Price Analysis Tools

Top Crypto Price Analysis Tools Reviewed | AceofCrypto

The Real Game Behind Crypto Price Analysis Tools

You can’t win in crypto if you’re flying blind.

Price analysis isn’t some optional side quest,

This right here is your damn map, compass, and radar rolled into one.

Wanna ape in before the next pump?

Need to know when to exit that alt before it nosedives harder than BitConnect?

You need the right tools, not some TikTok influencer whispering sweet nothings into your bag.

Here’s the full playbook.

Sliced, diced, and served raw.

I’m AceofCrypto. Gonna dissect the best price analysis tools that actually matter, no chill, all kill.

You Need To Know The Right Price Analysis Tools

These tools are the numberboards.

Keep up with the score right here.

Plan your next move right away.

And if you’re not watching them the right way?

You’re basically trading with a blindfold and a dream.

Here’s what the alpha expects from price analysis tools:

- Live data across exchanges (no more panic-refreshing Binance)

- Volume honesty — not that fake inflated garbage

- Alerts before dumps, not after

- Portfolio overview (because guessing ain’t a strategy)

- On-chain breadcrumbs before the whales nuke you

Every second counts. Trade fast. Exit faster. But think slow.

These tools are where thinking starts.

Price Trackers I Actually Use (Not Just Hypeware)

These are the trackers I roll with. Not because they’re trendy. They do the job right. Each one’s a blade in your arsenal. Here’s what they are, and how to use them right.

