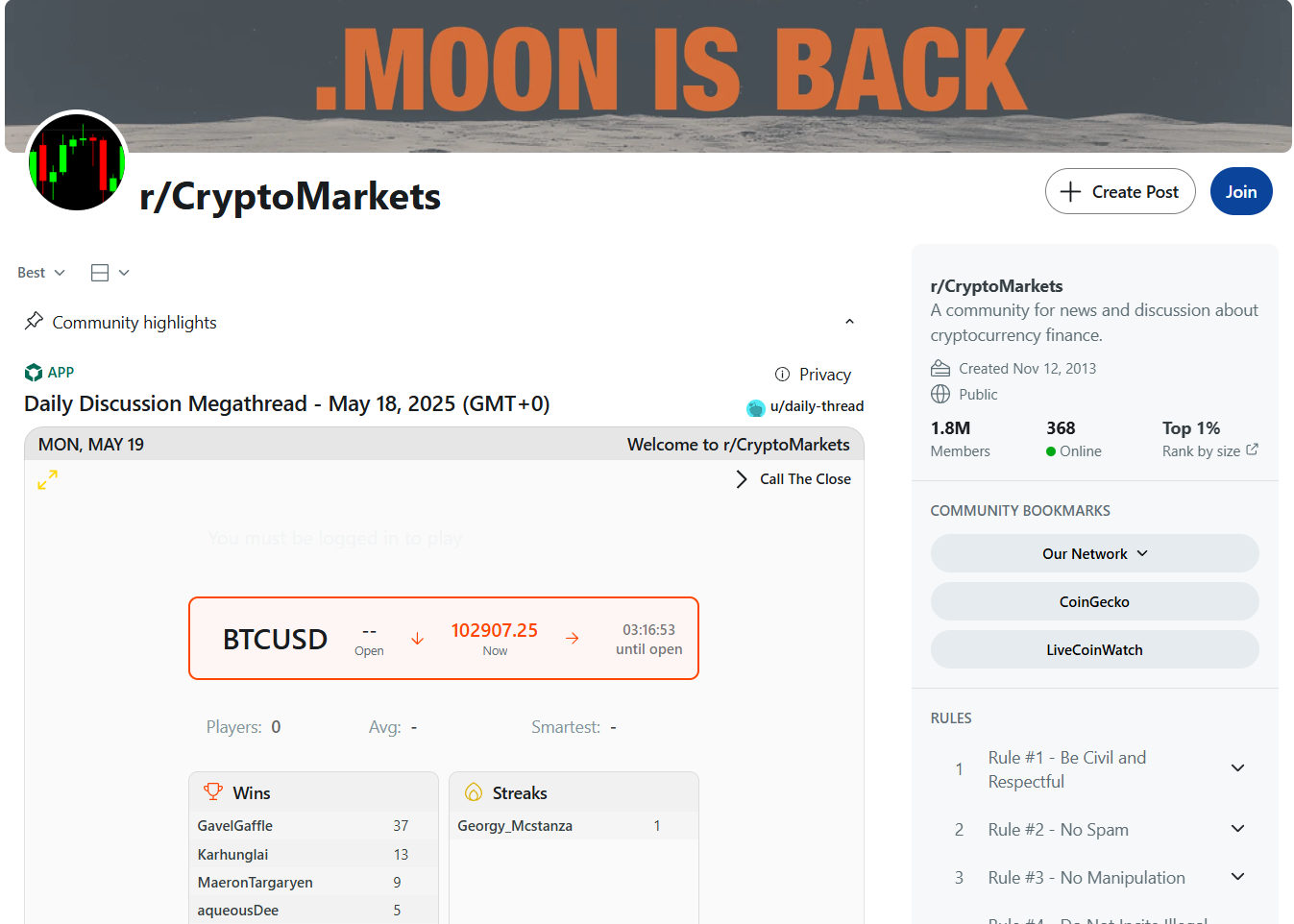

r/CryptoMarkets Subreddit Review

r/CryptoMarkets

r/CryptoMarkets, The Traders’ War‑Room

AceOfCrypto here, breaking down subreddit behaviors, so they don’t pull you into liquefaction with their crab mentality. I’ve been surfing the waves on r/CryptoMarkets since its inception, and here to hit you with some signals before you join the crowd.

This is where the boots hit the ground and the charts matter. r/CryptoMarkets calls itself a “cryptocurrency market discussion” sub, and that’s not a lie, the posts get right into trading, macro, flows, TA, on‑chain metrics. As of recent coverage it lists around 1.7 million members. So it’s sizable, big enough to matter, but not so big that every post is swallowed in noise without filter. If r/CryptoCurrency is the retail noise arena, r/CryptoMarkets is the “serious retail/trader” bull‑pen.

Gonna break this one down. Read the whole thing or get rekt by the noise.

