Staking Tools

Best Crypto Staking Tools for Passive Yield | AceofCrypto

Top Crypto Staking Tools: Because Letting Your Coins Nap Is for Losers

Everyone talks about HODLing like it’s a flex. “I just hold.” Cool, bro, so do broke people.

I stake.

I earn while I tweet memes.

I wake up richer than I was at 3 AM.

Let’s talk about staking tools, the real secret sauce of passive crypto income. No fluff. No boomer “rewards programs.” Just raw yield, compounding, and enough liquidity to make TradFi bankers cry in their Patagonia vests.

What Is Staking (and Why You’re Probably Doing It Wrong)

Staking = locking up coins to secure the network

You = get paid like a king just for being useful

But staking done right? That’s the alpha move.

Here’s the difference:

- Normie staking: “I clicked stake on Coinbase, I’m earning 3%.”

- Chad staking: “I staked via Lido, farmed with stETH, looped it on Aave, and now I’m making 19% while playing Elden Ring.”

We’re not here to make lunch money. We’re here to dominate the yield game.

Top 5 Staking Tools: Ranked by Chad Energy

1. Binance Staking – Costco for Yield Junkies

Binance lets you stake everything from ETH to sh*tcoins with names that sound like energy drinks.

Why It Slaps:

- Endless asset options

- Locked + flexible staking

- Yields that make Coinbase users look like interns

- It’s fast, clean, and convenient

Why It’s Mid:

- Binance owns your keys. Not your keys, not your coins

- Locked staking = babysitting unlock dates

- Fine print that’s more slippery than your DEX LPs

Ace Tip: You want passive income while scrolling Twitter but can’t be bothered to open MetaMask. Binance makes it dumb easy.

2. Coinbase Staking – Where APY Goes to Die

If Binance is the Chad of staking, Coinbase is that guy asking for a MetaMask tutorial on Reddit.

What It Does:

- Staking for ETH, SOL, ATOM, etc.

- Auto-on for normies

- You open the app, and boom — staking

What’s Trash:

- You’re getting paid 3% when everyone else is making 9%

- Zero control, zero transparency

- You’re basically tipping Brian Armstrong for being mid

Ace Tip: You’re allergic to DeFi or want grandma to earn on her ETH. Otherwise? Grow up. Do better.

3. Kraken Staking – Old School, Still Hits Hard

Kraken was staking before TikTok even knew what Bitcoin was.

What Makes It Slap:

- High APYs

- On-chain + off-chain staking

- Clean UX, no fluff, just yield

- Security = Fort Knox energy

What’s Mid:

- Not for U.S. users anymore (thanks SEC)

- UI still looks like it’s from 2014

- Off-chain staking is more like glorified lending

Ace Tip: You want a CEX that’s got rep, rewards, and a solid exit plan. Kraken’s where the OGs go when they don’t want DeFi drama.

4. Lido Finance – The Giga Chad of Liquid Staking

If you’re not using Lido, you’re leaving money on the table and respect on the floor.

Why It Slaps:

- Stake ETH, get stETH — which you can use to do more DeFi

- Zero lockup

- Wild composability (use stETH in Aave, Curve, Yearn, etc.)

- It’s how smart money multiplies

Why It’s Risky:

- Smart contract risk — you’re one exploit away from tears

- stETH depegged once and Twitter almost imploded

- You trust a DAO. DAOs are messy.

Ace Tip: You want to stake ETH but still play the game. This is how real yield farmers stack ETH and flex IQ points.

5. KuCoin Staking – Earn While You Sleep (Or Forget You Had That Bag)

Soft staking. Flexible rewards. No KYC (unless they change the rules again).

Why It Slaps:

- Soft staking = you can still trade anytime

- Potential bulls earn decent yield

- No hassle, no lockups

- KuCoin’s got a weirdly deep staking catalog

Why It Sucks:

- You don’t control custody

- KuCoin’s rep is… not Kraken

- Good APYs but platform stability? Ehh

Ace Tip: You’re holding random altcoins and want them to at least pay rent. Perfect for lazy degens who can’t remember what they even bought last month.

Ace’s Staking Stack: Big Brain Edition

Here’s how I split my staking game like a ruthless crypto landlord:

- Lido (ETH) – Liquid staking + farming = boss mode

- Binance – I dump dust bags into locked staking and forget

- KuCoin – Soft stake mid-tier coins like ATOM and KAVA

- Coinbase – I don’t use this, unless I’m being paid to

- Kraken – Legacy holdovers from early bull runs

Ace Tip: Stake via Lido, borrow against stETH on Aave, and farm with the borrowed stablecoins. That’s yield on top of yield. That’s the infinite stake loop.

Rookie Mistakes That Cost You 6-Figures of Passive Income

- Staking coins with no yield (seriously?)

- Leaving ETH idle in your wallet while stETH exists

- Locking coins without knowing the unlock window

- Staking on platforms with 2% APY like it’s a flex

- Not auto-compounding (lazy is fine, dumb is not)

Fix it:

Choose liquid over locked

Always read the fine print

Use DeFi protocols to multiply rewards

Keep your coins working, not waiting

Staking Is How You Win While Doing Nothing

Let the rest of crypto burn themselves on leverage plays and meme coin FOMO.

You?

You stake. You farm. You wake up with bigger bags every day.

Crypto’s moving fast.

But staking?

That’s slow, silent domination.

You either let your coins nap…

Or you force them to print.

AceofCrypto out.

Stake hard, laugh louder, and never let a coin chill rent-free in your wallet.

Simple way to deposit & Earn.

We offer simple and trusted staking solutions for individuals, institutions, and developers

Earn weekly staking rewards on your crypto. Instantly unstake at any time with no penalties.

Ethereum staking.