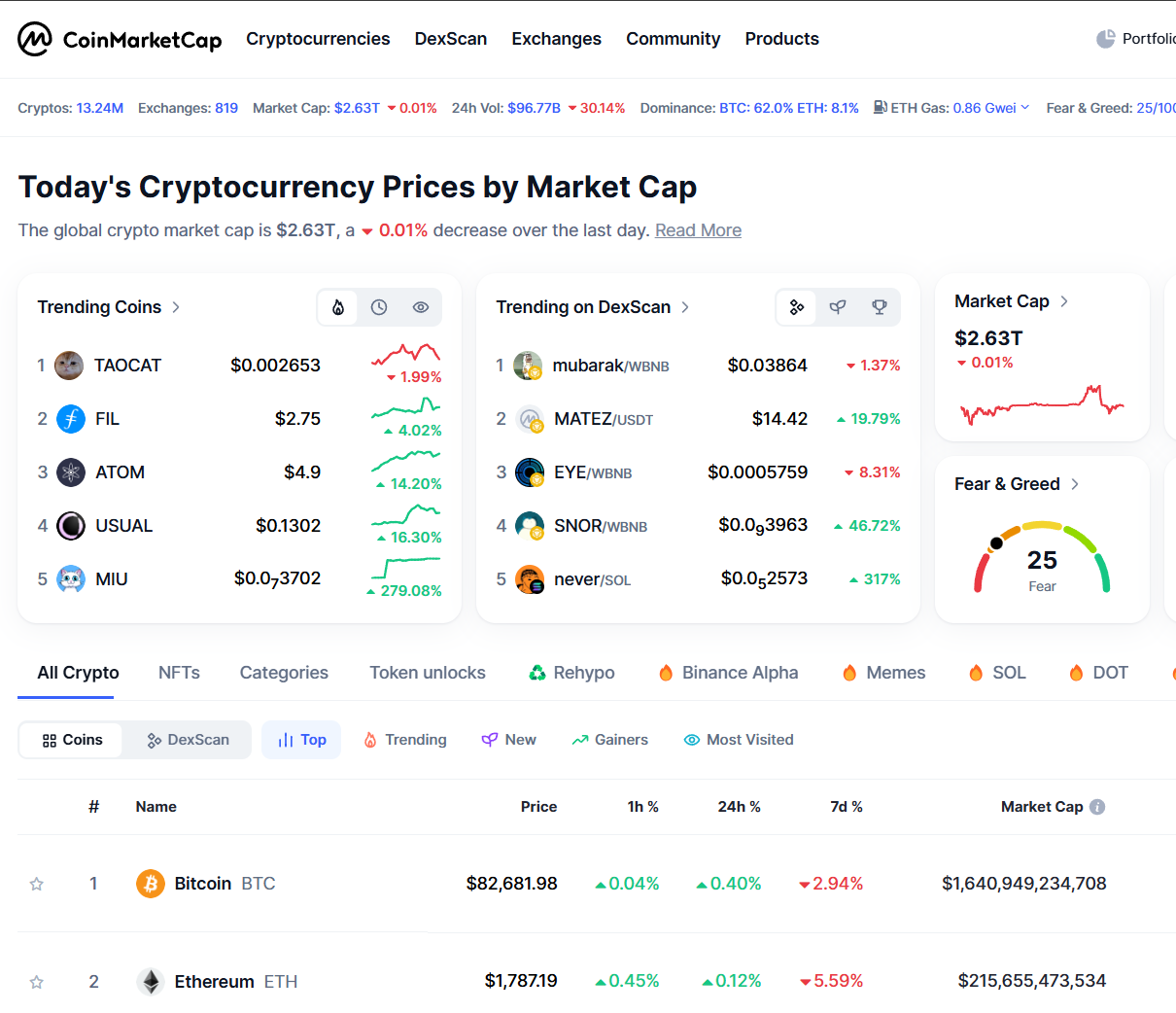

1. CoinMarketCap – The Big Mac of Trackers

The OG. Massive listings, exchange rankings, and portfolio tools.

Why It Slaps

- Massive database

- Widely integrated

- Clean UI (even your grandma could read it)

Why It Sucks:

- Paid placements = shady coin rankings

- Volume inflation galore

- Feels more like an ad board than intel base

Ace Tip: Quick-scan rankings, peek new listings, set baseline alerts. Then double-check everything elsewhere.

2. CoinGecko – The Underground Godfather

The degen’s favorite. Clean stats, fewer lies.

Why It Slaps:

- Real(ish) volume data

- Dev activity, community scores, GitHub links

- NFT, DeFi, and metaverse tabs

Why It Sucks:

- UI still feels Web1

- Data sometimes lags during heavy traffic

Ace Tip: Spot early bulls, analyze project health, dig into tokenomics. This is your research lab.

3. TradingView – The Chart Master

Wall Street-grade charting software — built for crypto maniacs.

Why It slaps:

- Pro-level TA tools

- Custom scripts, patterns, fibs, RSI, MACD — you name it

- Multi-asset tracking across crypto, stocks, and forex

Why It Sucks:

- Not built for token discovery — this is a charting machine

- Free version has annoying limits

Ace Tip: Chart like a sniper. Draw lines, set alerts, and snipe entries like you’re taking headshots.

