Stablecoin Guide

Stablecoin Guide and Comparison 2025 | AceofCrypto

Stablecoin Guides That Won’t Bore You to Death (or Get You Rugged)

“Bro it’s pegged to the dollar, what could go wrong?”

Ask Terra.

Ask Titan.

Ask the millions who got stable-rugged during “temporary depegs.”

Stablecoins are supposed to be safe.

But most people can’t even explain what backs them, or what doesn’t.

You’re trusting a coin that’s promising stability in the most volatile market in the world.

That’s like hiring a juggler to babysit your retirement fund.

So here’s how you actually learn about stablecoins, without falling for marketing fluff.

These are the only platforms with guides worth reading.

AceofCrypto’s skimmed ‘em all so you don’t have to lose your savings on “algorithmic trust.”

Read the full reviews on these platforms.

Get the ins, and snipe like a God!

Why You Need a Stablecoin Guide That Doesn’t Lie

- Not all stables are “stable” (looking at you, UST).

- You gotta know the difference between fiat-backed, crypto-backed, and algorithm-backed.

- You will hold one. Might as well not get blindsided by a depeg.

- Also: yield farming + stablecoin = free lunch… until it isn’t.

AceofCrypto’s read the fine print and translated it into “human”.

Newbies rely on one guide and get rugged.

Pros juggle 5 to get the right ins.

Ace takes you into their core with full reviews.

Read the reviews, retain the data, and rise to the top.

Crypto relies on intel, and I’ve got terras to hand out.

Stablecoin Guides That Don’t Suck

Stablecoins keep your boat afloat. The value doesn’t change beyond a decimal point, but some will rock your boat. Ace brings you the top stablecoin guide reviews.

These are enough, but some contain fluff, while others are weighing in on favorites.

Know about their game.

Play them back right at them.

Stay ahead with AceofCrypto’s reviews and breakdiwns.

1. Coinbase – What is a Stablecoin?

Corporate clean, but gets the basics across.

If you just discovered crypto last week, start here.

Why It Slaps:

- Clear, beginner-friendly breakdown

- Compares different types of stablecoins

- Explains USDC (Coinbase’s golden child) in detail

Why It Sucks:

- Biased toward centralized options

- Doesn’t dive into algorithmic risks or collapse history

Ace’s Tip: Read this when you want a mom-approved crash course on stablecoins and don’t want to think too hard.

2. Binance – What is a Stablecoin? A Beginner’s Guide

A little more meat on the bones.

Feels like someone who’s seen a farm implosion wrote this.

Why It Slaps:

- Includes centralized, crypto-collateralized, and algo stablecoins

- Explains use cases in DeFi, trading, and payments

- Gives real-world examples beyond just USDT and USDC

Why It Sucks:

- Skips over the shady side of certain BSC-issued stablecoins

- Glosses over regulatory risks

Ace’s Tip: Read this if you want to farm stables, stake ’em, or use ‘em in DeFi without getting smoked.

3. CoinGecko – What Are Stablecoins?

CoinGecko Tells it like it is, minus the fluff.

A Gecko with bite.

Why It Slaps:

- Compares top stablecoins side by side

- Covers what can go wrong (finally!)

- Breaks down risk vs. backing in plain English

Why It Sucks:

- A little dated in some sections

- No deep dive on current depeg events or collapses

Ace’s Tip: This is your reality check before staking your savings into a 30% APY “risk-free” pool.

4. CoinDesk – What is a Stablecoin?

More journalistic, less tutorial-y.

Good if you like context, news, and why stablecoins make regulators sweat.

Why It Slaps:

- Balanced, non-biased overview

- Talks regulation, market impact, and tech

- Doesn’t sugarcoat the risks

Why It Sucks:

- Not a step-by-step guide

- A bit wordy if you’re just trying to learn on the toilet

Ace’s Tip: This one’s for when you’re halfway through a bull run and wondering if the “stablecoin” you parked your profits in is actually stable.

