WorldCoinIndex Site Review

WorldCoinIndex

WorldCoinIndex Review is The Fast, Lightweight Tracker Without Drama

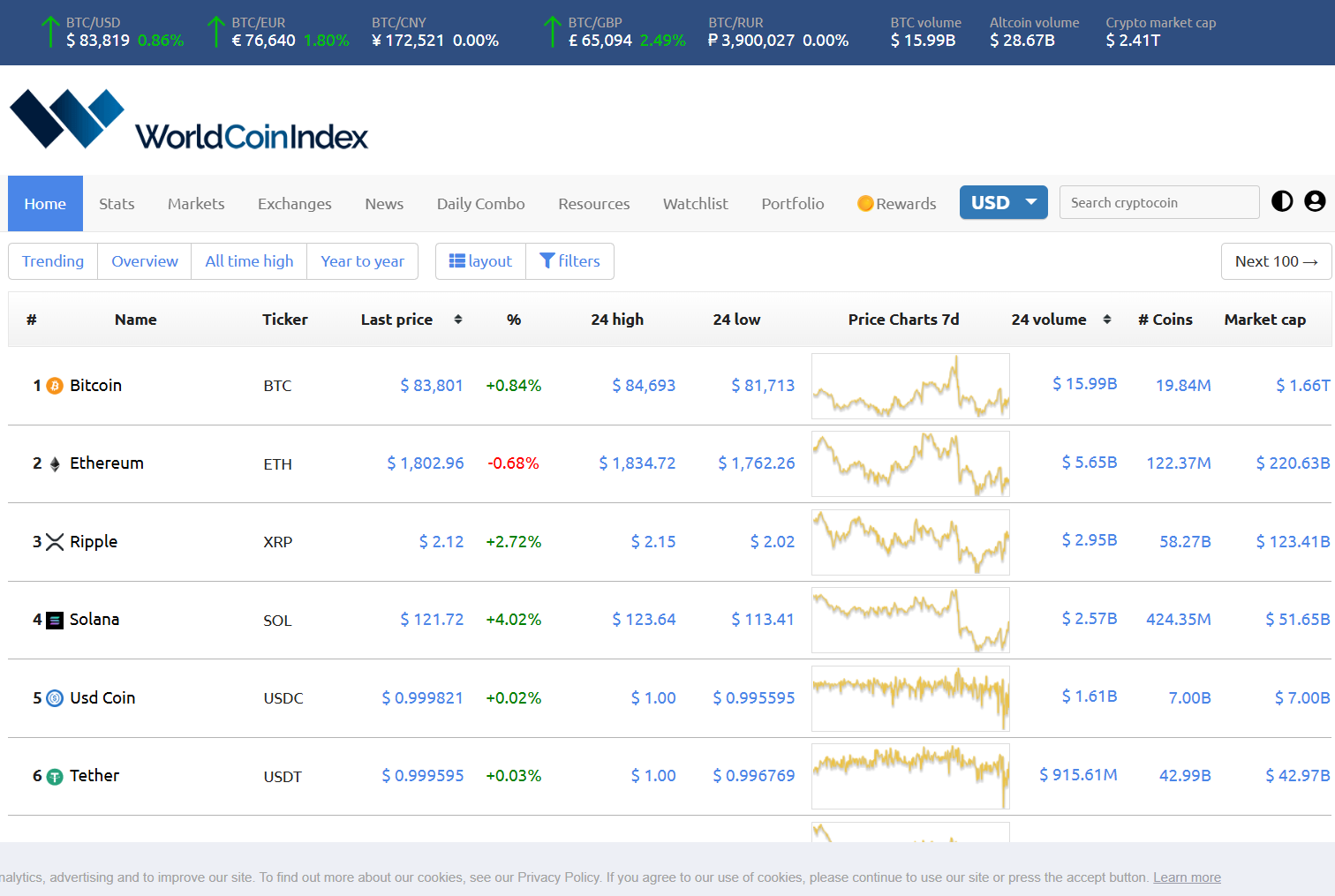

This is AceOfCrypto here to get you interested (or not) in WorldCoinIndex. I spit facts because I used it good. You want clean numbers fast and no bullshit. WorldCoinIndex (WCI) does that. Launched mid-2010s, built as a lean price index, it lists roughly 1,500+ coins and connects to ~100 exchanges across 7,000+ markets. It serves price tables, charts, widgets and a free API with a sensible rate limit. That’s the elevator pitch. Now the details that matter. Ace’s used it, mastered it, and here to give you the full lowdown on how degens ought to use it. Don’t skip, we pros keep this as the reliable fifth.