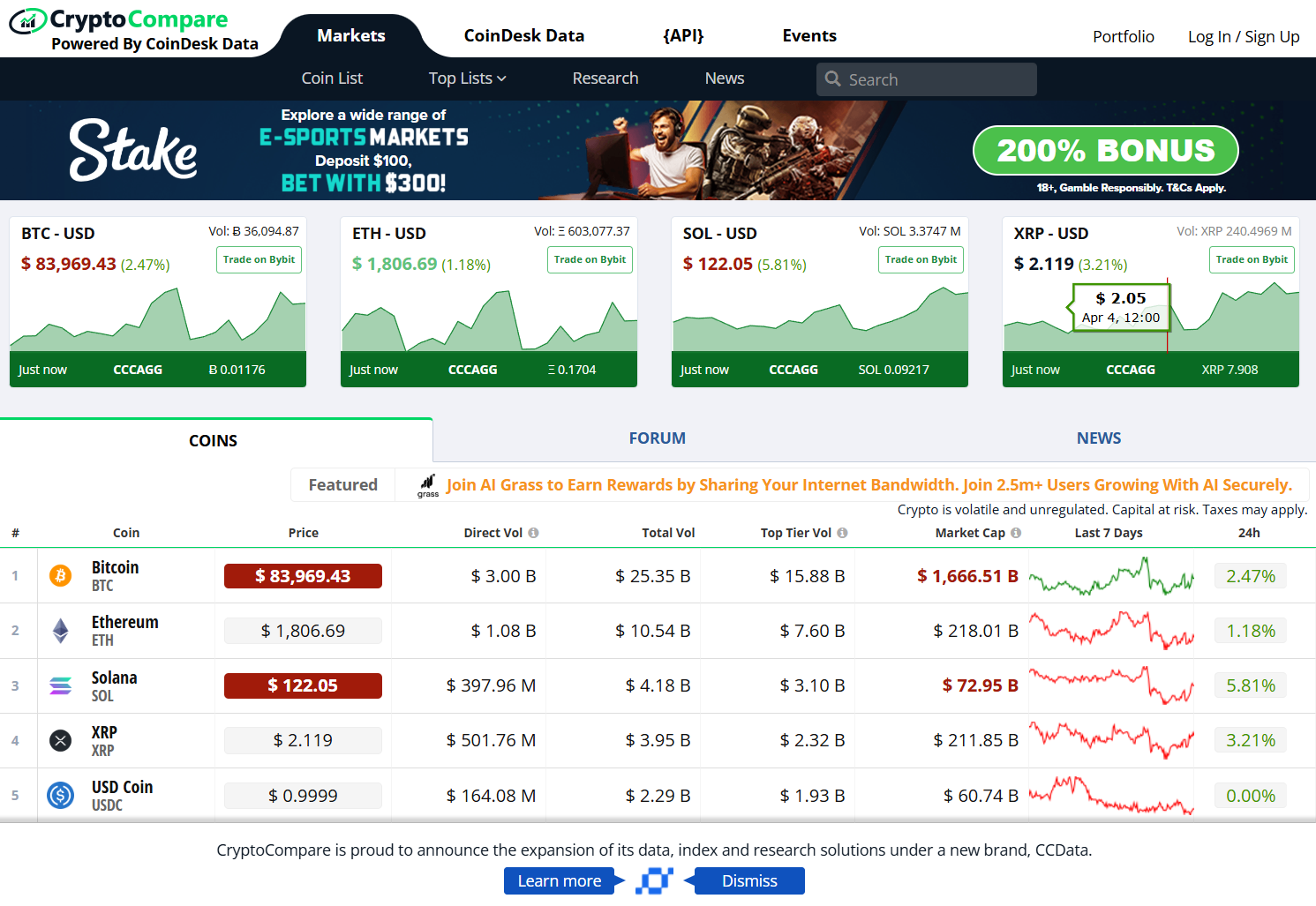

4. CryptoCompare – The Analyst’s Playground

A deep-data dashboard for the spreadsheet junkies and institutional lurkers.

Why It Slaps:

- Full market overviews

- News aggregation

- API access for devs

Why It Sucks:

- Not ideal for apes — too info-heavy for casuals

- UI feels like Excel got a facelift

Ace Tip: Build your thesis. Compare projects head-to-head. Verify signals with fundamentals.

5. CoinStats – Portfolio Zen Mode

🧠 What It Is:

A portfolio-first tracker for multi-chain warriors.

Why It Slaps:

- Syncs to wallets and exchanges

- Portfolio analytics

- In-app swaps and alerts

Why It Sucks:

- Not super deep on token research

- Occasional sync issues on smaller wallets

Ace Tip: Track your whole bag in one place. Great for active traders juggling wallets like hot potatoes.

Price Analytics Sites Lie (But You Can Spot ‘Em)

Behind every chart? A narrative. Behind every ranking? An incentive.