5. Investopedia – Stablecoin (Definition, Types & Risks)

It’s Investopedia. You’re basically reading the WebMD of crypto.

Still, sometimes you need a glossary-nerd to break it down clean.

Why It Slaps:

- Very well structured and digestible

- Covers key terms like overcollateralization and peg mechanisms

- Explains risks like death spirals

Why It Sucks:

- No in-depth examples or crypto-native insight

- Feels like it was written by someone who doesn’t touch DeFi

Ace’s Tip: Good for understanding buzzwords like “seigniorage” without crying blood.

Rookie Stablecoin Mistakes That’ll Cost You

It’s just a starting point. Yet I see a lot of you running into walls on stage one. Avoid these mistakes.

- Trusting “pegged” means “guaranteed.”

- Ignoring collateral ratios, if it’s 1:1 backed by hopium, not enough.

- Yield farming with algo stables like it’s 2021, wake up.

- Holding only one stablecoin, spread your risk, or pray during every crash.

- Not checking where your stable is actually stored or minted, some chains be wildin’.

Ace’s Stablecoin Stack

When I’m rotating out of plays or prepping dry powder, here’s what I use:

- USDC – For clean CEX trades and compliance-friendly DeFi moves

- DAI – When I want decentralization with a sprinkle of chaos

- BUSD – Only when Binance’s still acting like Binance

- FRAX – Experimental, but spicy if you know how to exit fast

- USDT – When I’m in a hurry and don’t ask questions

Stablecoins Are the Final Bosses of Risk Management.

Ignore them, and they’ll destroy your portfolio quietly.

Master them, and they’ll fund your next 50x altcoin run without blinking.

Stay stable, stay skeptical, and read before you trust.

AceofCrypto out.

Tap in. Peg strong. Exit smarter.

Stablecoins are a type of cryptocurrency whose value is pegged to another asset, such as a fiat currency or gold, to maintain a stable price.

What Is a Stablecoin? A Beginner’s Guide to Where and How to Buy Stablecoins

What Are Stablecoins? Top 5 Stablecoins in 2025 By Market Cap

With PayPal’s announcement that they are creating a U.S. dollar-pegged stablecoin, PayPal USD (PYUSD), many are wondering about this type of cryptocurrency and how it functions.

Bridging the gap between fiat currency and cryptocurrency, stablecoins aim to achieve stable price valuation using different working mechanisms.

Discover how stablecoins like USDC and USDT are regulated in the US, the evolving legal landscape and what 2025 could bring.

A stablecoin is a type of cryptocurrency that is designed to maintain a stable market price. Recently, this type of digital currencies has grown in popularity, and we now have numerous stablecoin projects.

Stablecoins are digital assets designed to maintain a consistent value. Learn how they work, their types, and their role in reshaping global finance.