What is WorldCoinIndex?

WorldCoinIndex is a straightforward crypto price index and data provider, a stripped-down CoinMarketCap alternative for wannabe degens who want price boards, quick filters, and an easy API. WorldCoinIndex lists ~1,500 cryptocurrencies and ties into over 100 exchanges and thousands of markets to pull price and volume data. The site shows prices in BTC and a dozen+ fiat currencies and offers charting, trending lists, and an API that updates roughly every five minutes. Perfect for those keeping their eyes glued to the screen for the smallest fluxes.

What Crypto Communities Say About WCI

Users who know their game usually praise WCI for speed and simplicity. Traders who just want bright, scannable tables and embeddable widgets like it. Critics point to limited token depth (not the tens of thousands other trackers claim) and occasional stale data on tiny pairs. Several writeups call it the “utility belt”. It ain’t flashy, but it gets the job done. That’s good enough to keep it by your site, not as the primary.

Usability & UX

Desktop loads fast. Filters are simple: price ranges, volume buckets, market cap brackets. Mobile works, but WCI is desktop-first, the interface is functional, not pretty. Widgets and embeds are easy to install for blogs and dashboards. No ad circus, no bloated dashboards, just a clean price board you can trust to load quickly. If you want pretty heatmaps or fancy sentiment overlays, go elsewhere. If you want speed, WCI wins.

Data Accuracy & API Behavior

WCI pulls from multiple exchange APIs and exposes price, volume, market cap and basic charts. The API is free with keys, updates every 5 minutes, and caps requests (70/hour per IP). That’s deliberate: WCI trades ultra-real-time claims for reliability and low strain. For top coins numbers look solid; for microcaps the gaps are often treacherous, with missing markets, delayed feeds, or inconsistent liquidity reporting show up. Use WCI for snapshots and embeds, not for high-frequency trading or forensic volume validation. Surface level skating, good. Deep dives, use the big players.

Extra Features (what you’ll actually use)

Widgets & Embeds

Drop a tidy price table, ticker or single coin widget onto any page. Fast to deploy, low overhead. Good for blogs, portfolios, or dashboards.

Market Tables & Filters

Quick filters for price bands, market cap brackets, and volume thresholds. Good for scanning gainers/losers and spotting movers. No deep tagging system though.

Charts & Historical Snapshots

Basic candlesticks and simple timeframes. Enough for a quick glance. Not a trading terminal.

API (free, limited)

JSON API, free with key, updates every 5 minutes, 70 req/hr per IP. Great for simple apps and embeds, not built for heavy bot traffic.

Currency Display & Fiat Options

Prices in BTC and 13+ fiat currencies. Handy if you trade in a local fiat rather than USD.

Pros of Using WCI

- Fast, clean price boards; great for quick scans.

- Simple, free API with reasonable rate limits for small apps.

- Low UI friction, minimal ads, fast load times.

- Covers core coins and many mainstream markets reliably.

Cons of Using WCI

- Smaller token universe (~1.5k) vs giants that list tens of thousands.

- 5-minute API updates and request limits make it poor for HFT or low-latency bots.

- Microcap / obscure pair data can be stale or missing.

- No deep on-chain metrics, developer activity, or advanced analytics.

Risks of Relying Only on WorldCoinIndex

Like I said, no one relies on a single price tracker alone, it’ll sink your boat, and make your bags disappear faster than the magician’s rabbit. Here’s what you risk if you use WCI as standalone.

Missing Microcap Depth

If you trade tiny tokens, WCI will blindside you. It doesn’t promise exhaustive market depth. Cross-check listings before sizing positions.

API Rate & Update Limits

Five-minute refresh + 70 req/hr = not for speed traders. Alerts and widgets reflect that cadence. Don’t use WCI as a single feed for live execution.

Volume Blindspots

Reported 24h volume can be skewed or delayed for some markets; WCI’s simple aggs don’t reconcile wash-trade risk like specialized services. Validate liquidity on exchange UIs or on-chain.

No Deep Analytics

No vesting schedules, no unlock calendars, no GitHub activity. If your strategy needs tokenomics for sizing, WCI won’t cut it.

Rookie Mistakes on WorldCoinIndex

WCI works real good for quick glances, but even pros screw up. Here are the most repeated mistakes on WorldCoinIndex.

- Trusting WCI microcap prices as tradable prices without checking exchange orderbooks.