Here’s how the it’s all rigged:

- Exchanges pay to boost coins up the ranks

- Listings get delayed for “partner projects” to front-run

- Volume gets spoofed, dev activity gets gamed

Ace Tip: Watch for low market cap + high volume combos. If it smells fake, it probably is. Use multiple trackers. Find the outliers. That’s where the alpha hides.

Build Your Tracker Stack: A Toolkit, Not a Crutch

Every tool’s got a role. Here’s how to stack ’em:

CoinMarketCap – Overview, new listings

CoinGecko – Deeper dive, dev health

TradingView – Real charts, TA setups

CryptoCompare – Full-blown market context

CoinStats – Bag tracking, alerts

Pro move: Set alerts across all platforms. Use discrepancies as entry or exit signals. Data lag = your alpha.

Rookie Mistakes with Price Analysis Tools

You know what kills bags faster than a rug? Dumb tracking moves. Don’t be that guy.

- Relying on a single site for your entry point

- Ignoring volume discrepancies

- Trusting CMC hype coins

- Setting no alerts (aka emotional trading 101)

- Blind faith in green candles

Fix it:

Cross-check everything

Learn basic TA — trendlines, support/resistance

Check GitHub links + community engagement

Read the whitepaper (no, seriously)

TA or Die: Why Charts Move Whales

Tracking price is one thing. Understanding what it’s saying? Whole other game.

You don’t need to be a chart wizard. Just learn:

- Support vs resistance

- Volume spikes

- RSI/MACD divergences

- Breakout patterns

Ace Tip: Learn 2–3 setups and master them. You don’t need the whole playbook — just a killer few moves that work.

Ace Wisdom: Track to Attack

Look, crypto is chaos. Price trackers won’t save you, but they’ll sharpen you.

This is your edge:

Know what each tool’s built for

Don’t trust headlines, trust signals

Stack your data, then act without hesitation

One click too late, and you miss the pump.

One alert too early, and you dump too soon.

Price analysis is about rhythm with the algo.

Learn it. Master it. Then move with lethal intent.

This ain’t guesswork. This is bloodsport. You track or you get tracked.

AceofCrypto out.

(Read twice. Then go sharpen your toolkit.)

Top cryptocurrency prices and charts, listed by market capitalization. Free access to current and historic data for Bitcoin and thousands of altcoins.

CoinGecko is the world’s largest independent cryptocurrency data aggregator with over 17,000+ different cryptoassets tracked across more than 1,000+ exchanges worldwide.

Where the world charts, chats and trades markets. We’re a supercharged super-charting platform and social network for traders and investors. Free to sign up.

Track cryptocurrency markets with live prices, charts, free portfolio, news and more.

CoinStats is the leading crypto and Bitcoin tracker on the market. Track over 20000 coins, 300 exchanges/wallets across 120 blockchains from a single platform

CoinTracking: The Leading Portfolio Tracker & Tax Calculator ✓ Easy tax reports ✓ Simple imports from 300+ exchanges & blockchains ➤ Get now for FREE!

Track your entire portfolio: stocks, crypto, ETFs & more. In one powerful app. Delta gives you clarity, control, and the edge to invest smarter.

Coinigy is a powerful and intuitive tool for managing your digital wallet portfolio. Coinigy interface provides real-time market data, charting tools with instant market notifications across all major exchanges in one place—and it does so much more!

We provide tools for crypto research to analyze markets and find data-driven opportunities to optimize your investing. Dive in and explore our on-chain, social and development data.

We provide on-chain and market analytics tools with top analysts’ actionable insights to help you analyze crypto markets and find data-driven opportunities t…

Your source for following the DeFi stories of the moment. DeFi Pulse is real-time, blunt, and everything you need to stay in the know.

Learn how social media impacts markets with LunarCrush, a social media analytics tool that helps you gain an edge using social and market intelligence.

ChartIQ, now part of S&P Global Market Intelligence. ×. Compact Chart; Core … Frameworks. Angular React · Request a Demo. Instructions for use with screen

CryptoCompare

CryptoCompare

CoinStats

CoinStats