Top Crypto Tax Software

Top Crypto Tax Software for 2025 Filings | AceofCrypto

Crypto Tax Tools So Good, Uncle Sam Might Start Using ‘Em

You didn’t get rugged by a memecoin, more like tax season.

The IRS don’t care about your portfolio’s potential, just the realized gains.

Tracking 142 swaps, 3 blockchains, staking rewards, LPs, airdrops, and that one time you bridged to an L2 just to farm something called $PEEPEE?

Yeah. Good luck explaining that in Excel.

Here’s how to survive tax season without selling your soul (or your seed phrase).

Got here a bunch of crypto tax tools.

All checked, tried & tested by AceofCrypto.

Hit the right buttons, read ‘em full reviews.

Ignore the tax, and get the shaft.

You’ll Need These Crypto Tax Tools (Yeah, Even Degens)

Taxes hit harder than a bear market and don’t bounce back.

You “forgot” to file? The IRS didn’t.

You’re liable the second you click confirm.

These tools plug into everything and untangle the mess, if you use the right ones.

Don’t pick a glorified spreadsheet. I tested the real deal.

Here’s a few to start.

Got a whole lot of full reviews.

AceofCrypto keeping y’all updated.

Crypto Tax Tools That’ll Get You Across Clean

1. TurboTax – The Mainstream Money Counter

The vanilla milkshake of tax tools.

Boring? Sure. But it works if you’re not deep in crypto.

Best used when your portfolio looks more like a 401k than a memecoin farm.

Why It Slaps:

- Cloud-based, connects straight to Coinbase & Robinhood

- Handles stocks, fiat jobs, and crypto in one spot

- IRS-trusted, normie-friendly

Why It’s Risky:

- Can’t handle DeFi, staking, or NFTs

- You’ll need another tool to sort your on-chain chaos

Ace’s Tip: Use it to finalize your taxes if you’ve already done the dirty work elsewhere. Not made for degens, and that’s okay.

2. CoinLedger – The DeFi Degenerate’s Lifesaver

This is what happens when a CPA gets rugged by a shitcoin and builds software.

It’s chaos-proof and built for the brave.

Why It Slaps:

- Supports 500+ wallets, exchanges, and blockchains

- Handles staking, LPs, airdrops, even protocol-specific events

- Auto-classifies everything so you don’t lose your mind

Why It’s Risky:

- Pricing scales fast if you’ve got a lot of transactions

- UI chok es on massive trade histories

Ace’s Tip: Perfect for your DeFi war chest. Clean it up here before pushing to TurboTax or your accountant.

3. Koinly – Clean UI, Killer Reports

Looks like a startup, calculates like a monster.

Everything’s simple, elegant, and borderline addictive to look at.

Why It Slaps:

- Real-time tax previews, capital gains summaries

- Global tax support and regional report formats

- Easy enough for freelancers and traders alike

Why It’s Risky:

- Can miss obscure LP tokens and dust bags

- Free version is just a shiny teaser, you’ll pay eventually

Ace’s Tip: Use it if you care about clean exports and plan to hand them off to a real accountant or for international tax filing.

4. CoinTracker – CEX-Friendly, Low Stress

The chillest tax app in the room. You plug it in and forget it until April.

Not for maniacs, just degens who want one dashboard to rule them all.

Why It Slaps:

- Deep CEX integrations (Coinbase, Gemini, etc.)

- Tracks both portfolio performance + taxes in one

- Minimal learning curve, clean visuals

Why It’s Risky:

- Weak DeFi, NFT, or multi-chain support

- Won’t keep up with cross-chain yield farming or DEX spaghetti

Ace’s Tip: Great for investors who stay on the rails. If you’ve never swapped on Arbitrum, this is all you’ll ever need.

5. TaxBit – IRS Approved (No, Literally)

The tool that gives off Big Government Energy, in a good way.

If the IRS had a favorite child, it’d be this one.

Why It Slaps:

- Used by exchanges and the IRS, audit-proof level reports

- Enterprise-grade tracking with compliance baked in

- Designed for high-volume, high-value traders

Why It’s Risky:

- Clunky for casuals, not made for weekend flippers

- Interface feels like you’re working in a government portal

Ace’s Tip: Use this when you’re pulling big six-figure trades or getting audited isn’t a “what if” — it’s a “when.”