Earn stable crypto rewards passive income through crypto staking. KuCoin Staking helps users earn passive income through on-chain staking activities.

Earn your crypto rewards safely and securely at Crypto Earn – the world’s most regulated platform, as measured by licenses, security and privacy certifications.

The leading validator for Proof of Stake blockchains. Non-custodial. Secure. World-class. Staking has never been this easy.

Stake and host nodes. Trusted validator serving 735K+ users across 70+ blockchain networks. Secure, automated, and non-custodial. 99.9% Uptime.

Rocket Pool is a decentralised staking protocol providing liquid & node staking products for the Ethereum (ETH) ecosystem.

Tracks Stocks, Bonds, Crypto, Alts, Homes, Cars, Commodities, Debts and more. International bank & brokerage accounts. Supports all currencies.

Staking Rewards is the leading institutional yield aggregator. Access market leading staking opportunities and earn 20% more on your crypto holdings.

The complete staking solution for 700+ institutional clients to earn rewards on their digital assets.

Stake tokens, host nodes, and earn rewards with P2P.org. Explore our staking solutions for ETH, BTC, and more!

Staking reinvented with liquid staking

Our blockchain world is digital and fascinating. But it exists for the sake of humankind and the betterment of our lives. So it’s only logical to base our approach on making people the center of our strategy. We aim to set a higher standard for you and our partners. If you have questions that need answers, you can count on us at any time of day.

OKX – Buy BTC, ETH, XRP and more on OKX, a leading crypto exchange – explore Web3, invest in DeFi and NFTs. Register now and experience the future of finance.

Gemini makes crypto simple. Buy, Sell and Store over 70 coins including bitcoin on the trusted crypto-native finance platform. Become a crypto investor today.

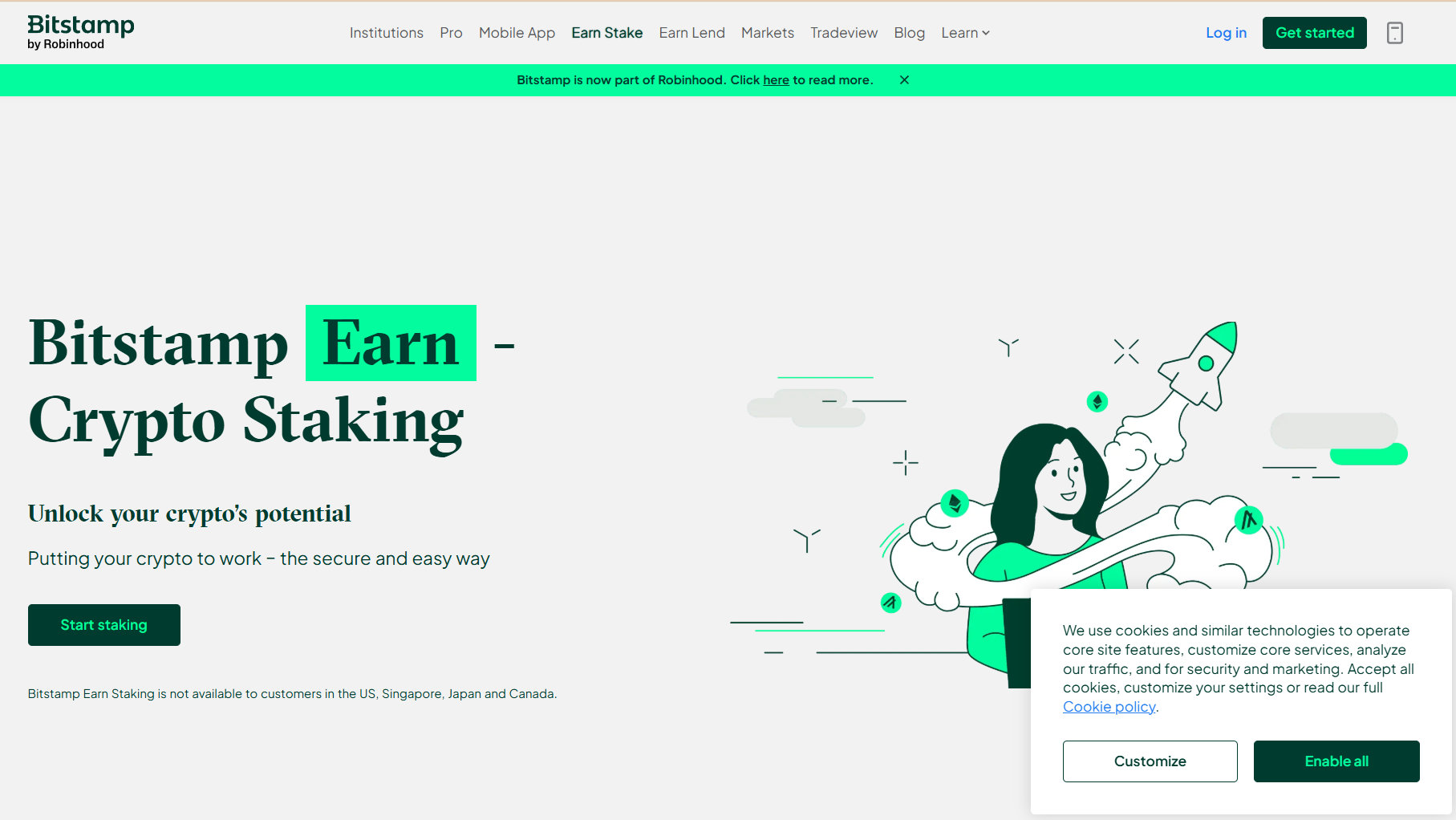

Bitstamp Earn – Crypto Staking Unlock your crypto’s potential

Putting your crypto to work – the secure and easy way