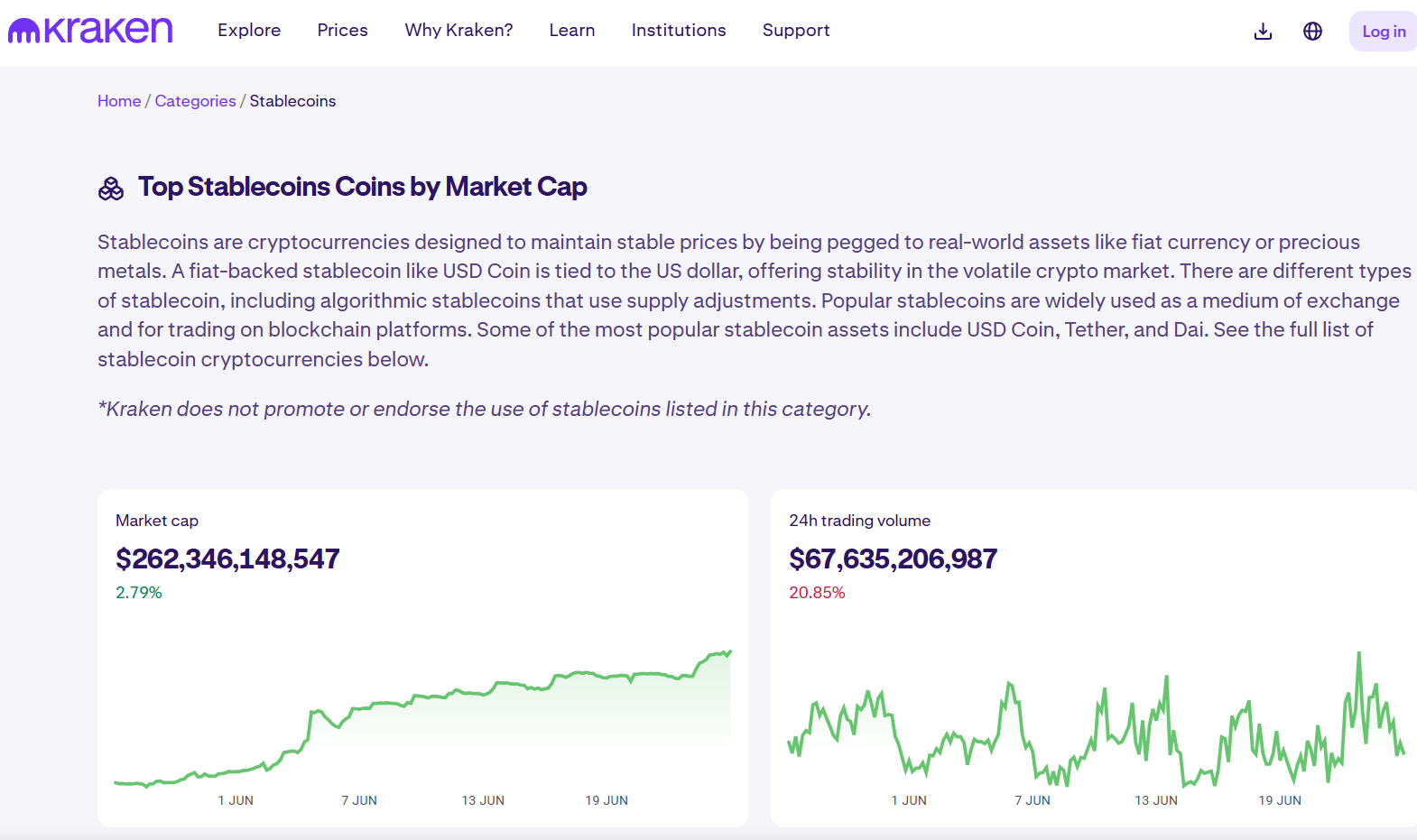

Stablecoins are cryptocurrencies designed to maintain stable prices by being pegged to real-world assets like fiat currency or precious metals. A fiat-backed stablecoin like USD Coin is tied to the US dollar, offering stability in the volatile crypto market.

Stablecoins are the most used tokens within the crypto ecosystem for good reason. This guide to stablecoins is how you can decide which work best for you.

Stablecoins are cryptocurrencies that claim to be backed by fiat currencies. Unlike cryptocurrencies like Bitcoin, their prices remain steady.

Stablecoins are digital currencies designed to maintain a stable value by pegging to assets like the U.S. dollar. Learn how they work and their use cases.

Get the full lowdown on stablecoins, what they are, how they work, where to buy them, and the most popular tokens.

Stablecoins are crypto assets that aim to keep their price “pegged” to the market value of an external asset such as a fiat currency or commodity. This enables on-chain access to tokens that are purpose-built for stability in a market known for its volatility.

This stablecoin guide takes a look at the different types of stablecoins in the cryptocurrency market and its importance in the most volatile trading environment.

Your detailed guide to stablecoins, what they are, how they work and how they could impact on the future of cryptocurrencies.

Stablecoins explained for beginners — including meaning, different types, and how stablecoins are transforming crypto payments, trading, and financial access.

What are stablecoins? How do they work? What do you use them for? Visit BitPay online to read our guide to stablecoins and how you can start using them.