- Using the free API for production trading bots and hitting rate limits mid-pump.

- Assuming “listed” means liquid. Lots of tokens are listed but thinly traded.

Ace’s Pro Tips – use this or lose money

- Use WCI for dashboards, blogs, and quick scans. Pair it with CoinGecko or CryptoRank for depth.

- Test the API under load before you automate alerts. Respect the 70 req/hr cap.

- For microcap buys, open the exchange orderbook and check taker liquidity. Don’t trust aggregated 24h volume blindly.

- Use fiat display if you trade in local currency. Avoids conversion math mistakes.

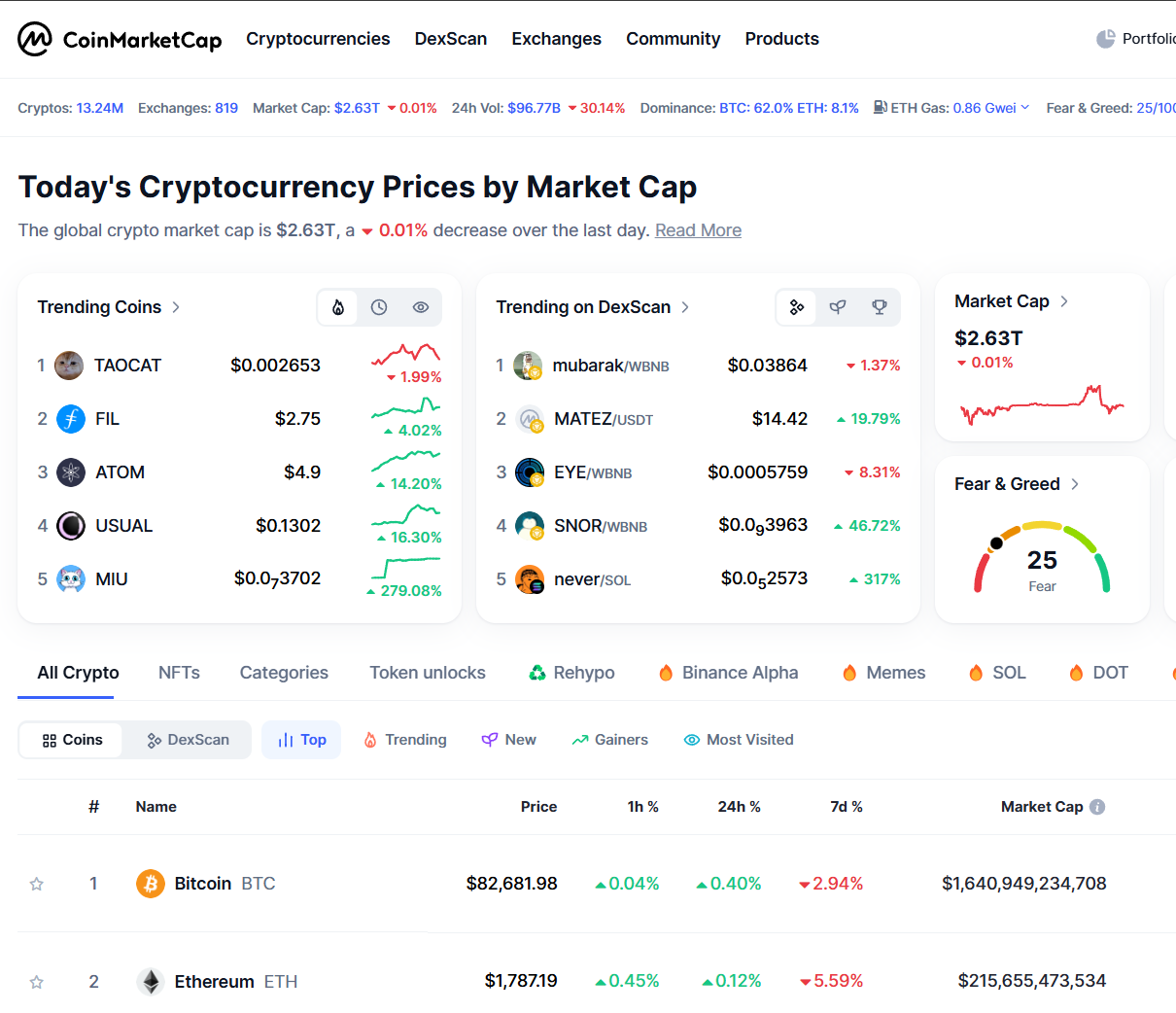

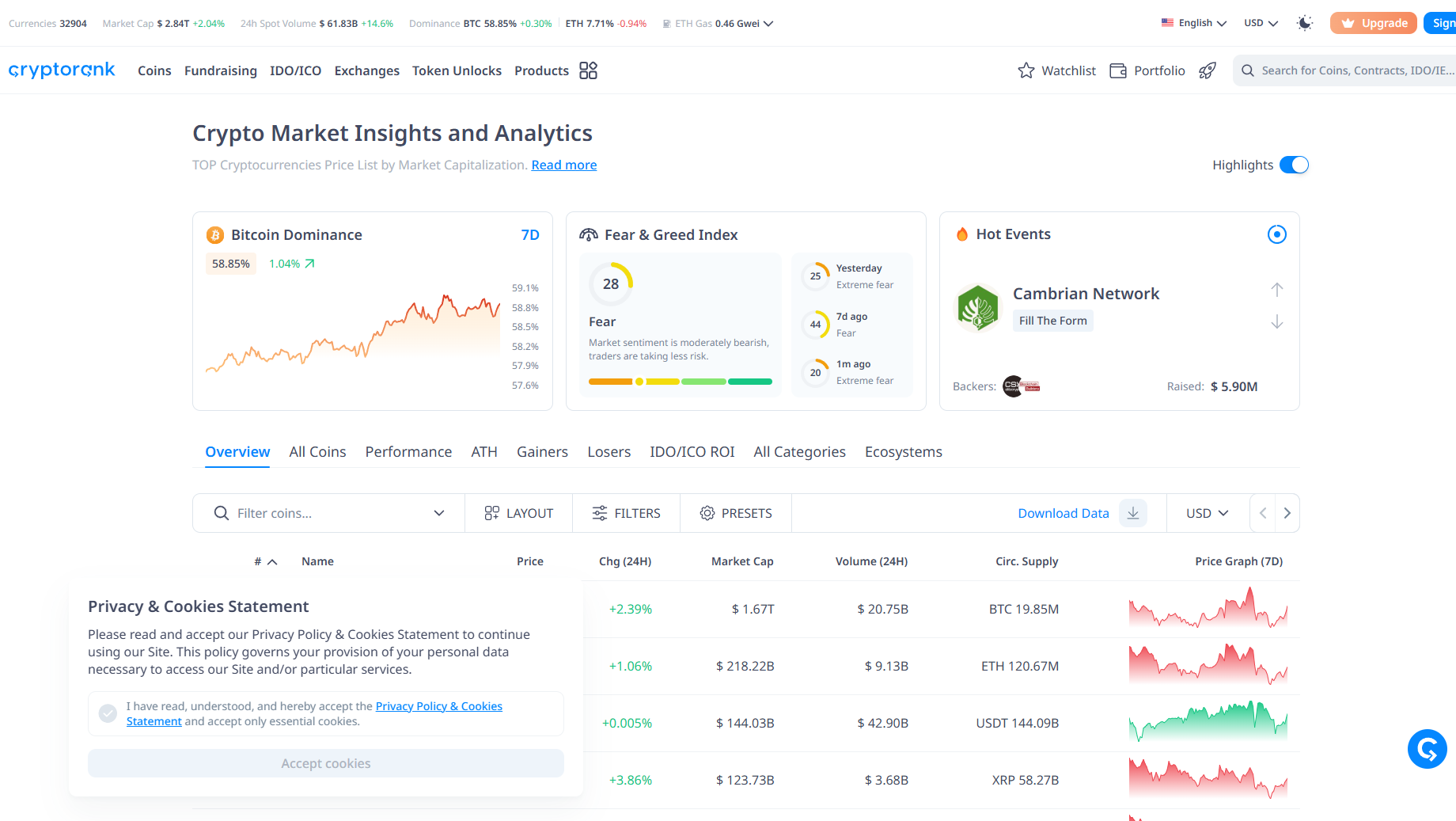

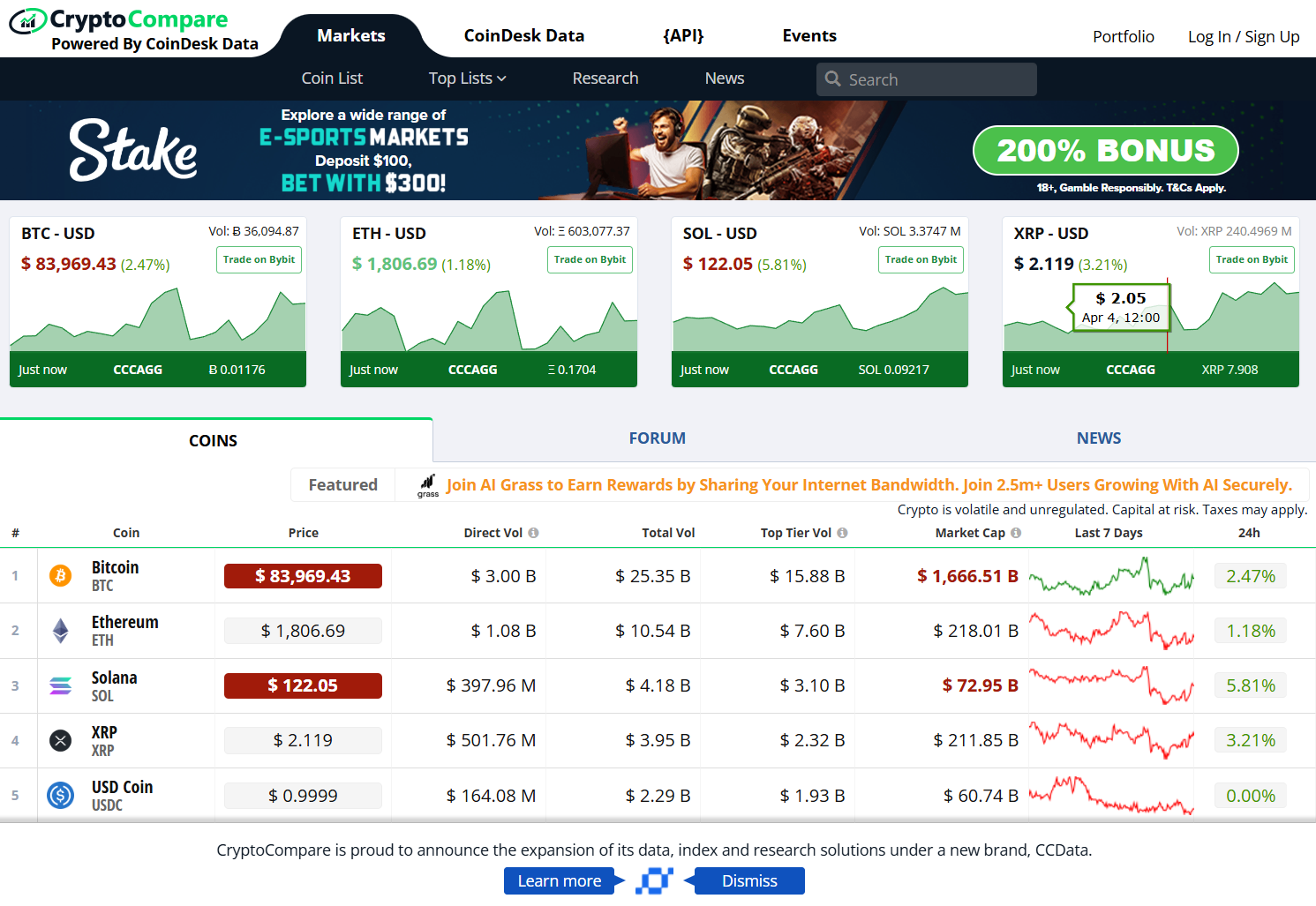

How WorldCoinIndex Stacks Against The Competition

- vs CoinGecko – WCI gives cleaner, faster price boards; CoinGecko gives deeper token & DeFi metrics.

- vs CoinMarketCap – WCI is lighter and quicker; CMC has broader exchange coverage and deeper liquidity flags.

- vs CryptoRank.io – CryptoRank dives tokenomics, unlocks and investor data; WCI is faster for live price tables.

- vs Live Coin Watch – LCW tracks more coins and exchanges; WCI keeps it tidy and predictable. Choose speed and simplicity vs extreme breadth.

Ace’s Verdict on WorldCoinIndex

WorldCoinIndex is the tool you open when you want clean price tables, embeddable widgets, and a free, simple API that doesn’t whine. It’s fast, reliable for main coins, and great for dashboards. It loses to the heavy hitters on microcap depth, on-chain signals, and millisecond feeds. Use it as your index board, not your execution engine. Cross-check before you bet heavy.

AceofCrypto Out

Waiting can get you rich

As long as you have laser focus.