and the expectations for this concept in the future.

Decentralized finance, or DeFi for short, replicates traditional financial functions through smart contracts on a blockchain.

Get started on your DeFi journey today with this primer on decentralised finance (DeFi).

Download the ebook on Decentralized Finance (DeFi) and start learning about how it works, elements of the DeFi ecosystem, and the interplay between blockchain and DeFi.

Ready to take a deep dive into blockchain industry’s latest wave of innovation? Read our beginners course to get started with DeFi and acknowledge yourself with yield farming, flash loans, and other decentralized financial instruments!

DeFi Guides and all things about DeFi – trustless and transparent financial products built on top of the blockchain

We dive deep on a much-hyped fintech sector. Here’s how DeFi actually works, what issues it aims to solve, and where it’s going next.

The Times 03/Jan/2009 Chancellor on the brink of second bailout for banks.Satoshi Nakamoto launched the Bitcoin network by including this headline from The Time

What is DeFi? Decentralized finance is fast gaining in popularity as an alternative to traditional financial services, with compelling advantages.