When “Just HODL” Doesn’t Cut It

Even if you “never sold,” you might still owe taxes.

Airdrops? Taxed.

Staking rewards? Taxed.

Swapping shitcoins for stablecoins to save your soul? Taxation Sensation All The Way!

Every on-chain move might count.

That’s why you need a tool that reads your wallet like the IRS would, and tells you before they do.

The 5 Dumbest Tax Mistakes I See Every Cycle

- “I’ll do it later” – until April 14th, when nothing exports right.

- Using FIFO when you should’ve gone HIFO – yes, it matters.

- Ignoring gas fees you could deduct – that’s literally free money.

- Losing records from dead exchanges (RIP FTX) – no receipts, no mercy.

- Declaring NFTs as “digital art” instead of capital assets – rookie move.

Ace’s Tax Filing Stack (2025 Edition)

I don’t mess around. Here’s what I run and recommend:

- Koinly – My daily driver. Dashboard smooth enough to enjoy losses in real-time.

- CoinLedger – For the degenerate bag I refuse to consolidate.

- TaxBit – My audit insurance. What they see is what I file.

- TurboTax – Normie gateway to finish the job and file federal.

- CoinTracker – For glancing at my ETH net worth like it’s a mood ring.

Crypto Profits Aren’t Real Until You File

You dodged rugs.

You flipped JPEGs.

You aped into pre-sales and actually pulled out in profit.

Don’t let the IRS fumble your bag because you thought ignoring tax was “decentralized.”

Stack the right tools now, or pray your auditor never learns what airdrop means.

Stay smart. Stay filed. Don’t pay more than you have to.

AceofCrypto out.

Tap in. Pay up. Get rich clean.

Prepare and file your taxes with confidence through TurboTax. Have an expert do your taxes or do them yourself. 100% accurate, however you choose to file taxes, guaranteed.

Calculate Your Crypto Taxes in 20 Minutes. Instant Crypto Tax Forms. Support For All Exchanges, NFTs, DeFi, and 10,000+ Cryptocurrencies.

Koinly calculates your cryptocurrency taxes and helps you reduce them for next year. Simple & Reliable.

Track, calculate, and maximize savings with Cointracker’s crypto tax software

— trusted by 2.5M+ people to save time and simplify their crypto taxes

Taxbit is the premier end-to-end compliance and reporting solution for the Digital Economy. We offer enterprises and governments an API-powered single system of record for tax and accounting for digital assets and beyond