What This Sub Really Is

Strip away the “funny memes and market jokes” veneer and you get a research feed disguised as a subreddit. People post levels, macro commentary, on‑chain flows, unlock events. But make no mistake: it’s still retail‑heavy, still emotional, still full of “this is the breakout” posts. Use it as context, not a quick guide to moons. According to one site: “treat r/CryptoMarkets as a real‑time research tool, not a trade trigger.” That sums it.

How the Crowd Behaves

Unlike broad‑spectrum subs, here the posters tend to care about timing: “when’s the move, where’s the reaction”. You’ll see charts with annotations, comment threads debating setups, and a higher ratio of “why this matters” vs. “moon or bust”. But you’ll also see the same traps: new accounts hyping micro‑caps, blog‑style text walls, and “go to 100x” clickbait. The crowd is somewhere between hopeful retail and wannabe analyst, sophisticated enough to look serious, naive still when liquidity hits.

The Emotional Engine

The mood here feels like a calm before a storm or the tension in a trading pit when volume’s about to flip. When macro prints hit (CPI, ECB meetings, large unlocks), this sub lights up with “what if” threads and “where’s the liquidity” posts. When the market drifts sideways, it turns into watch‑party threads: “still in accumulation mode?” “waiting for the breakout”. Posts aren’t always emotional, but the underlying sentiment is always: Are we positioned or getting crushed? That’s the engine.

Market Insight: Thermometer or Thermostat?

r/CryptoMarkets is closer to a thermostat than most Reddit crypto subs. Because it’s trader‑oriented, its reactions tend to be earlier, more technical, and more reason‑driven. But it still lags professional desks and HFT flows. You won’t find institutional order books; you’ll find smart‑retail trying to anticipate them. Use it to sense where liquidity and sentiment are shifting, not to catch the tail of a move. Not a realistic expectation on a reddit thread.

Coins They Hype (and Coins They Pretend Don’t Exist)

Here you’ll get plenty of posts on major liquidity plays: Bitcoin, Ethereum, large alt unlocks, L2 roll‑ups. Micro‑caps still show up, but they’re more likely in “risk trade” threads than “moon” threads. What gets ignored? Low‑volume gems without catalyst, projects with no listing flow, long‑term protocol plays lacking near‑term data. The narrative favors tokens with visible flow, visible charts, visible event risk, because that’s where the trading edge hides.

The Hidden Risks

Since this is a trader hub, the traps are: over‑positioning, confirmation bias, chart‑blind impulsivity. Shill posts hide as “TA” threads. Newbie accounts drop “setups” without risk management. The sub is not prepared to substitute for disciplined process. If you just follow the top thread without doing your own invalidation, you’re playing retail’s game, which is always late. Also, because this is “trader talk”, there’s a higher volume of technical‑jargon noise that can obscure simple truth.

Narrative Rot

While r/CryptoMarkets changes faster than general subs, the recurring cycles remain: “macro‑markets about to shift”, “altseason imminent”, “big unlock this week = explosion”. Every time the same narrative script runs with slight variation. Traders start to believe the endgame is always this move, this week, this token. Recognising when the script has played out is half the edge. Observe, don’t fall through the illusions.

The Tells Traders Can’t Hide

Watch for the swell of “I’ll post my level, join me” threads, when those cluster, the market’s already too attention‑heavy. When titles shift from “possible breakout” to “confirmed breakout” with lots of flair and little data, caution. When many posts reference the same chart or the same flow metric, you’re already late. And silence during sideways action often means accumulation is happening off the radar, that could be the green‑light moment.

How Ace Uses This Sub

I log in, sort by flair “Macro / On‑Chain / Levels”, filters for posts with receipts (on‑chain links, unlock schedules, option flow screenshots). I don’t target “which coin 10x” threads, targeting which coin is being positioned quietly. This is where I watched the sub’s noise to spot when the market’s already positioned, so I either take the opposite risk or stay off. r/CryptoMarkets is my confirmation of what others are about to react to. I write my invalidation first, then check this sub to see if the crowd is aligning against or with me.

How to Survive This Sub Without Getting Wrecked

Use r/CryptoMarkets like a high‑speed data feed, not like Reddit usually. Adjust your mindset: you’re researching, not prognosticating. Always verify, refs matter, sources matter, invalidation matters. If you scroll and only see hype, skip. If you’re trading based on the top post and the comments all agree, you’re likely too late. Focus your attention. Set filters. Write your stop. Then walk away until the move or the next print.

This Subreddit is High‑Signal Crowd, High‑Risk Traps

r/CryptoMarkets is one of the sharpest crypto subs you’ll find without institutional paywall. But sharp doesn’t mean safe. If you use it well, you get early signal and market‑structure read. If you use it like a bulletin board, you end up paying the liquidity premium. This community can elevate your edge, if you remember: it tells what’s already happening, not what will happen. Observe first, act later, log in every day!

AceOfCrypto Out

Madness is in the threads,

Watch your step for the boom.