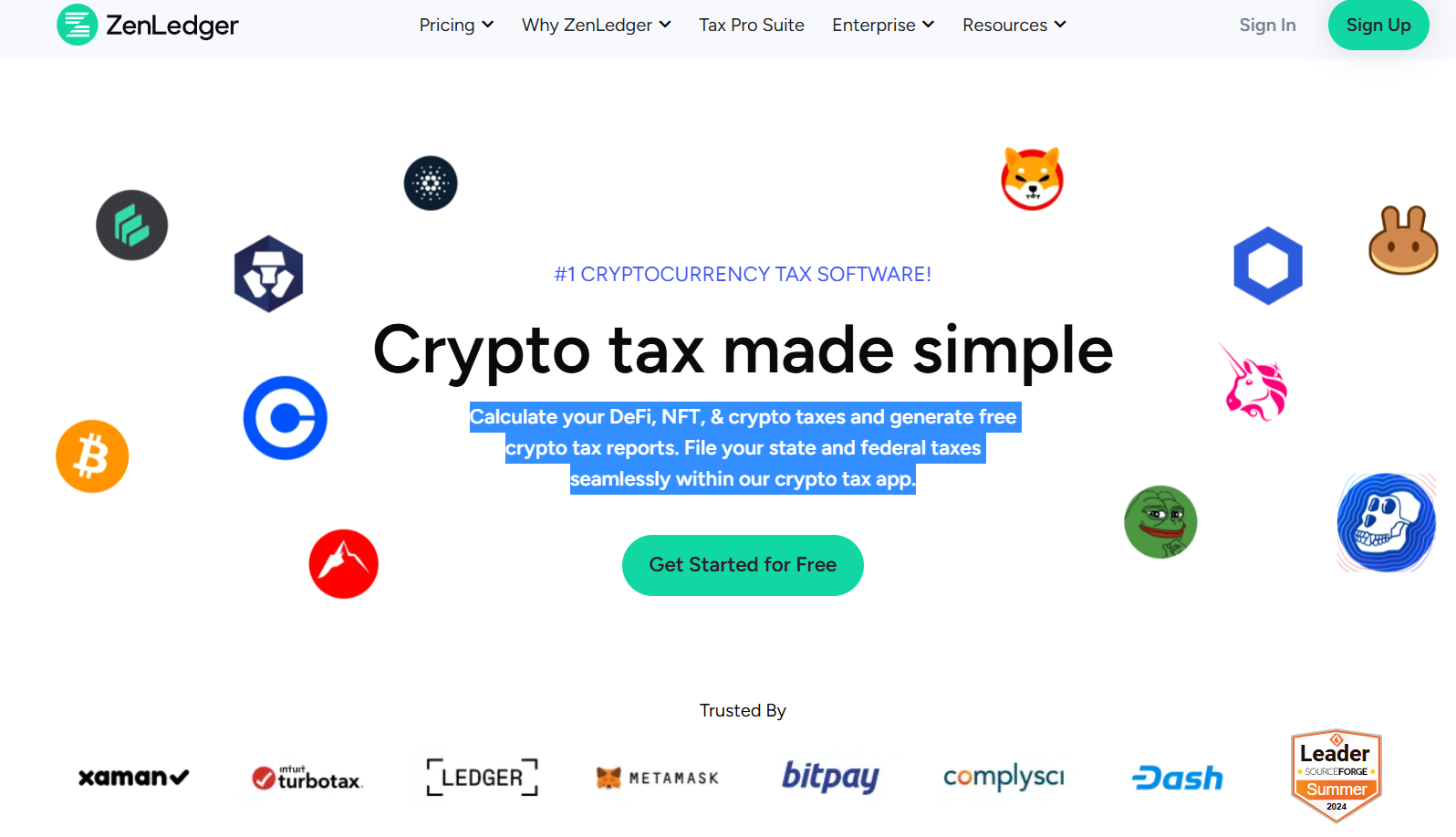

Calculate your DeFi, NFT, & crypto taxes and generate free crypto tax reports. File your state and federal taxes seamlessly within our crypto tax app.

Crypto tax software, but also a full-service crypto tax accounting firm. With us, you can track gains, calculate taxes, and generate tax forms.

Fallen down the crypto rabbit hole? Don’t waste hours scouring block explorers and drowning in spreadsheets—import transactions automatically from over 3500 sources.

CoinTracking: The Leading Portfolio Tracker & Tax Calculator ✓ Easy tax reports ✓ Simple imports from 300+ exchanges & blockchains ➤ Get now for FREE!

Make bold decisions: Track crypto investments, make smarter decision, report your taxes. Get started for free!

Easily file your crypto taxes with Awaken Tax — the smart crypto tax software for DeFi, NFTs, and CEX trades. Fast reports. No spreadsheets. Try free.

Calculate & Report Your Crypto Taxes 💰 Free tax reports, DeFi, NFTs. Support for 800+ exchanges ✅ Import from Coinbase, Binance, MetaMask!

Welcome to Kryptos, your all-in-one platform for crypto tax, DeFi, and NFT management. Simplify finances and thrive in the fast-paced Web3 world!

Effortlessly calculate your crypto taxes. Unmatched privacy. Automated support for Coinbase, Binance, Kraken. Accurate, compliant crypto tax reports.

Bitcoin and Crypto Taxes for Capital Gains and Income

Explore KoinX, the leading crypto tax software offering accurate tax reports and a user-friendly portfolio tracker. Streamline your crypto finances with ease.

Ledgible Crypto Tax and Accounting platform provides tools for institutions, tax pros, and enterprises to monitor, report, and handle crypto.

We offer enterprise-grade accounting, reporting, and audit software for your digital assets.